What insurance companies can do with WhatsApp.

WhatsApp Business opens the door to better communications, leading to better customer engagement, greater trust, and lasting long-term relationships.

Worldline offers digital services and open banking for insurance organisations.

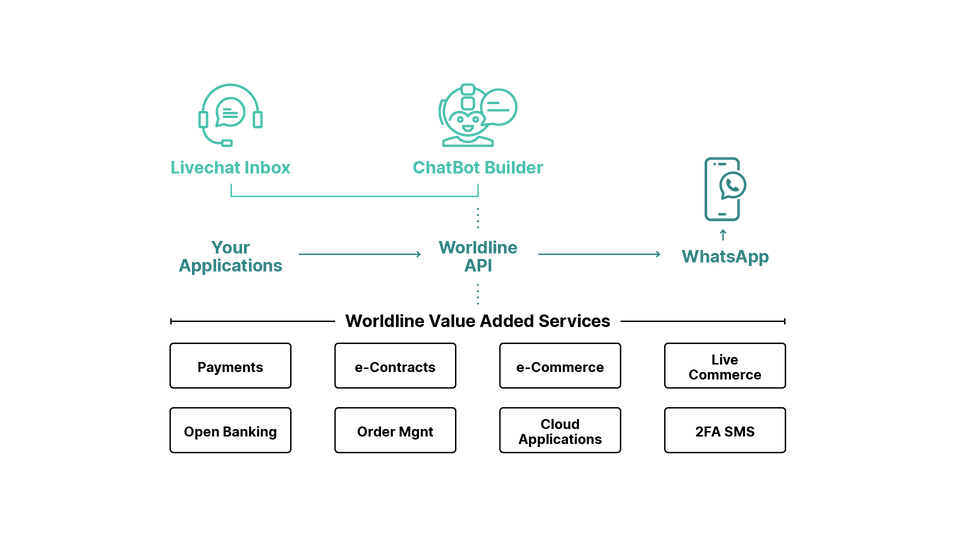

An API to connect insurance companies and customers

Working with your WhatsApp Business API

Worldline is an official Business Service Provider of WhatsApp and offers WhatsApp connectivity to companies.

WhatsApp Key Use Cases for Insurance Companies

Improving customer experience for insurance services with WhatsApp Business Platform

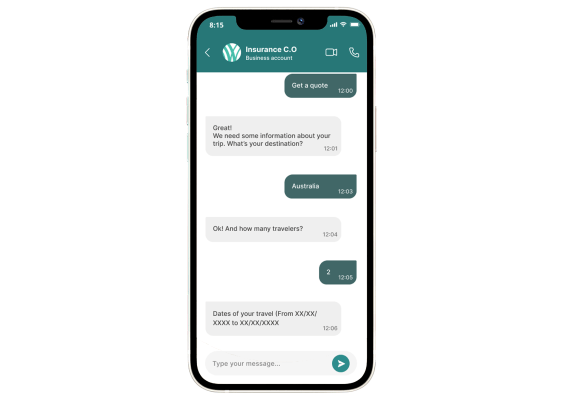

Claims process automation including customer authentication, sending documentation, claim tracking and more.

Facilitation of access to support services through automated processes, transfer to agents or callbacks.

Automated access to the most important processes of the private area without human intervention: send or download documentation, duplicates, policy information, change personal data.

Sale of new products and services including payment options.

Forwarding a conversation from a Chatbot to a customer service agent.

Facilitation of access to support services through automated processes, transfer to agents or callbacks.

Automated access to the most important processes of the private area without human intervention: send or download documentation, duplicates, policy information, change personal data.

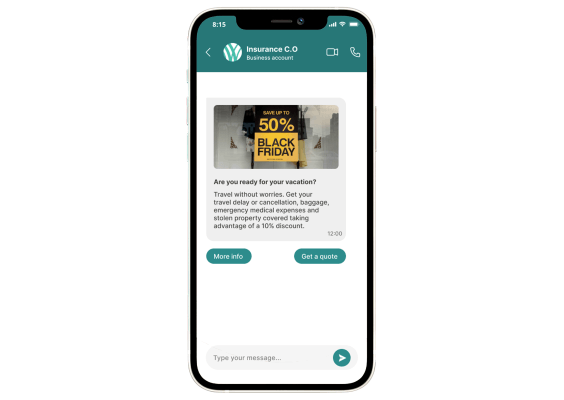

Sale of new products and services including payment option.

