A merchant’s guide to minimising chargebacks

14 / 09 / 2022

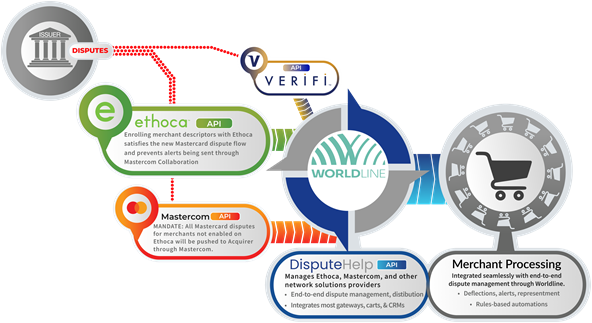

As Worldline announces its partnership with DisputeHelp to leverage the Mastercard Acquirer Collaboration mandate to its merchant’s advantage, Damian Palgan provides a guide to taking advantage of the solution to improving the merchant’s bottom line.

Arguably, one of the most significant challenges when selling services or products online is chargebacks. According to recent data from Mastercard, around 50% of e-commerce merchants are currently seeing more chargebacks, with just one costing them anywhere between US$20-$100. As operational expenditure increases, businesses now stand to lose around three times the amount of an original transaction, making dispute management more important than ever before. As Worldline announces its partnership withDisputeHelp to leverage the Mastercard Acquirer Collaboration mandate to its merchant’s advantage, Damian Palgan provides a guide to taking advantage of the solution to improving the merchant’s bottom line.

If chargebacks are not carefully managed, businesses risk incurring significant losses that go far beyond just cost. They also face the issue of potential brand damage among credit card processors. To remain efficient, competitive and sustainable, companies must take positive steps towards ensuring they operate at the lowest chargeback rate possible.

The issue of chargebacks can be a sensitive topic among e-commerce merchants who work hard to generate value and reap the rewards of strong sales activity. However, chargebacks play an essential role within the consumer economy by acting as a mediation tool in the event of disputes that may arise between businesses and their customers. That said, they can be awkward to manage, damaging to performance levels and an indicator of fraudulent activity.

With that in mind, when a consumer initiates a dispute, it is important for merchants to collaborate closely with issuers, acquirers, and payment service providers, to prevent fraud and unnecessary costs. Just as merchants have evolved to meet the needs of consumers who have embraced omnichannel marketing and digital billing, they also must change how they approach chargeback management in line with recent card scheme mandates. Not doing so poses serious financial and reputational risks and may lead to termination of the merchant processing account all together.

