The payments landscape in India: A forward-looking perspective

The new normal for expected digital payments’ (payments other than cash and checks) growth numbers in India seemed unreal until recently. In a recent report, Credit Suisse estimated that digital payments in India would reach $1 trillion in FY23 with mobile payments accounting for $190 billion, the estimate for 2018 is $10 billion.

The new normal for expected digital payments’ (payments other than cash and checks) growth numbers in India seemed unreal until recently. In a recent report, Credit Suisse estimated that digital payments in India would reach $1 trillion in FY23 with mobile payments accounting for $190 billion, the estimate for 2018 is $10 billion (Credit Suisse Equity Research, “The WhatsApp Moment in Payments”, February 5, 2018). The report states that “digital payments in India are soaring on the back of global tech giants entering the market as aggregators for retail transactions”. In the same vein, another report estimates that e-commerce transactions will grow to $64 billion in 2020 from $38.5 billion in 2017

(India Brand Equity Foundation, Report on E-commerce, April 2018). Finally, McKinsey estimates that net new payment revenues in India will increase by 13% on an annual basis (McKinsey, “Global Payments Map 2017”).

‘Destructive creation’ is an apt term for the digital payments space in India. New innovations are fueling changes in every sphere leading to a significant widening of the potential market and driving down costs of transactions.

Even if these predicted numbers are taken with a pinch of salt, and they probably should be because the numbers likely include P2P transfers, the growth percentages are still likely to be large. Given that the digital payments space is a constantly evolving one, it is worth asking 2 questions:

- While there is a governmental push for digital transactions, can regulations potentially hurt the growth of digital payments given there is no possibility of lofty numbers being achieved without private sector players?

- How is the P2B space going to move forward?

A small flashback

Up until November 2016, the term ‘demonetization’ was largely relegated to macroeconomic textbooks and viewed largely only as a theoretical policy idea; that changed when the Government of India implemented it. It can be debated whether the policy was a success or not but what cannot be debated is the fillip it gave to digital payments, and more importantly, fundamentally changed the nature of people largely accustomed to cash – by some estimates, cash accounted for over 97% of transactions.

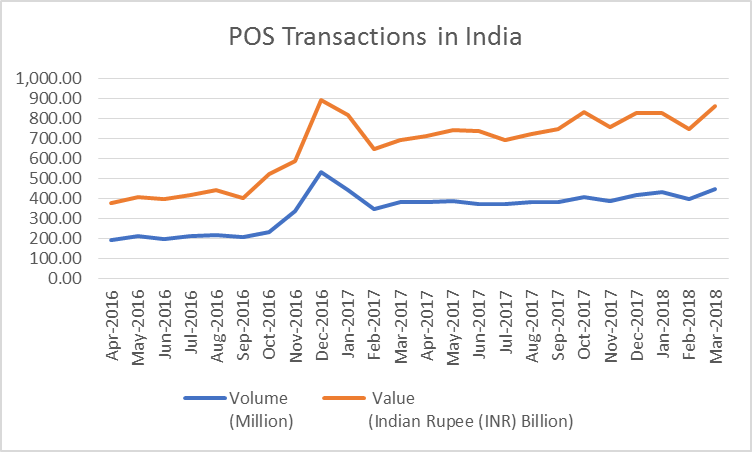

Source: Reserve Bank of India - May 2018

While cash has made a comeback into the economy and POS transactions have largely leveled off from their highs, the conversation around digital payments has changed from something that was largely perceived as relevant only to the urban population to something that has a more inclusive and sustainable feel to it.