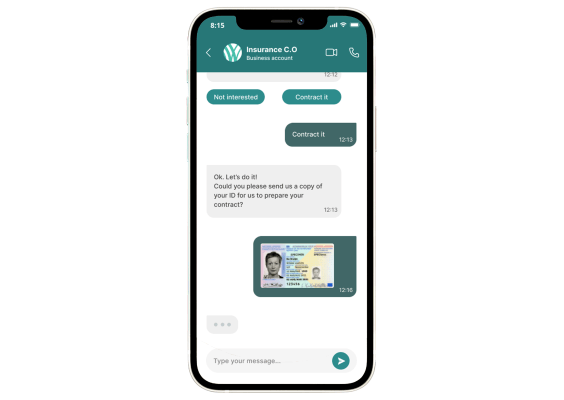

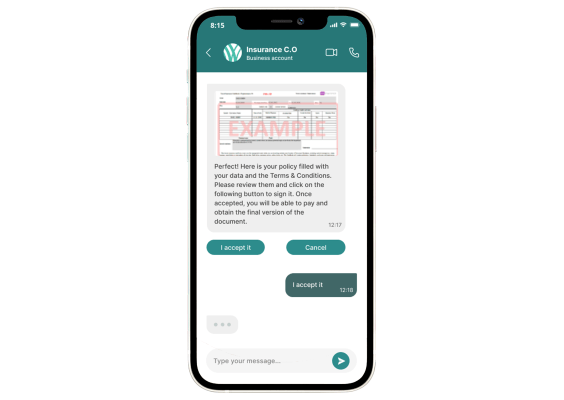

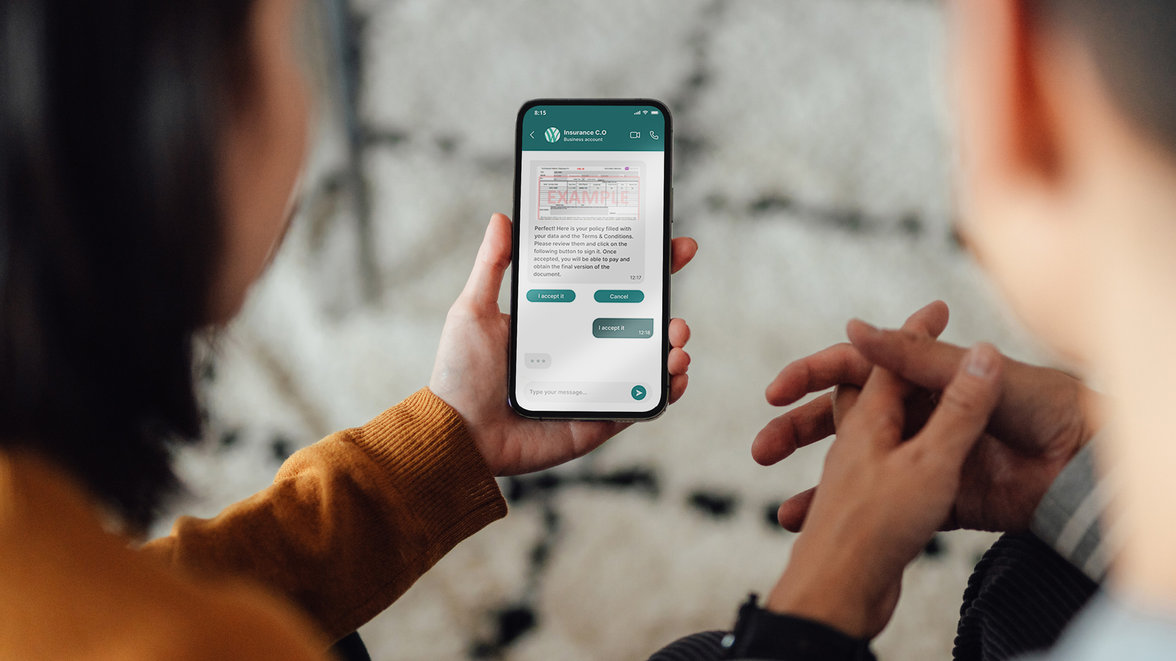

Hiring of services that requires contracts with digital signature.

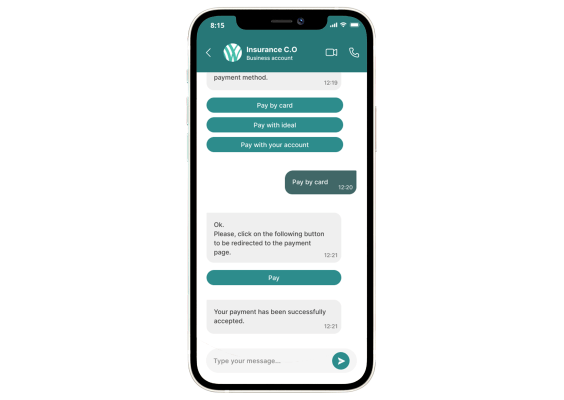

Integration of the payment process in the contracting workflow including payment account to account or by card.

Assisted sales support via Live Conference with advisors.

Informative messages such as leads follow-up, police renewals, or claims tracking.

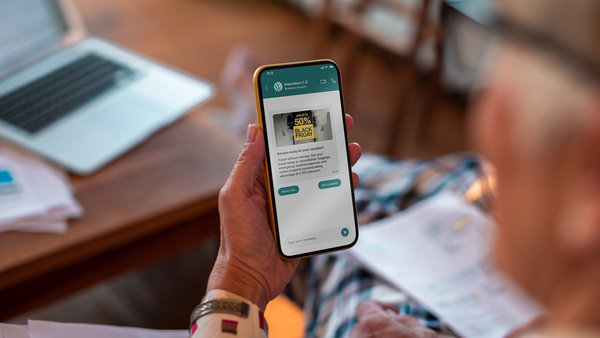

Marketing messages such as new products, cross-selling and up-selling promotions or personalised offers.

Additional costs notifications that includes payment options.

Debt recovery with payment options.

Webinar: WhatsApp for Businesses: Leveraging First-Class Customer Experience

The WhatsApp Insurance revolution is here!

Worldline is ready to help insurers explore and leverage our financial services experience to create better products and services. Get in touch to hear how we can help your company on the next steps of your digital journey.

-

-

-

The Future of Authentication: Exploring the impacts of FIDO

Learn more -

Empowering Self-Service: LM Control and Worldline's Transformative Payment Solutions

-

Greener Payments - Do payments need to be greener?

-

-

-

Worldline announces partnership with risk expert RiskQuest BV to provide best-in-class credit checking

Learn more -

Mastering the Art of Delivering Payments Acceptance Excellence: Choice of Payment Methods and New Ways to Pay