Worldline E-Payments

The complete web shop solution

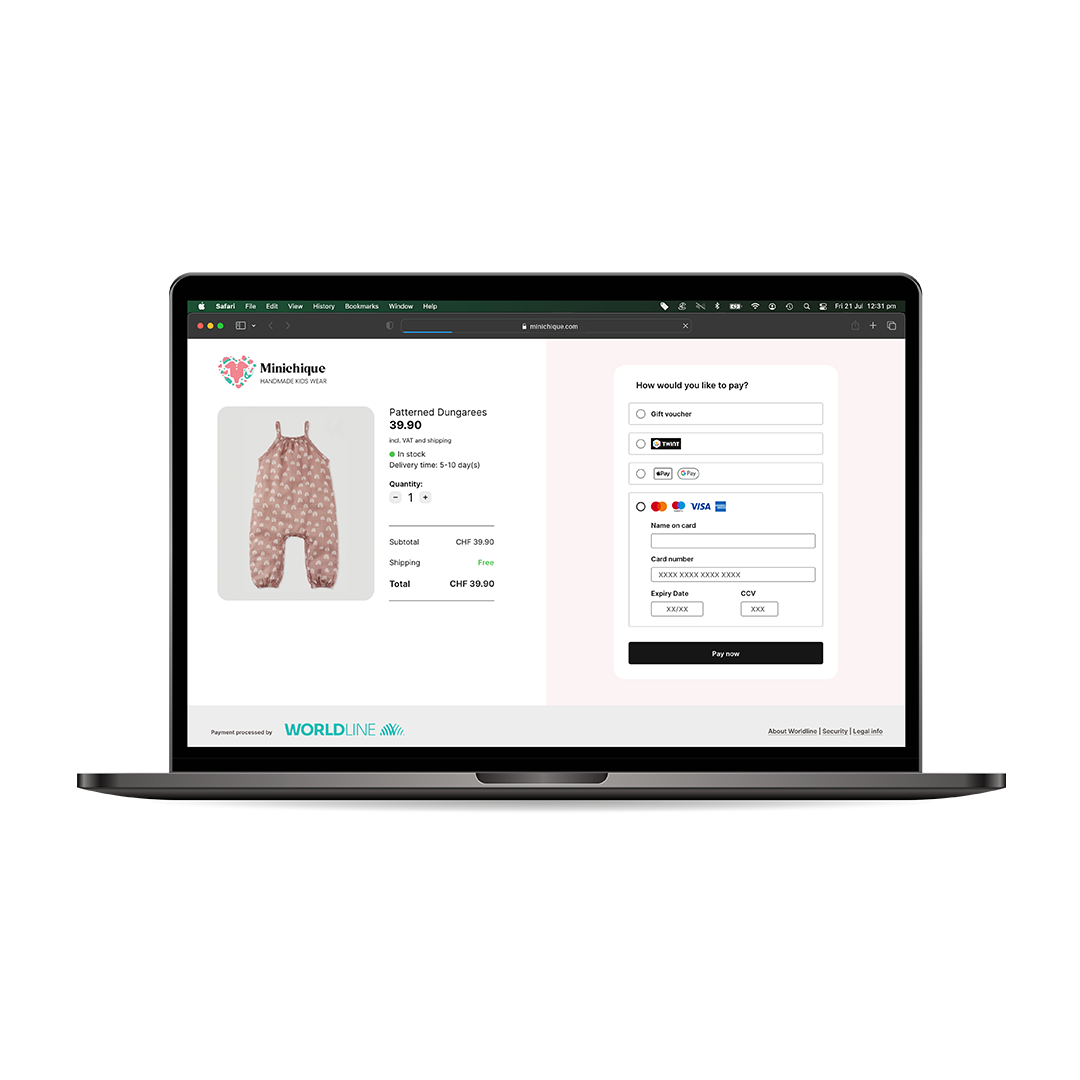

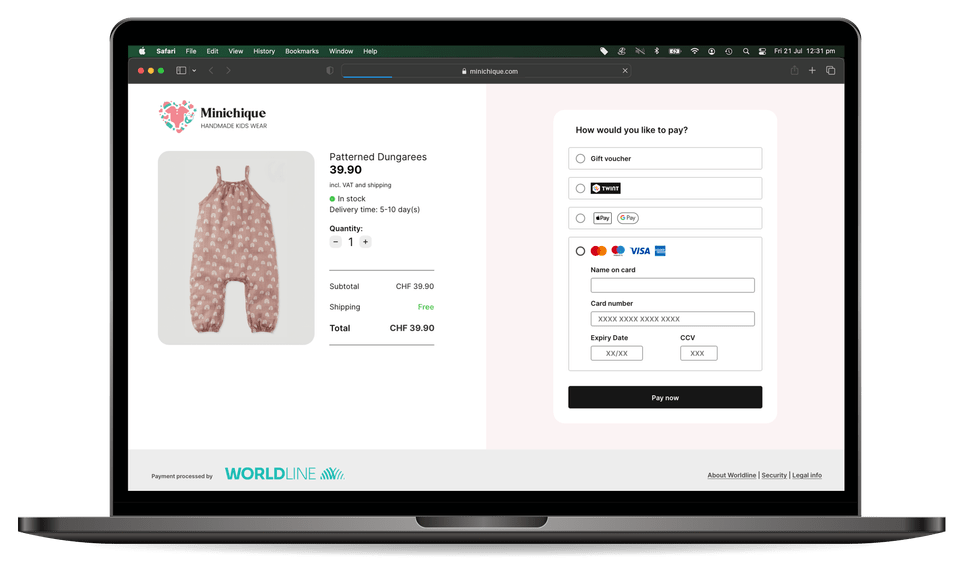

Easy payment acceptance in your online shop

| 1.7% + CHF 0.19 | CHF 0.- | |

| per transaction | setup fee & monthly costs |

Online sales made easy

With the complete Worldline E-Payments solution, you can accept payments easily and securely in your online shop.

Accept payments in your online shop

- Plug-and-play integration into your Web shop and PCI DSS certification

- Access to Saferpay Backoffice to manage payment transactions in real time

- 27 languages, 47 currencies

- Refund and one payout for all payments

- Simple API integration

| Information about the fees | |

|---|---|

| Surcharge commercial cards and non-domestic transactions: Applies to transactions with international commercial cards and card transactions outside the EEA. | 1.3% |

| Processing of chargebacks | CHF 30.- |

| Setup fees | CHF 0.- |

| Inactivity fee This fee is charged if no transactions are made during a six-month period. | CHF 9.90 for 6 months |

Plug-in for your online shop system

Start selling online easily with our certified plug-and-play extensions for your e-commerce platform's shopping cart.

Konfekteria online shop

Discover how Hinda Kammoun from Konfekteria.ch has optimised her online business for personalised sweets with the Worldline E-Commerce solution. Learn more about efficient order processing and various payment options that support small businesses.

To enjoy the full experience and watch our videos, please accept the cookies.

Questions and answers

-

Acceptance of all standard credit and debit cards, mobile payment methods and cryptocurrencies: Visa, Visa Debit, V PAY, Mastercard, Debit Mastercard, Maestro, Diners Club International, Discover Card, WeChat Pay, Alipay, UnionPay, JCB, Google Pay, Apple Pay, TWINT and Crypto Payments.

-

