Online Payments

Online payments that help businesses of all sizes strengthen their e-commerce offering.

I want to reach my potentialBreak down the payment barrier.

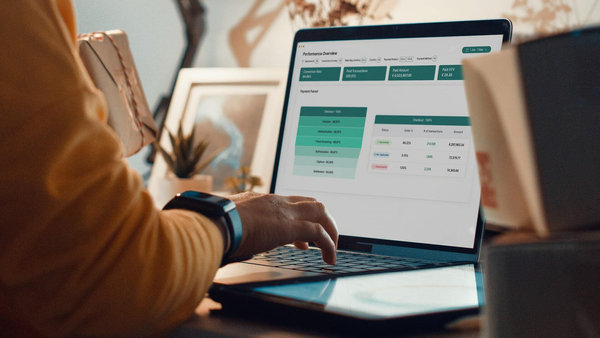

Already have an acquiring partner? No problem. Keep your business in tune with current trends and offer your customers the latest payment methods they want to see with Worldline Online Payments. With fraud management tools and international payment included, we have a solution that covers it all.

Your business. Transformed with online payment solutions.

Don’t let online payments complexities hold you back. No matter what your ambition, we will help you to boost your e-commerce business, taking the pressure off and enabling you to reach new heights. Here’s how.

Offer the greatest ways to pay.

If you’re ready to optimise your online payment solutions, look no further than Worldline Online Payments. Simply fill in a few details and we’ll get right back to you.

Why choose Worldline?

You might also be interested in

-

-

-

Maximize Profits Through Payments

Learn more -

Empowering Self-Service: LM Control and Worldline's Transformative Payment Solutions

-

Autonomous Payments - What if you never have to pay for anything?

-

-

-

Worldline announces partnership with risk expert RiskQuest BV to provide best-in-class credit checking

Learn more -

Mastering the Art of Delivering Payments Acceptance Excellence: Choice of Payment Methods and New Ways to Pay