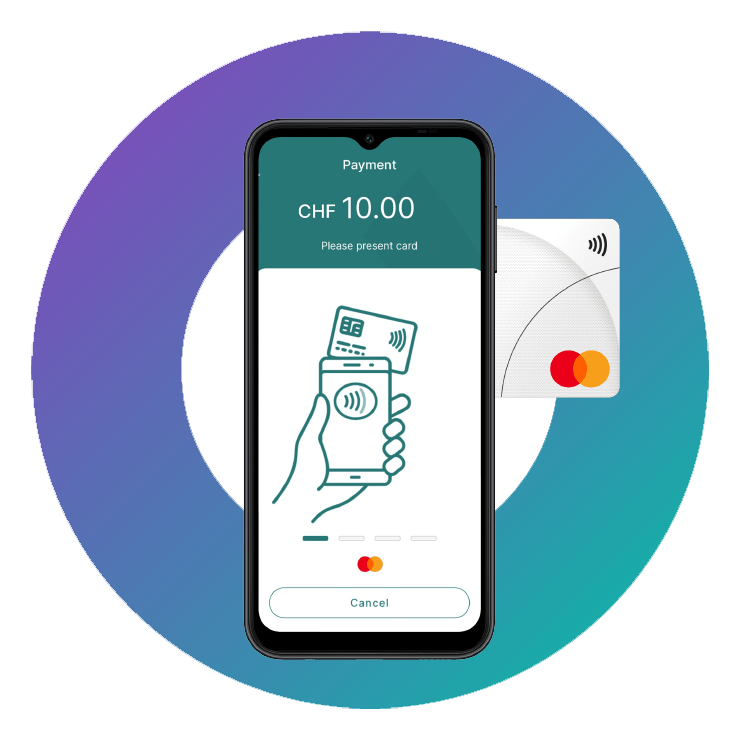

Worldline Tap on Mobile

The new way to accept payments

Accept cashless payments on your Samsung Galaxy A14 LTE Worldline Tap on Mobile Edition. Get started quickly and easily – no fixed costs or setup fees apply. Register now, download the app and get started.

| CHF 0.- | 1.7% |

| fixed monthly costs and setup fees | per payment |

Maximum fee for transactions with Debit Mastercard and Maestro: CHF 2.00 | Maximum fee for Visa Debit und V PAY: CHF 3.50

Register now for Tap on Mobile and benefit from a CHF 50.- cashback.

Just get started

* Cashback-eligible buyers of the Samsung A14 and Worldline Tap on Mobile offer at digitec.ch or galaxus.ch with an online registration at Worldline until March 31, 2024, and a minimum spend of 5,000 CHF until September 30, 2024. If the conditions are met, the payout will be made in November 2024. The cashback is paid out once per Tap on Mobile account.

Your advantages with Tap on Mobile

Process contactless payments easily and quickly by app – with no fixed costs

- Android app, all you need is a smart device

- PIN entry for payments above the contactless limit (CHF 80.00)

- Easy and fast acceptance of contactless payments via NFC

- Digital receipt by e-mail or QR code scan

- Transaction summary in the app

- Statistics in the free online portal

| Information about the fees | |

|---|---|

| Maximum fee for transactions with Debit Mastercard and Maestro** | CHF 2.00 |

| Maximum fee for transactions with Visa Debit and V PAY** | CHF 3.50 |

| Minimum fee | CHF 0.10 per transaction |

| Surcharge commercial cards and non-domestic transactions Applies to transactions with international commercial cards and to transactions with cards issued outside of Switzerland | 1.3% |

| Processing of chargebacks | CHF 30.- |

| Setup fees | CHF 0.- |

** plus any surcharges

Ideal for small businesses

Tap on Mobile is the ideal entry-level solution for small businesses who want to accept card payments. There are no start-up costs, monthly costs or setup fees, you pay only when you accept a payment. Ideal for keeping your fixed costs low. Especially if you are just getting your business started.

Simply “Tap & Go”

- Launch the Tap on Mobile app.

- Enter the transaction amount.

- Your customer holds their credit or debit card or their smartphone against your smartphone.

- If the amount is over CHF 80.00 (limit for contactless payments), the PIN is requested.

- On completion of the payment, the transaction summary is displayed with the option to obtain a digital receipt (by e-mail or QR code).

Questions and answers

-

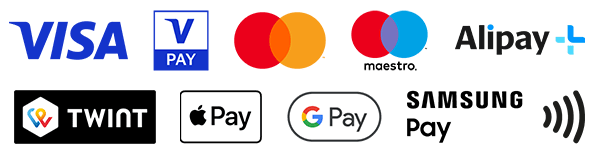

Contactless credit and debit cards and mobile payment methods:

- Visa

- Visa Debit

- V PAY

- Mastercard

- Debit Mastercard

- Maestro

- Alipay+

- TWINT

- Apple Pay

- Google Pay

- Samsung Pay

-

You can accept the new PostFinance Card with Debit Mastercard at any time with Tap on Mobile. The transaction with this card is processed as a Debit Mastercard. The old PostFinance Card without Debit Mastercard is currently not accepted.

-

Yes, you can accept TWINT payments with Tap on Mobile.

-

Yes. If the amount to be paid is above the contactless limit for the card, the PIN must be entered.

-

You can view the transaction process directly in the app. For an overview of all transactions, our free online portal myPortal is also available; you will receive the link and access data by e-mail.

-

Payment is made within the next 1-2 working days. If you process a transaction today, the amount will be in the bank account 1-2 working days after.

-

You can use Tap on Mobile on up to five different Android devices with one account.

-

As a certified and regulated financial services provider, we are committed to complying with all guidelines and requirements in accordance with the international PCI security standard to ensure that all transactions on your Android device are secure.

During the installation of the app, the following authorizations and information will be requested from your Android device:

- Authorization to use NFC

NFC (Near Field Communication) access is required to read the credit or debit card.

- Authorization to access/manage the camera

For secure PIN entry, the app requires the rights that ensure that no display recordings can be made during the payment process. This should also protect you as a merchant from misuse.

- Authorization to manage connections

The app must ensure that a payment process is not interrupted by a call, for example. For this, Tap on Mobile requires you to set yourself as the default caller ID and spam app.

- Authorization for the device location

The location is used for the digital receipt. This allows you to provide your customers with a receipt showing the location of the payment. The device location is also used to fulfil security requirements or to detect possible fraudulent use of the app.

- Accessibility services

These rights are needed to ensure that the app is not hidden during the payment process and is always open and visible.

The various authorizations and information serve to ensure the security of each individual transaction. This turns your Android device into a payment terminal, including PIN request for amounts over CHF 80.

- Authorization to use NFC

-

Tap on Mobile can be used by sole proprietorships with and without registration, corporations and partnerships, public authorities, municipalities, cooperatives, foundations, charities or associations. The app may not be used for private purposes.

-

No, Tap on Mobile is only approved for use in Switzerland.

-

No, the cashback of CHF 50 will be paid out once per online registration / Tap on Mobile account. You can connect up to 5 devices per account.