The Merchant Wallet, a new lever to re-enchant customer journeys and boost revenues | Blog

Every day, a new Merchant Wallet sees the light of day but what are they exactly? How do customers and brands benefit from it? What are their success factors? Using the specific case of Total’s Merchant Wallet launch, here are some answers.

Every day, a new Merchant Wallet sees the light of day but what are they exactly? How do customers and brands benefit from it? What are their success factors? Using the specific case of Total’s Merchant Wallet launch, here are some answers.

The future of payments in a new merchant world

Companies specialized in payments, such as Worldline, forecast that mobile payments (m-payments) will triple in the coming years. The transition to digital payments, or cashless payments, varies depending on the country. In some, such as Switzerland, Belgium or South Korea, the "cashless" revolution appeared very quickly. In other regions, this change is slower for cultural, social and economic reasons. Nevertheless, the trend is clear: regardless of the payment culture, the ratio of liquidity used to the volume of payment transactions continues to fall.

In addition, with the advent of post-millennial generations, customers strongly demand the possibility to pay with their phones. According to a recent study by Cofidis Retail conducted with GFK, 43% of young people want to (28% of all French people).

Companies have clearly grasped this new opportunity and challenge by developing a mobile-friendly customer experience. Today, the act of payment is an integral part of the customer journey. It becomes one of the levers of conversion, seen more and more as a marketing tool.

In the near future, electronic and "phygitalized" (Phygitalization: a process that combines the advantages of a physical point of sale with digital functionalities) payments will continue to develop, particularly the Merchant Wallet.

What is a Merchant Wallet?

Today, there are two types of Wallet: the electronic payment Wallet and the Merchant Wallet.

The electronic payment Wallets, proposed by mobile phone operators or banks, offer a dematerialized payment method in a large acceptance network. The consumer will register different payment methods in a single application, such as a bank card or PayPal account. This wallet remains however confined to payments.

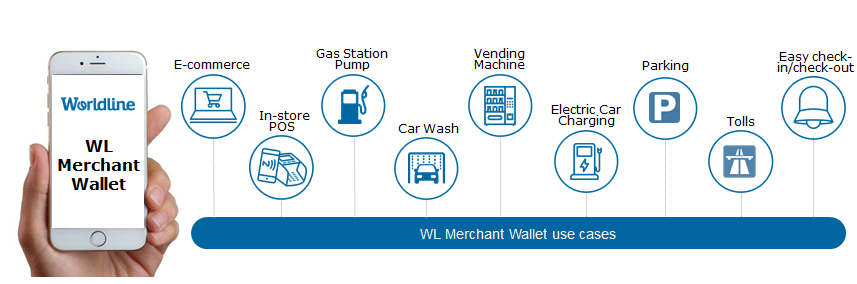

Merchant Wallets have more functionalities than just payments; they add a range of value-added services. The Wallet, whether multi or single merchant, offers many integrated possibilities, such as a loyalty programs, product recommendations or geolocation.

These Wallets are configured to meet a common ambition: to provide a richer and more pleasant user experience. Not only do they make the customer journey more fluid, improve the payment stage and make it more transparent, they also create a link with customers thanks to dedicated digital activity before and after the purchase.

Why the Merchant Wallet?

The Wallet has been developed to make one of the primary reasons for customer dissatisfaction disappear: queuing. To do this, mobile payment will take over from physical checkouts and thus reduce waiting time or even eliminate the act of payment at the checkout.

Many players in the mobility world ambition to position themselves as transport hubs by bringing together their services and those emanating from the ecosystem of their partners, and sometimes competitors, through their Merchant Wallet. For example, a rail transport operator will soon give its customers the opportunity to:

- Compare the cost of a trip ((by train, car, bus, etc.)

- Book their favorite route

- Pay for the selected tickets

- Earn miles on their loyalty program

And all this will be possible end-to-end from a single mobile application.

Benefits for brands

To achieve their objectives, merchants can count on several levers:

- The conquest: enrolling new clients and increasing their level of commitment. The deployment of the Merchant Wallet must be seen by internal teams as an evolution of the loyalty program, with all the attention it deserves.

- The fertilization of its customer capital: collection and analysis of a considerable mass of behavioral information with the digitization of journeys, and much more effective animation of its customer segments. Exploiting this windfall, merchants will have the opportunity to push contextualized offers at the right time.