PostFinance Pay, American Express and PayPal can be added. For this, a supplemental agreement must be signed with the relevant Acquirer. For this, please contact our customer service. In addition, CHF 0.29 is charged per transaction via third-party Acquirers.

-

We support a wide range of shop systems, which you can find listed here. We will be happy to check your desired shop system, but we essentially only work with those listed here.

-

You can find the payouts in our customer portal myPortal. Please note that third-party Acquirers such as American Express or Post Finance are not listed in myPortal.

-

Learn all about the integration, interface configuration and use of Saferpay here to ensure that the integration of the payment solution into your business application runs smoothly right from the start.

-

No, the test and live systems are completely separate from each other. No data exchange takes place.

-

Generally speaking, yes. There are several ways to do this. Two scenarios can be:

- The shop carries out the transaction, but the ERP system does not carry out the capture until the goods are shipped. You only need to set up a connection between the shop and the ERP system so that transaction data can be exchanged between them. At the same time, the ERP system can carry out the capture with the transaction ID that the shop receives from Saferpay. Please note, however, that reservations may expire depending on the payment method and issuer of the card, as indicated here. To avoid this, you should use approach 2.

- The customer's card is stored by the shop in the Saferpay Secure Card Data (SCD) Store. The transaction takes place at the point in time when all goods can be shipped, which is carried out by the ERP system using the SCD data received. Keep in mind that the solvency of the cardholder may change by this point in time.

It's easy to get started

3 steps to accepting online payments

Would you like to test Worldline E-Payments beforehand?

With our test system, you can make test payments.