Tips & tricks around card fraud

Don't give credit card fraudsters a chance

This is the best way to protect yourself

Credit cards are a practical everyday companion for many guests and are widely accepted as a means of payment. Unfortunately, neither cards nor terminals are 100% safe from fraud and manipulation attempts, and fraudsters are also becoming increasingly sophisticated in order to make money with stolen card data. We help you to protect yourself efficiently against fraud and thus avert possible damage to your business – either at the POS or via e-commerce.

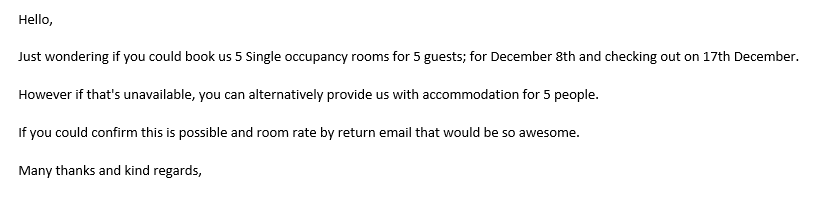

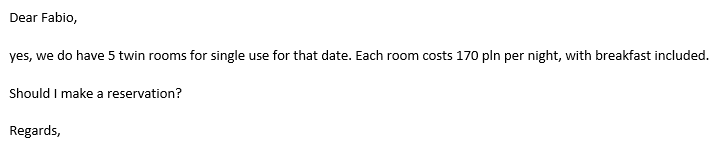

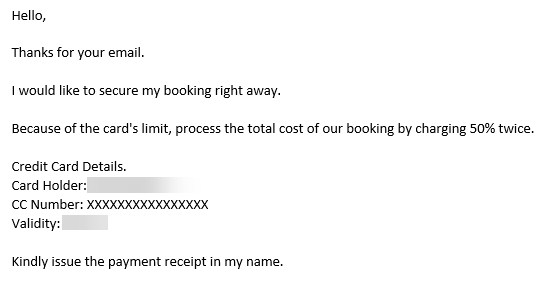

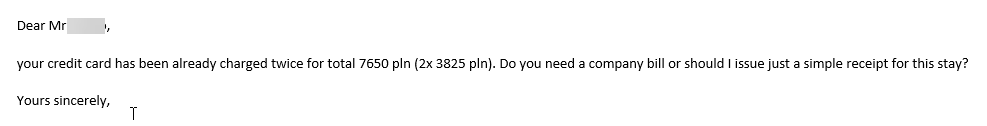

What is the most common scam?

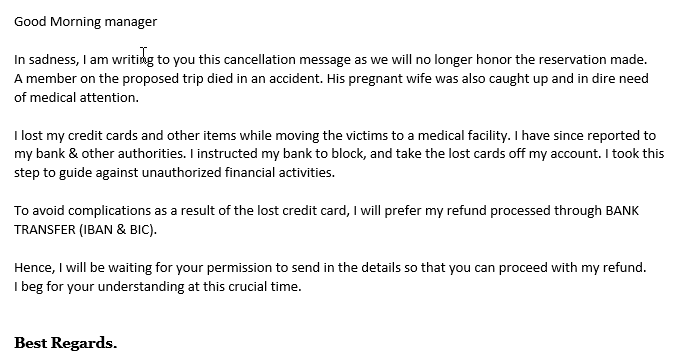

One of the most popular scams is reservation fraud: Usually, a stolen credit card is used to book a longer hotel stay and the card is charged. In return, the fraudsters demand a booking confirmation by email. After a few days, they cancel the booking under a pretext - very often illness, accident or a medical emergency in the family are given as the reason. They then ask for a credit on a new credit card or for a transfer to a different account than the one used for the booking. Attention: The financial damage this could cause you as a hotelier or restaurateur is immense. Because you could lose your money twice: Firstly, through the chargeback from the real cardholder and secondly, through a credit to the fraudster.

What can you do to avoid being caught in a scam? We have put together the most important tips for you. Please read them carefully to be prepared for potential fraud attempts.

