The evolution of the in-store retail experience has been somewhat overlooked in recent years in favour of e-commerce. E-commerce has led the way in adapting to changing customer demands and preferences and, by comparison, in-store retail innovation has lagged behind.

The Covid-19 pandemic has accelerated the trend of e-commerce being the preferred way for many customers to shop. However, we believe that consumer demand for in-person, physical, brick-and-mortar shopping will reappear in large parts of the market.

A pent-up shopping demand will potentially bring a more significant number of customers back into stores for an engaging, real-world shopping experience enhanced by digital solutions. Yesterday’s retail models and tactics will not be sufficient in the future. Retailers need to be ready to meet this new challenge and position themselves in such a way so as to be at the forefront of this retail renaissance.

"A pent-up shopping demand is bringing customers back into stores for an engaging, real-world shopping experience."

Merchants will need to think about how technology can help them improve both the “buying experience” (making transactions seamless for their customers) and the “shopping experience” (giving customers an experience they’ll want to spend time engaging with). This will require them to acknowledge and adapt to both increased online competition and rapidly evolving customer tastes

They can get to know their current and prospective customers better and offer customised, personalised, contextualised and seamless experiences using available data. And they can use technology to automate their back-end processes related to logistics and predictive analytics.

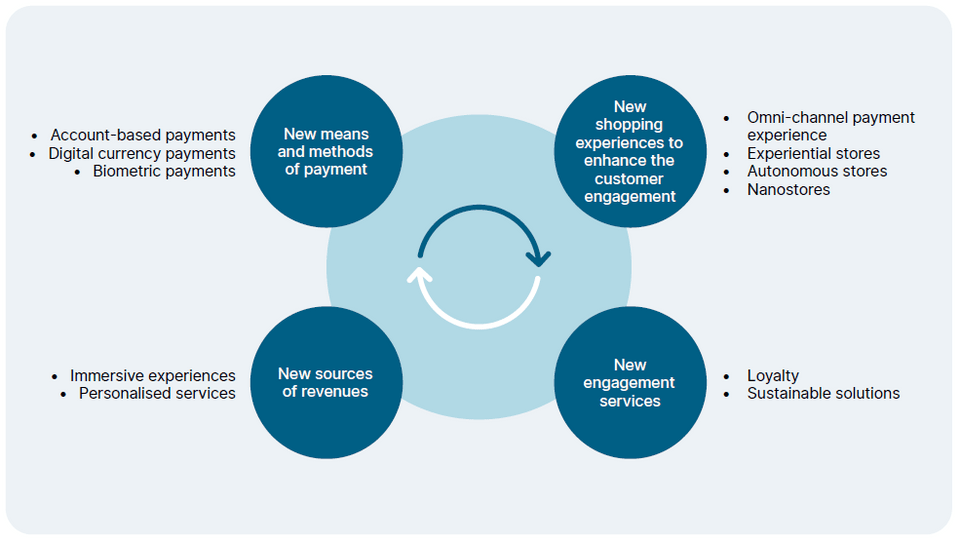

How merchants can embrace the renaissance of physical stores

Embracing the renaissance of physical stores

Merchants and customers need to have efficient, secure, trustworthy and easy digital payment channels to move from cash to digital payment with the level of privacy technology expected by the user. Merchants need to know the maturity of the payment technologies available in the different national markets and adopt them.

Customers are becoming more and more omnichannel-oriented and expect a consistent payment experience across all the channels. The best examples of this are mobile wallets (Google Pay, Apple Pay, Samsung Pay, WeChat Pay, Alipay etc.) which are reshaping in-store payments across the globe.

New payment methods are emerging due to their potential to provide greater convenience and ease of use:

Account-based payments. Account-to-account payment methods are increasingly deployed in physical stores offering a new, secure and fast payment method.

Digital currency payments. The coming years may see Central Bank Digital Currencies (CDBCs) as an enhanced electronic version of cash. These digital currencies could provide a fast and secure payment for merchants to attract new customers.

Biometric payments. Face, fingerprint, hand, voice and behavioural recognition can facilitate customer identification at the store and provide a seamless, convenient, secure, private and trusted payment experience.

New shopping experiences to enhance customer engagement

Omni-channel payment experience. Merchants can offer different payment options to customers combining the physical store with the online channel (such as buy online pick up in store, web in store, buy in store return online, etc.). Merchants should look into providing the digital experience in-store in the same way they provide an in-store experience through digital channels. They could offer new options like Click & Go so customers can purchase products in-store for delivery to their home, even when they are not in stock at the shop itself.

Experiential stores. Merchants need to show their customers the added value of their physical stores by providing new experiences that can only be achieved in the physical shop where the customer can touch, try, taste or feel the products before buying them.

Autonomous stores. These stores provide a new and improved shopping experience, enabling cashier-less checkout and invisible payments for customers.

Nanostores. Moving stores to people instead of moving people to the store. These can be enabled by solutions such as Worldline’s Pick-Go-Pay, piloted in The Netherlands earlier this year.

New sources of revenue

Immersive experiences. Merchants can offer online interactions in-store. For example, live-stream shopping provides an attended one-to-one shopping experience where customers can view the products they buy, select their preparation and interact with the seller to receive recommendations. This mirrors the real physical experience and personalises the online experience for the customer.

Personalised services. Retailers can offer customised, personalised and contextualised experiences to their customers. A unified commerce strategy will drive these customer experiences across every channel.

New engagement services

Loyalty. Merchants, small businesses and large corporations need to engage their customers with their brand and increase loyalty. For example, applying analytics to better understand customer behaviour throughout their journey at the store and to create personalised and contextualised experiences.

Sustainable solutions. Merchants need to adapt to sustainability trends impacting stores, such as second-hand stores, the circular economy, green payments, carbon calculators, digital receipts, digital warranties, social currencies and charitable donations. Worldline terminals allow people to make a micro-donation when buying goods or services. In 2020, they collected over 25 million donations totalling more than €339 million.

No one-size-fits-all payment solution

The retail ecosystem is very heterogeneous. From the smorgasbord of products and services they sell, they can be as small as a 1-person store with 1 square metre of space to one staffed by hundreds of employees and extending over thousands of square metres of real estate. Any proposed solution cannot be one-size-fits-all but a nuanced one based on the characteristics of the merchant.