Klarna Payments

20 / 09 / 2021

A high number of payment cancellations in the shopping cart poses a challenge for many online merchants. One reason for this could be the means of payment on offer. Or those which are not on offer. That is why we are constantly expanding the means of payment we offer.

Almost half of all customers abandon their online purchase if their preferred payment method is not accepted. Until recently, merchants were able to process a total of 26 means of payment on the web shop using the Saferpay online payment system.

All three means of payment are easy to integrate on the Saferpay payment page.

In Switzerland, paying by invoice is just as popular as paying by credit card: according to the Swiss e-commerce opinion survey carried out in 2020, 76% of respondents said they preferred these two payment methods. Integrating Klarna Payments isn’t just worthwhile for you for this reason. Klarna also assumes both the credit and fraud risk for all payment methods.

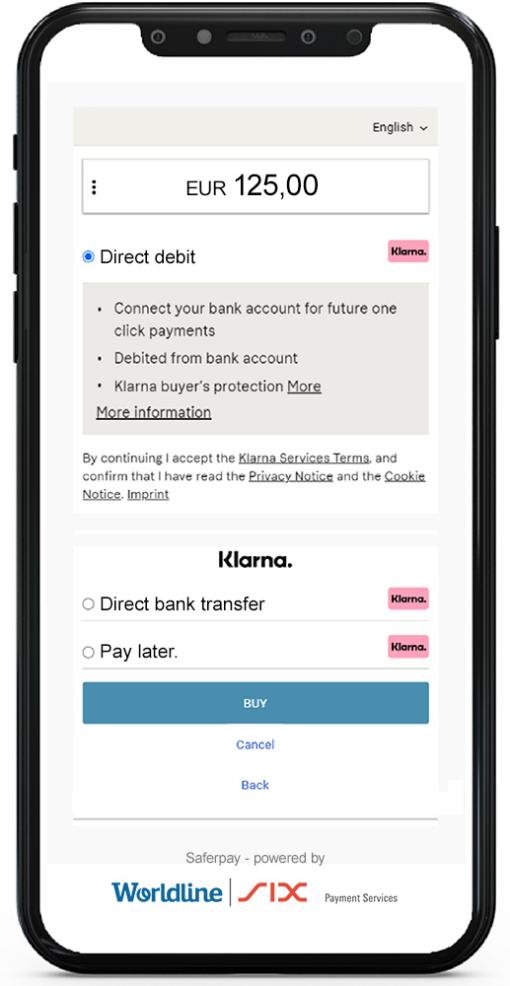

Pay Now

Your customers make payments quickly, easily and securely. Secure bank payments are made in just a few seconds. Klarna Pay Now also supports recurring payments and subscriptions.

There are various ways to Pay Now:

Instant funds transfer

Fast and secure payment via online banking. Klarna bears the risk associated with credit and fraud loss so you will always receive your money.

Direct debit

Making payments by direct debit is convenient. Your customers’ data is saved so they can pay with just one click next time. This saves time and Klarna bears the risk of potential losses.

Advantages for you

- Increased turnover

- Increased conversion rate

- Low transaction fees

- All purchases are covered by Klarna Buyer Protection

- Risks associated with credit and fraud loss are fully covered (no chargeback)