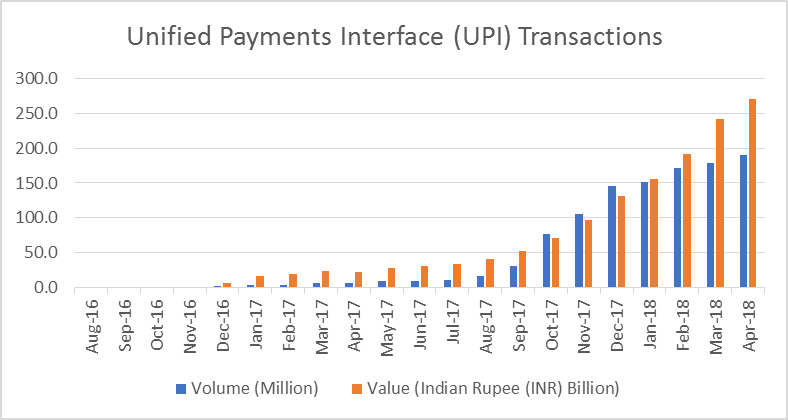

Source: National Payments Corporation of India - May 2018

A proxy for this inclusiveness and sustainability can perhaps be seen in the volume and value of UPI (Unified Payments Interface) transactions in recent months. UPI is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing and merchant payments into one hood (NPCI website). While the estimates for merchant payments through UPI range from 10-25%, albeit primarily through e-commerce platforms, it is a good indicator that people are taking fairly swiftly to the idea that there are digital alternatives to cash.

The regulatory environment

Regulations in India have always been the great unknown known – we know that they will be there; what they will be or their impact is almost always unknown.

The government’s and regulator’s position on digital payments can largely be divined through the lens of the Reserve Bank of India’s (RBI) report, Payment and Settlement Systems in India: Vision-2018. The fruition of this vision rests on 5 Cs: Coverage (access to a wider variety of electronic payment devices), Convenience, Confidence (secure), Convergence (interoperability), and Cost. It goes without saying that the most serious challenge to this mission is the omnipresence of cash. A report released by the World Bank in April 2018 confirms that this is the case.

While the government and other institutions are providing a whole host of incentives to promote digital transactions, there are rules and regulations being put in place that could be a potential hindrance to the growth of digital payments. Some of them are:

- MDR caps– The lifeblood of any merchant acquiring industry is the merchant discount rate (MDR). Under the ambit of promoting digital transactions, the RBI has reduced MDR on debit cards to low levels and has placed much of the burden on merchant acquirers who already operate on razor thin margins – there was no change in interchange fees. This problem can be mitigated if the regulator takes a considered stance by working with industry players who make these digital payments happen by creating more acceptance points. In another move, the government has removed MDR charges on all debit transactions below INR 2000. While the government will reimburse acquirers, they do so with a lag.

- KYC/AML – The RBI has placed onerous requirements of KYC/AML on digital platforms such as e-wallets effective March 1, 2018. News reports in early March indicate that over 90% of e-wallet users had not completed the KYC norms. Subsequent data from the RBI suggested a massive hit – transactions on m-wallets fell from INR 131 billion in February 2018 to INR 101 billion in March 2018 with a further expected slide. Transactions have picked up since then with June transactions reaching INR 146.3 billion. However, the natural state will only be known once all incentives are removed or substantially reduced.

- Data storage – On April 6, 2018, the RBI mandated that all payment providers store their data within India and gave them a 6-month deadline. The reason given was: “In order to ensure better monitoring, it is important to have unfettered supervisory access to data stored with these system providers as also with their service providers/intermediaries/third-party vendors and other entities in the payment ecosystem”. This could likely give cold feet to foreign entities coming in because of this measure as well as affect foreign entities already present in India.

- Cryptocurrencies – Cryptocurrencies are an extremely new form of currency that does not require a centralized system, hence making them difficult to regulate. However, the underlying Blockchain technology has many more uses beyond virtual currencies. It is largely being used for B2B transfers and has hardly any P2P usage. The impact of Blockchain on the industry and on P2P payments is yet to be seen.

The P2B space – Looking forward

The Indian digital payments space is getting crowded with players ranging from a few with 100 merchants to those with millions of users. What is proliferating is being driven by good old-fashioned capitalism tempered by regulation. However, as in any maturing market, when the dust settles, there will only be a few winners left: the winners will have one or more of the following characteristics: ease-of-use, customers are used to/adaptable to using them, large market presence, frictionless, low cost and profitable despite lowered margins. The obvious holy grail of modern payments is enabling easy, secure payments for anyone, anywhere in the digital or physical world, all using a single account.

