From automatic to autonomous payments – can “things” pay?

01 / 03 / 2020

Internet of things (IoT), Banking of Things, Payment of Things, there are so many buzzwords ending with "things". IoT has generated tremendous excitement and opportunities for innovation which explains its impact on the banking and payment industry, recently drawing increasing attention.

Can "Things" pay?

Internet of things (IoT), Banking of Things, Payment of Things, there are so many buzzwords ending with "things". IoT has generated tremendous excitement and opportunities for innovation which explains its impact on the banking and payment industry, recently drawing increasing attention.

According to eMarketer’s estimation, the US proximity mobile payment transactions will grow by 31.8% in 2020, compared to 2019, reaching a total of $130.36 billion. By 2021, the total transaction value will reach $161.41 billion. For Europe, we can expect similar trends in "tap-and-go" adoption.

Payment convenience does not only apply to shop counters, it is also entering the automotive space. Through tokenization, payment credentials can be stored in connected cars, allowing cars to make payments for surrounding services such as electric charging, gas, parking and drive-in purchases at fast food restaurants. Today, when you book a cab on an app, you simply get in the car, enjoy the ride, and then get out at your destination. There is no need to take care of the payment in the cab as this step disappears into the background.

These promising trends show that millennials and generation Z are embracing payment solutions that bring the best convenience, whereas merchants’ and service providers’ goals are to make payments as frictionless as possible, and sometimes "invisible". Let's face it, the easier it is to pay, the more customers will purchase.

Why should the banking and payment industries consider the impact of IoT?

There is no doubt that the potential of IoT will bring unprecedented opportunities for many industries. Especially, there are many reasons for the banking and payment industries to seriously consider IoT.

IoT helps accelerate the development of sharing economy platforms, from which pay-per-use business models naturally emerge. The world we live in today is endangered by climate change; sharing assets and resources in an efficient way can reduce the wastage of natural materials. Moreover, the younger generation is becoming less and less emotionally attached to materialistic possessions like owning a car, a washing machine, or even a coffee machine. Instead, they prefer to spend time and money on immaterial products such as travelling, going out with friends or loved ones, etc. This change of mindset will boost the sharing economy to the next maturity level. In this context, if banks are to expand their businesses into a sharing economy, they should consider the potential benefits of IoT to monitor and manage assets, limit financial risks, and secure profitability.

With over 38 billion connected devices by 2020 (triple from 2015), billions of additional transactions are expected, but most of these opportunities still remain untapped. For example, a smart "sales hunter" can seek a specific product and close the deal automatically at the given permissible price on behalf of the consumer. Imagine if Alexa could do this for you!

What if solar panels could sell overharvested energy to some other consumers/machines, with the dynamic pricing and corresponding payment transactions being handled autonomously between two devices, enabled by Blockchain technology?

As part of the Green Deal, EU member states are encouraged to invest in public infrastructures that fight against climate change. One of the necessary infrastructures will be electronic tolling, where the drivers are charged by "when/how/where-you-drive" in combination with cars’ characteristics such as power type (e.g. gasoline, electric, etc.).

There are indeed many other potential use cases that will drive new growth for both the banking and payment industries that merit further exploration.

From automatic to fully autonomous payment

In fact, contactless payment could be considered as the "primitive" and most successful form of IoT payment. With the rapid and inevitable spread of IoT infrastructures, current payment means are not sufficient to deal with future needs. We will see payments shifting from automatic (i.e. with some level of automation like contactless payment) to fully autonomous (i.e. payments conducted by an agent hosted in a device).

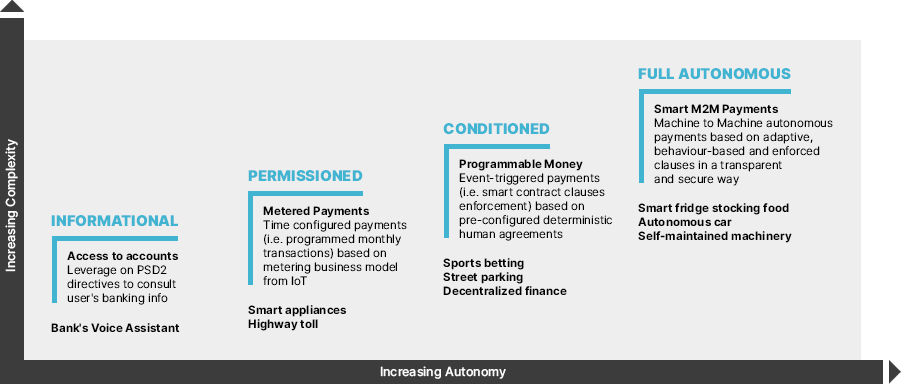

Hence, we can define four levels of increasing autonomy in payment:

- Level 1 (Informational) - The device/software agent has permission to access a user’s bank account only to provide information regarding the data available in this bank account.

- Level 2 (Permissioned) - The device/software agent must ask the explicit consent of the user before triggering a payment. The user can grant this permission by any digital (biometric or non-biometric) mean.

- Level 3 (Conditional) - The device/software agent triggers a payment only under certain conditions set previously by a human agent.

- Level 4 (Full Autonomous) - The device/software agent triggers a payment without human intervention. The user could be optionally informed or not informed at all, in real time, about the payment being made.

What are the challenges of autonomous payment?

In the Fintech industry, innovation happens fast but adoption takes time. Contactless payment took more than a decade to reach the current level of market penetration. The adoption speed of innovative payment solutions depends not only on proven technology, but also on the ecosystem and, most importantly, on users’ trust. Without this trust, there can be no payment.

Autonomous payments have many challenges lying ahead, including trust, security, privacy, fraud, regulation and scalability. In a world of connected devices, the focus should shift from how information is collected and communicated to how it is protected and shared. Furthermore, consent management will be essential for autonomous payments, not only from the technical aspect (e.g. contract, authentication, subscription models) but also from the human centric aspect (e.g. acceptability, accessibility, trust, user experience).

Worldline is a front runner when it comes to innovation of future payments. We collaborate with customers, financial institutions, startups and technology partners to drive the true purpose of payments, which is to best serve consumers by making payments frictionless, secure and trusted.

Interested in a unique opportunity to co-innovate with us at the Worldline e-Payment Challenge 2020?

Please visit our dedicated website to learn more.