Chargebacks and how they work

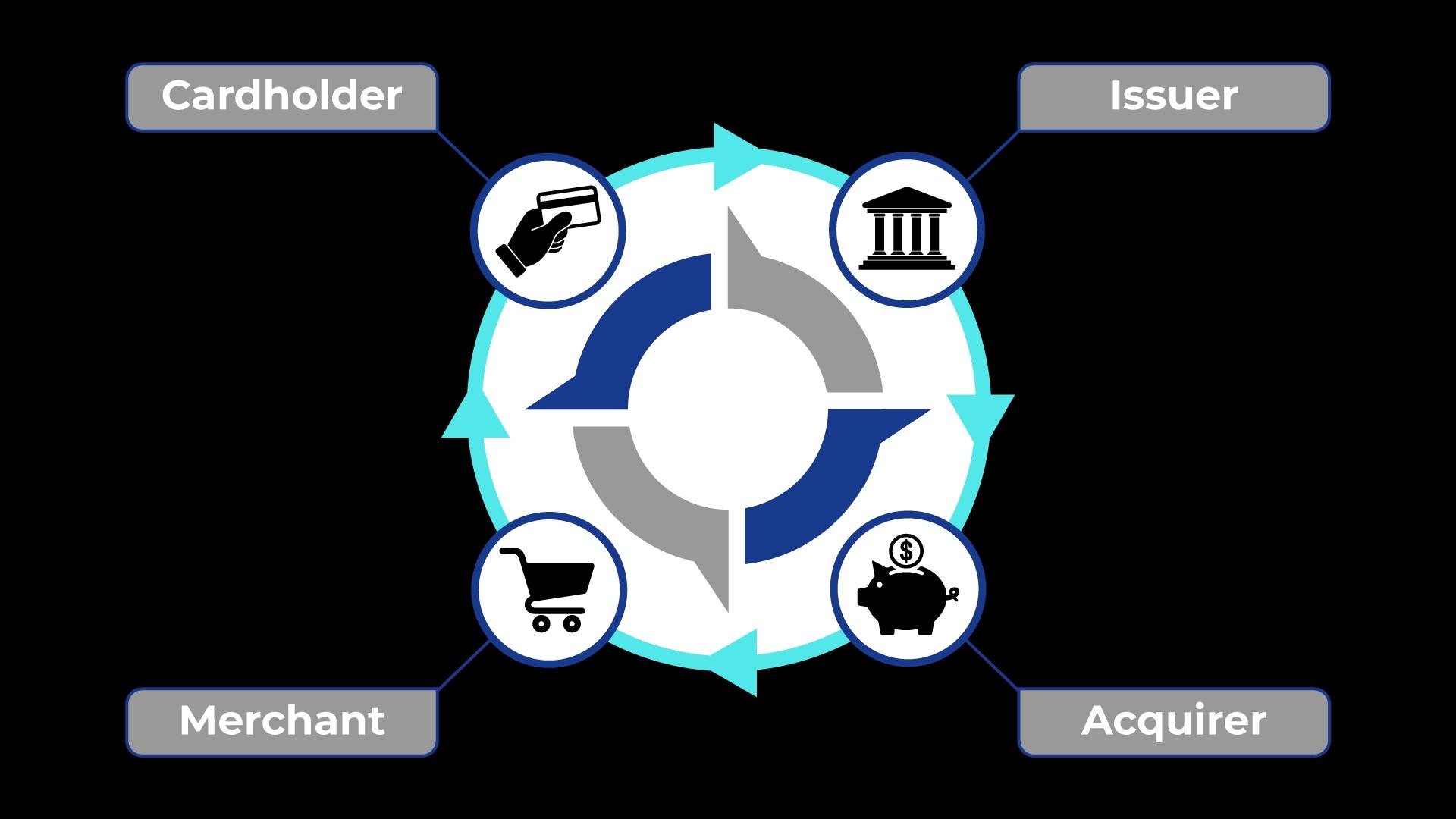

Chargebacks have several causes including customer disputes, merchant error and fraud. The chargeback process is essentially designed to protect all parties by providing a formalised way to arbitrate customer dissatisfaction.

At its most basic, a chargeback is effectively the request for a reversal of a payment in the event a customer contests a charge on their account statement. Examples of this scenario might be if the customer receives a damaged product, or if the merchant has made a processing error by charging the customer twice. In such cases, a customer is entitled to file a chargeback request with their bank for transactions made on credit or debit cards. Once approved, the customer receives the transaction amount back in full. But if the merchant disagrees with the chargeback claim, they can themselves contest it and seek to justify their actions.

The chargeback process differs depending on the payment provider but essentially, it involves a customer requesting a chargeback and then the bank validating it. After this happens, the merchant may look to dispute the chargeback. If the merchant doesn’t dispute or loses such attempt, funds are taken from the merchant’s account and then returned to the customer.

The legal basis behind the chargeback process

All reputable merchants want to do right by their customers, particularly in the event of a dispute. And, from a regulation and compliance perspective there are a set of rules, rights, and obligations to adhere to.

Chargeback laws date back to a time when payment methods such as credit cards were only just being introduced. Of course, plenty has changed over the years with pre-chargeback Alerts being provided to merchants through Acquirer Collaboration being the most recent update.Local consumer credit legislation will explain much of the useful information that both merchants and consumers need to understand.

Pre-chargeback alerts and their importance

A pre-chargeback alert is a notification that is sent to merchants to inform them about a dispute being confirmed between the cardholder and their card issuing bank and a chargeback on its way. These warnings allow the merchants to resolve such disputes through refunding the related transaction much quicker without the need for a chargeback to be filed, improving customer satisfaction and lowering associated costs. Additionally, due to being notified about the dispute much faster than through a chargeback, they can update their fraud defences and take appropriate actions such as suspending the service or stopping shipment of goods to prevent further revenue losses.

These notifications are particularly important for businesses which operate in high-risk sectors which are more prone to chargebacks. These might include those who offer subscription-based or adult services – as these can be deemed as emotional purchases that are linked to so-called friendly fraud, or the customer belatedly changing their mind.

The reality is that chargebacks can occur at any time. And if you don’t have adequate information on when the dispute or fraud occurred, you cannot manage or mediate them effectively, making having a chargeback alert solution in place particularly vital.

How can my business best manage and prevent chargebacks?

Effective dispute management that harnesses the latest developments in technology is essential to recoup what would otherwise be lost revenue.

The best way to do this? By partnering with a knowledgeable payments provider that makes the whole process easier.

For global e-commerce and enterprise-scale merchants, a competent dispute management solution can make a huge difference, as it automates chargeback defence, reduces costs and sources of error while streamlining the process and increasing win rates. Application Programming Interfaces (APIs) also allow merchants to directly integrate chargeback disputes into existing IT systems, offering a more customisable experience while leveraging existing enterprise data.

As per a recent Mastercard mandate, starting this month all chargebacks will be pre-empted by an Alert sent to the bank who processed the transaction. Through Worldline’s partnership with DisputeHelp all merchants will receive such notifications and be able to take full advantage of their chargeback preventative value through our comprehensive platform with rule-based automation functionality.

Via Worldline’s Dispute Help offering, we can provide end-to-end dispute management and distribution that is compatible with both Visa and Mastercard. This solution aims to reduce merchants’ chargeback counts and ratios so that they don’t breach any pre-set parameters and risk having their accounts closed. The solution also integrates seamlessly with merchants’ gateways, carts, and Customer Relationship Management (CRM) systems to facilitate automated, rule-based chargeback resolution management in the most effective way, with minimal disruption.

As a merchant, it’s important to be prepared to react quickly to chargebacks by maintaining good records and the required authenticating data at the time of purchase. When you receive a request for information related to a disputed transaction, it is critical to respond within the required timeframe. Merchants who handle chargebacks in-house, especially those without a dedicated chargeback team, can often find themselves missing deadlines or losing cases because they didn't have enough time to put together the best possible case.

Discover how Worldline can help you protect your revenue and better manage the chargeback process via secure transactions and its dedicated dispute management solution: Global Collect

-

-

-

The Future of Authentication: Exploring the impacts of FIDO

Learn more -

Floya: The MaaS solution for the Brussels-Capital Region

-

Autonomous Payments - What if you never have to pay for anything?

-

-

-

Worldline announces partnership with risk expert RiskQuest BV to provide best-in-class credit checking

Learn more -

Making authentication more accessible: a necessity for banks & best practices for an enhanced user experience.