Who are the Millennials ?

The Millennials are the generation who became adults at the beginning of the 21st century. Born between 1980 and 1996, they are also called “Digital Natives”. Since high school, they have a permanent access to mobile phones and instant messaging. They were the first ones to attend university with laptops and digital tablets. Internet grew up along with them: in the TVs, the cars, the buildings and even in the clothes. Digitalisation is historically an integral part of their daily lives and it creates a different mindset and another way of interacting with the world around them.

If the first reflex is to think that this generation has favoured the emergence of online banking, which is a fact, the break with the other generations is more complex.

How Millennials‘ expectations and demands are reflected within the banking sector ?

The relationship between Millennials and banks today

In order to understand the behaviour of Millennials, it is necessary to understand the socio-economic context in which they have lived. The succession of economic crises and recessions, particularly the one in 2008, have led to a distrust of traditional financial institutions. This has severely tainted Millennials' trust in banks, who now perceive banks as an intermediary more than a partner.

This new perception is impacting 2 important elements in their relationships with banks : loyalty and trust.

These clients are less loyal towards banks

According to Le Courrier Financier, people aged between 18 and 34 years old are staying less than 5 years enrolled in the same bank. Also, according to the Gallup report, when better benefits and services are offered, Millennials are more likely to switch bank than the previous generations.

Millennials have this automatic habit of comparing - with online tools for example- the different range of possibilities and alternatives available, which is still a new concept in the banking sector. They are less “attached” to one bank and their choice will depend on their project and needs (for example, they will choose a traditional bank for their investing actions and a digital bank for their daily operations).

Banks have then a double challenge to face : on one hand, they have to understand and analyze the different projects in order to propose personalised offers and on another hand they have to pull the right levers to build loyalty within the Millennials generation. This is where customer relationship is entering into play because it needs to propose the adapted offers, channels and reactivity.

Trust authority is now transferred

Regarding trust, while previous generations went to their historical bank when it came to investing money, Millennials are looking for advice and feedback. They are also more likely to leave comments and rate banks following a product purchase.

We are facing a trust authority transfer because Millennials are giving more importance to communities and clients feedbacks than to the brand communication. To illustrate this idea, we can talk about the Gamestop case. Facing the difficulties encountered following the COVID-19 restrictions, this company saw its shares being shorted by investment funds, inevitably leading the group to bankruptcy. However, a community of traders composed of amateurs and Millennials gathered on the forum 'Reddit', have foiled the plans of investment funds by massively exchanging shares among themselves. Many investment funds lost billions of dollars and GameStop was finally able to pursue its business. This example perfectly illustrates the importance of trust in a community, in people who are in the same situation and who share the same values.