10 tips to help you avoid scams

- Always issue credits for the same card that was used for the original reservation.

- Be careful if the card presented is from a different country than the reservation. Therefore, always check the BIN (Bank Identification Number) of the card (bincheck.org).

- Look out for suspiciously high amounts and an increased number of transactions on one or more cards.

- Verify bookings where the guest does not match the person making the booking. You can check the authenticity of the card details using the Verification of Cardholder Information form. Worldline will clarify with the card-issuing bank whether the card really belongs to the person in question and will contact you after 72 hours at the latest.

- We strongly recommend not to make transfers in case of credit/debit POS transactions.

- Always pay attention to the sender of the email. Fraudsters often use a combination of numbers and letters and use a free email account (e.g. skyblue123@gmail.com).

- We strongly recommend that you use online payments with 3-D Secure procedure for reservations with advance payment.

- Please note that there is no liability in the event of misuse for telephone or email reservations (including advance payments) or reservations on the Internet without 3-D Secure processing. Only if the credit card has been read by the chip or magnetic strip at the payment terminal on arrival (or departure) there is liability in the event of misuse.

- Never leave your terminal unattended, and if possible do not leave it on the counter for easy access.

- Do not place any password near or on your terminal.

The most important questions and answers

-

The following names are most commonly used for fraudulent bookings:

Abrose, Kevin Clymans, Walter Hajdari, Everaldo Royless Michael Adamchuk, Natalia Cole, Philip Hara, Jacqueline Ruiz, Bernardo Alfred, Luiz Cook, Ghelen Harry, Daniel Sanchez, Mario Anne, Pauline Dempsey, Gary Heleven, Suzanne Shabazz, Taha Anze, Mitchell Drake, Samson Israeli, Abraham Simon, Robert Babacar, Diop Duckworth, William Jaworski, Hajnrich Sisik, Adam Baris, Cenk Eldridge, Steve Jones, Maria Smith, Nicholas Barraclough, David Eleven, Helen Lawton, Paul Wallin, Anton Bonifac, Madoc Erdogan, Cenk Macias, Veronica West, James Charles Bross, Norbert Faith, Greg Mark, Judith Williams, Niels Bruce, Bryan Finnen, Alexander John McClaskin, Gosseline Williams, Victor Bryant, Peter Gibbs, Edward McDorman, Frank Woldt, Dieter Carlsson, Michael Godfred, Jonathan Noor, Musa Woosley, Mike Chirs, Donald Gonzalez, Francisca Olanipekun, Ghelen Zaharia, Ioana-Daniela Chrysostomou, Diana Goole, Steve Parson, Eric Cleveland, William Gyuen, Okan Peel, Anthony -

Here you will find an overview of the most commonly used fraudulent email addresses: www.bbcanada.com/bb_stay_alert.cfm

-

Below you will find a typical email history:

-

No, you still need to be careful as any manual transaction can be reported as fraudulent by the legitimate cardholder.

-

In most cases, fraudsters use stolen card data, not actual lost or stolen cards. Due to data leaks, fraudsters can obtain complete card numbers and expiry dates of cards that are still valid and functional. Sometimes the cardholder only discovers the fraudulent transactions when they see their monthly credit card statement.

-

No, in a manual transaction, even documents such as authorisation forms, credit card scans, passport copies, etc. are no guarantee that it is an email from the cardholder and that you are safe from chargebacks.

-

For recent transactions, the "transaction cancellation" option should be available on your terminal. If this is not the case, please use the "refund" function. For this, please make sure that you make a refund to the same credit card.

-

Pressuring the merchant with phone calls and emails is often part of the fraud scenario. In such cases, we advise our merchants to insist on payment (ideally with PIN confirmation) at check-in. In most cases, this should be enough to deter the fraudster. Alternatively, you can suggest payment by bank transfer.

-

If you have any further questions about card fraud, please contact our Fraud Prevention Specialists:

fraud_eu@worldline.com (Europe)

fraud@six-group.com (Switzerland)

merchantsecurity.austria@six-payment-services.com (Austria)