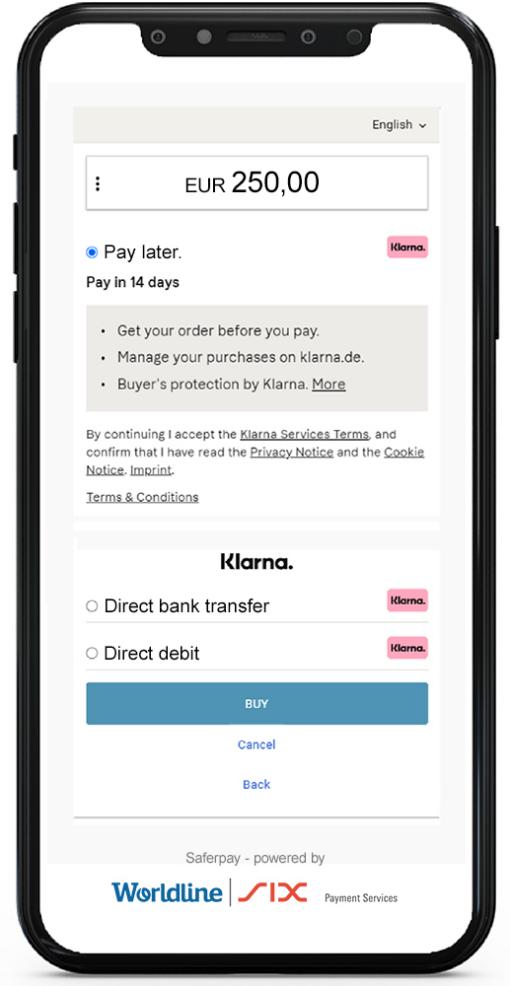

Pay Later

Your customers buy now and pay later (between 14 and 30 days, depending on the country).

This increases flexibility at the checkout and provides a smooth shopping experience. Klarna will send the invoice to your customer by e-mail. Returning customers are recognised and the information required is pre-populated.

Customers who are new to Klarna only need to enter a few personal details, which they always have to hand. Ideal for mobile shopping on the go.

Advantages for you

- Rate of aborted payments in the shopping cart decreases

- Klarna assumes all risk

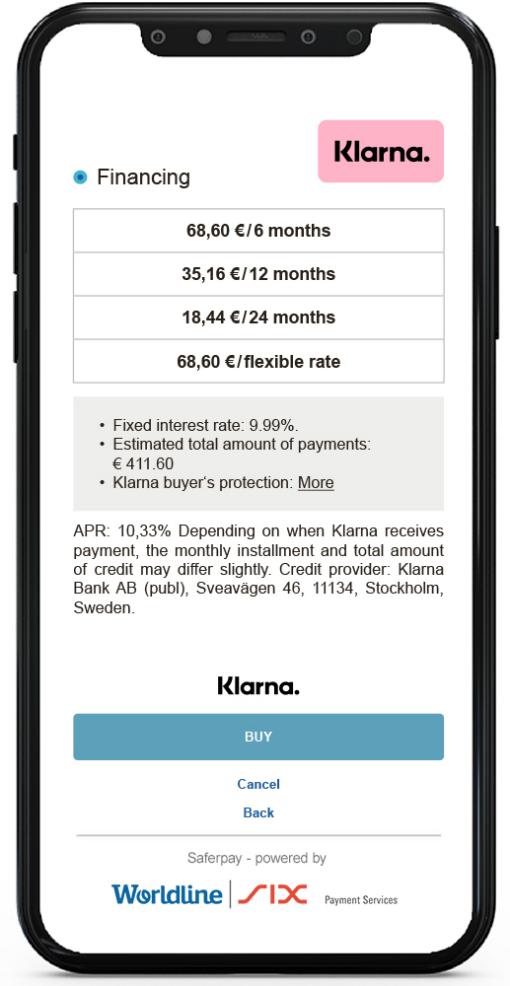

Financing

Financing increases your customers’ purchasing power and you benefit from higher turnover and better conversion rates by offering financing options. Your customers can choose between two instalment options:

Flexible from month to month

Flexible instalments of up to 24 months, with no fixed term. Your customers decide how much they want to pay each month. The balance can be paid in full or the minimum monthly payment can be made.

Fixed payment plan

Fixed instalments that are consistent and predictable, for example you can pay in 6, 12 or 24 monthly instalments. Your customers can choose their preferred instalment plan, giving them security and financial freedom.

Advantages for you

- Your customers’ purchasing power increases: the order value increases by up to 58%

- The conversion rate at the checkout is up to 30% higher

- The whole amount is paid out, regardless of how, when or whether the consumer pays

How can I activate Klarna Payments?

Activation couldn’t be easier:

- Sign a contract with Klarna directly. Then send an e-mail to: worldline.sps@klarna.com

- Make sure that your Saferpay connection supports Klarna Payments.

- Activate Klarna Payments in the Saferpay Backoffice.

Detailed information is available in our Klarna Payments Documentation.

Want to find out more about the acceptance which is on offer?

Please feel free to get in touch with our payment experts.

Contact Opens in a new tab