Omnichannel, a standard for Millennials

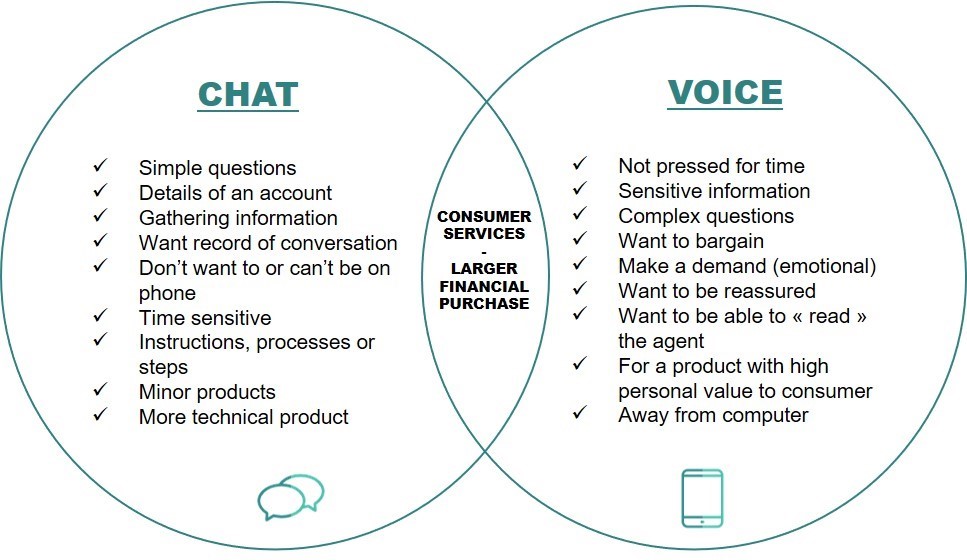

Omnichannel feature is now natural for Millennials, which means they are seeking a seamless customer experience with financial service providers across traditional and digital channels. Developing an omnichannel banking experience is fundamental to successfully attract and retain customers from this generation, who use different means of interaction for very specific needs (see chart below).

Source : Toward an Improved Understanding of Online Customer Service Delivery to Millennials Sharon K. Hodgea , Earl D. Honeycutta , and Danica Shipleyb

Despite the closing of numerous physical branches, still being able to visit them is reassuring for the Millennials. Also, the branch-less banks and the absence of a personal advisor represent important obstacles for this generation, who is considering enrolling into a digital bank. Digital Natives remain sensitive to physical interactions with their bank but are also asking for more digitalised services and self-service than the previous generations. These multi-faced behaviours reinforce Millennials' demands towards banks.

Influenced by the family environment, the Millennials expect simple and practical solutions

Often responsible for bank accounts until their kids become legally adults, parents are playing an important role for this generation. The choice of the first bank is thus commonly made by the parents without the children questioning this choice.

«I let myself be guided by my father, he knows the banking world better than I do» Grégoire, 18

Furthermore, the digital natives' relationship with money is changing progressively and they are more concerned about their spending. Millennials seek to stay in touch with their bank remotely, so they can ask questions as quickly and directly as possible. Millennials also expect their bank to manage their budget. This is when they need the most support and advice and when banks need to find new communication channels (videos and social networks in particular).

How do banks need to adapt to Millennials’ expectations?

Millennials are at the heart of a paradox. While they want quick access to online tools to act independently, they expect a very high level of service and concrete answers when they speak to advisors.

Faced with these challenges, the quality of customer relations and the simplicity of the customer journey are essential. To achieve this, the implementation of a centralised customer interaction management platform connected to the information system makes sense.

Why is Worldline Contact, a cloud platform for secure customer interactions management, relevant for banks

- Rapidity, simplicity of processing and monitoring. It is therefore necessary to be able to centralise data and to facilitate self-service access. Worldline Contact has a unique tool that allows the deployment of bots on all channels, which ensures continuity and consistency of experience. In addition, to optimize follow-up, Worldline Contact centralizes all customer interaction data in a single database and has a strong integration capability with database systems to consolidate the customer view.

- Continuous interactions, most often remotely, from the smartphone. Millennials already prefer seamless digital experiences so banks will increasingly be required to implement online financial services, which increases loyalty. In addition to offering a variety of digital channels (email, chat, social media or video calls), Worldline Contact integrates them with mobile applications to guarantee the user experience. Personalization for each user or profile of the proposed channels is also an important component in the banks' approach to Millennials.

- The same level of service and quality across all channels: Millennials want to be able to choose the channel, the platform used for their various transactions and have the same experience. This also means that omnichannel is no longer an option for this generation, that compares experiences across multiple banks. Only a customer interaction management solution can meet this challenge by centralising all interactions and applying common rules for authentication, qualification and routing.

- A need for expertise and ‘phygital’. Banks must adapt their organizations in order to satisfy a clientele that, at certain moments in the customer journey, needs advice and a meeting (physical or digital). To meet this expectation, customer interaction management tools must be able to equip experts who work remotely or are on the move. It is also necessary that the functionalities linked to the routing of requests to the right experts are at the level to support all possible business scenarios.

Millennials are an important generation in size - by 2025, they will represent more than 75% of the working population and thus become the primary customer target for banking institutions.

Providing a customer experience of good quality is one of the keys to build a loyal and trusted relationship with a generation that tends to evaluate and compare banks.

Need more information about Worldline Contact, the omnichannel customer relationship management solution designed for banks?

Go to Worldline Contact.

Need personalised coaching in understanding Millennials’ customer journeys?