- Simplify the complexity of navigating different worlds.

- Act as a bridge for currency exchange, both on- and off-ramp.

- Facilitate non-currency asset transfers

Bridging Virtual and Physical Worlds: From payment to property mapping (part 1)

17 / 10 / 2023

Exploring the ever-evolving landscape of digital payments, assets and NFTs in the metaverse. Discover the rise of virtual environments.

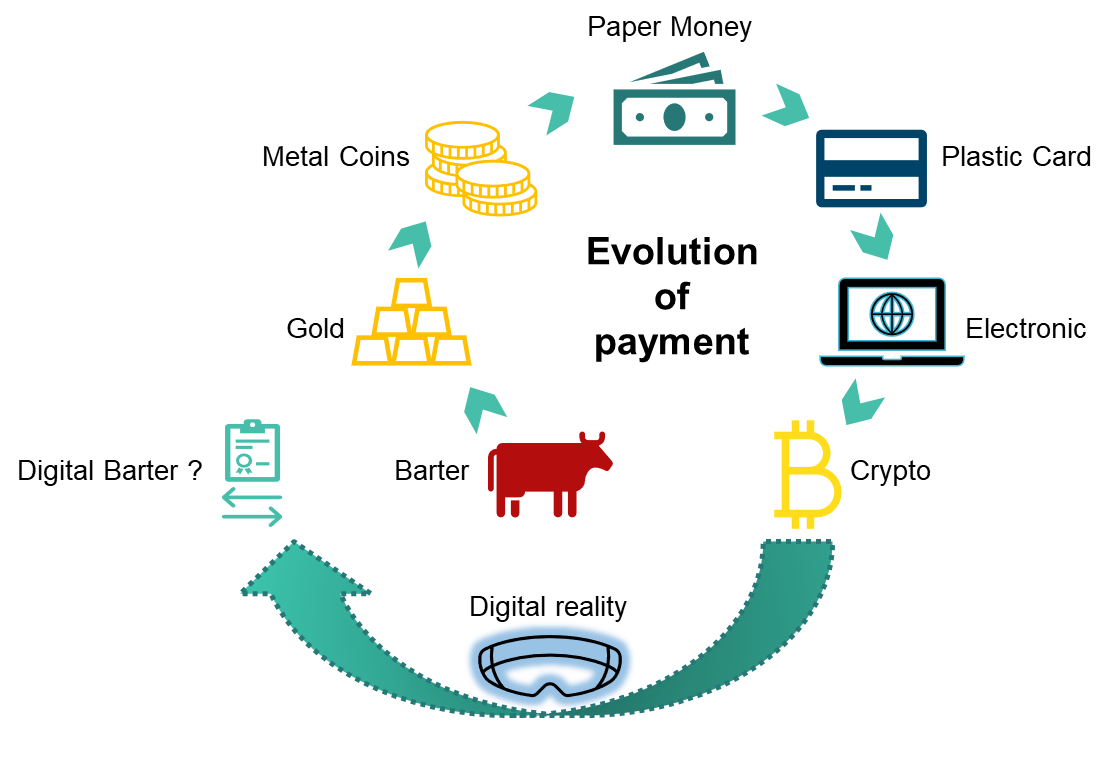

When thinking about transactions, we typically associate them with payments made using money. However, this hasn't always been the case throughout history. This raises the question of whether the need for an intermediary exchange denominator, such as currency, will be challenged as more goods and services become digital, as seen in virtual worlds like the metaverse.

How will payments look when ownership and valorization become predominantly digital?

The history of payments

To explore these questions, let's take a brief look at the history of payments. It all started with the barter system, where goods and services were traded directly without currency.

Over time, precious metals like gold and silver became currencies, with the first coins minted in ancient Greece and later spreading throughout the Roman Empire.

Paper money appeared in the Middle Ages in China and was later adopted in Europe.

In the 17th and 18th centuries, banks began issuing paper money and providing credit to customers. The 20th century introduced electronic payment systems, revolutionizing how people paid for goods and services.

Today, central banks manage currencies that include both physical cash and digital currency, when there are also decentralized cryptocurrencies like Bitcoin.

A transition between digital payments and traditional currencies

In today's financial landscape, with the rise of virtual environments, we are experiencing a transitional phase that blends conventional notions from the physical world with innovative approaches to both value the exchange and evaluate solvency.

These traditional notions encompass agreed-upon currency values (such as dollars, euros, etc.) and the inherent worth of raw materials (like wheat, oil, steel, etc.), which are determined by basic market pricing driven by supply and demand, as observed in stock or commodity trading markets.

Digital assets and NFTs

In the virtual world, the distinctions between fungible and non-fungible monetary assets are becoming increasingly blurred, as most of digital world transactions involve transferring identified ownerships relying therefore almost only on non-fungible assets.

Within a particular virtual environment that has its own asset management regulations and currency, the orchestrator of that world can effortlessly assume all roles.

However, as multiple virtual worlds and digital twins coexist, there will be a need for Trusted Payment Service Providers (PSPs) to address additional challenges:

“The transition of using other assets as a payment mean is already taking place in the real world”

Thus, in virtual worlds, PSPs must transform into flexible “asset managers”, as in virtual worlds monetary and other assets are managed more and more in a similar way. This can be achieved by incorporating digital assets that either represent a fully virtual value or mimic physical assets, such as Non-Fungible Tokens (NFTs) for digital twins. This diversifies value transfer beyond currency settlement as summarized in Table 1.

Transferring Value | Physical | Digital |

Currencies | Currency representations (card & account payments) | Digital currencies |

Assets | Asset representations (Digital Twin NFTs) | Digital assets (NFTs) |

Table1: Various types of assets that a contemporary payment service provider (PSP) must manage

This transition of using other assets as a payment means is already taking place in the real world, with platforms such as Shareitt, BarterPay, and EQUAL, leading the way towards a more versatile and adaptable financial ecosystem. This could result in the end of the hegemony of currencies as a sole means of transferring value, by using an intermediary asset (money) for exchange.

The question that comes up is whether this development can progress to the point of removing the intermediary exchange denominator (see Figure 1), and how this might impact the role of Payment Service Providers while promoting economic growth?

Figure1: What would be the next step in the process of completing a payment?

Stay tuned for the second part of this blog post, where I will further explore this topic.

Interested to know more? Stay tuned or contact WL labs.