The marketing department of a food distributor already benefits from excellent return rates of its checkout couponing solution aimed at upselling or cross-selling products on future visits. The same campaigns in real time on customers in a purchasing situation in the store and before the payment phase will have even better results.

There are different levers for cost reduction: after the amortization of development costs linked to the Merchant Wallet, the dematerialization of loyalty cards with or without payment function will represent savings of several million euros for leaders in the world of mobility or distribution.

More broadly, merchants will benefit from other additional advantages: in the longer term, they will be able to reconvert the square meters occupied by the eliminated checkouts, gain sales space or even reduce their number of payment terminals.

Consequently, the generalization of a Merchant Wallet can have considerable business impacts by generating 1 to 2% additional turnover after a full year of deployment; though it must be noted that the rate will depend on the speed of migration of loyalty cardholders to the digitized solution.

Feedback on the launch of a Merchant Wallet

When the customer is in a position to respond to the enticement, contextualized offers return rates that are disproportionate to what was previously achieved with the loyalty card and email campaigns.

Distribution players are not to be outdone, and are looking to re-enchant the customer journey. The Merchant Wallet trial ads are multiplying in France and abroad, promising that the users of the application will save time and money. For example, Total has set up its "eWallet" to solve its various problems: smooth payments, a controlled customer journey, and interactions with its customers.

Brand issues

In search of constant adaptation to the new digital world and a transformation of customer expectations, Total launched the "Total eWallet".

"Simplifying the customer journey is at the heart of our commitments. Our goal is to make our customers' shopping experience secure and smooth."

Antoine Tournand, Director of Networks and Cards at Total Marketing & Services

Strategic solution

Total's Merchant Wallet is intended for professional or private customers who have signed up for the eWallet service by referencing their Total private card and/or a universal payment method (bank card, third-party Wallet such as Apple Pay or provided by a bank, etc.).

The "Total eWallet", a 100% digital and connected solution, allows motorists to fuel up and pay for their purchases from their mobile phone. Thanks to this Wallet, European private and professional drivers using the Total network can access all the gas station services via a single mobile application with minimum waiting time.

Benefits for end consumers

Total launched this new innovation by placing customers at the heart of its strategy. There are numerous advantages for customers:

- A simplification of the "driver – fuel pump" customer journey: Customers benefit from speed of purchase, a reduction in time spent outside the car, but also avoid the checkout, and compensate for any payment unavailability by bank card. Filling up will take less than 45 seconds, a real advantage for customers. Indeed, three clicks in the application are enough: the first to unlock the pump, and the other two to select the fuel and the desired payment method, giving an express experience to customers, who will not have to go through the store or use a conventional automatic pump.

"We notice a time saving of 10 to 30%. Even if there is no line in the store, the Merchant Wallet saves time since it avoids making a round trip."

Gilles Bourron, Payment Methods expert at Total

- Payment transparency: Today, customers highly appreciate payment transparency and especially one-click payments. The application thus meets this demand to the greatest satisfaction of its users.

- Integration of transactions in the Total Services application with a personalized service: Transactions are recorded in customers’ mobile application. Invoices can be digitized and the consumers’ purchases can give rise to a personalized coupon system.

- Time saved at the store checkout: Depending on the format of the store and its peak hours, customers will be able to reduce their shopping time between 10 and 25%.

What are the key success factors?

Before embarking on a Merchant Wallet project, some questions have to be taken into consideration.

The first one is crucial – does the brand generate enough interactions with customers to have them agree to download an application that allows them to pay and be guided throughout their customer journey? If the answer is yes, it is important to go through a framework study phase with the aim of determining a common ambition for the various stakeholders (businesses, marketing, electronic payment services, IT, etc.).

Marketing workshops will have to provide the answers: customer segments to address, service packages to select, customer problems to respond to, and new journeys to consider. Technical workshops should qualify the impact of the new marketing ambition on IT as a minimum in terms of architecture, data repositories, and governance. A pilot will then be set up to validate the merit of the new ambition in terms of acceptance and use of the targeted customers before deploying the solution throughout the network.

In order to set up this new service for their customers, brands should call on companies experienced in the deployment of digitalized and secure payment solutions.