The P2B space is largely confined to physical and e-commerce segments. The e-commerce space in India is tricky because a chunk of the transactions, when excluding travel and entertainment, are potentially cash-on-delivery transactions. Online payments will continue to be largely confined to current modes such as cards, UPI, direct debit, etc. There is a possibility of cryptocurrencies coming into play too but that is still uncertain. The action will largely be in the physical merchant segment and is going to be a combination of asset and asset-light form factors.

Asset – POS terminals

Any stories about the death of POS terminals are greatly exaggerated. There are several reasons for this:

- The India digital payments story, form-factor wise, is not a special story that is different from other markets. POS terminals exist in every market and are continually growing even in mature markets. There is no reason to believe that POS terminals are somehow going to disappear overnight despite cost concerns. Anecdotal evidence suggests the number of POS terminals in the market is probably only at about 30% of its potential. Apart from this, POS is central to the government’s strategy of cashless payments.

- Merchant acceptance of POS terminals, especially in the organized sector and in tier-1 and tier-2 cities is high. Besides, POS is already institutionally entrenched into the merchant payments acceptance space.

- Cardholders, from a behavioral perspective, are already used to dipping their cards to make payments for goods and services and while some may move to a mobile-based form of payment, they are likely to never completely leave a card-based environment.

- Credit cards – The average transaction size of UPI is about 40% of credit cards’ ATS. Credit cards still account for a little over 50% of POS transactions in terms of value and will most likely continue to be around that number.

- POS terminals are flexible and can accept payments from mobile apps and also accept biometric inputs (including Aadhaar, a 12-digit unique identity number that can be obtained by residents of India, based on their biometric and demographic data) for payments.

Asset and Asset-Light - Mobile

It is obvious that form-factor for payment acceptance is changing and smartphones are driving the revolution. The aforementioned Credit Suisse report writes: “In just four months of launching its payments app, Google is already processing the same number of digital transactions as Axis Bank”. All mobile-based apps, if they hope to be successful, will necessarily have to ride on the UPI platform. Currently, while the UPI numbers are showing dramatic increases, it should be worth noting that merchant payments still account for only a small part of the total number. It is also worth noting that there are incentives being offered currently for UPI transfers and this will not last forever. There is a good possibility that some customers may switch back to more traditional methods once these incentives run out but the jury is still out.

The majors in the mobile money transfers space are all gunning for the merchant space and for good reason; without merchant adoption, the broader network effects are moot. This may come sooner than later with the introduction of UPI 2.0 that will have merchant payment features.

The real push in merchant acquiring is going to happen when mobile-based companies go the asset-light route or, in other words, a static printed QR code mode of acceptance. There is a massive merchant ecosystem, estimated at 40 million, that has not used electronic payments and that will offer real growth in digital payments.

Another push in the P2B is when interoperability within wallets becomes a reality.

How Worldline is prepared

Worldline has a global footprint, is a leader in many countries and brings this global experience to bear on local businesses. This coupled with its global innovation centre, dedicated R&D team and pioneering use of Host Card Emulation, Blockchain technology, AI and more, makes Worldline a force to be reckoned with in the Indian payments space.

Worldline is systemically prepared to capture a significant part of the market going forward because of its:

- Comprehensive capabilities – terminals, apps, acquiring solutions, issuing solutions, connectivity, processing, fraud and risk management, value-added services (EMI, DCC, etc.). Its offerings cover the entire payments value chain.

- Deep connections into the payments ecosystem – connected to banks (already a trusted partner of c. 40 banks and financial institutions in India and hundreds of banks globally), all payment schemes and connected with hundreds of thousands of merchants.

- Future-proof technology– with high speed, high availability and a robust, secure, high capacity processing engine. This is agnostic to form-factor, communication protocols and interconnection technologies.