What are the essential ingredients for creating secured and immersive VR-payment Xperiences?

19 / 07 / 2023

Even if the buzz around ChatGPT and Generative AI has subdued Metaverse hype, the technologies behind the Metaverse, such as Immersive Xperience, continues to attract and bring value in new use-cases. Are you ready for Immersive Payment Xperiences?

In recent years, the Metaverse has garnered interest and been envisioned in different ways. Metaverse combines three big areas:

- The next web shift, also called web3

- Digital assets

- Immersive Xperiences

One encompassing definition would be “the evolution of the Internet to become more immersive with a network of collaborative virtual worlds." Today, immersive Xperiences are expressed mainly through the use of Virtual Reality (VR) headsets. These headsets offer new ways to experience digital content and new ways to interact using body gestures, voice, and hand manipulations. These novel approaches call for innovative immersive customer journeys.

Virtual reality is already a significant market, focused on gaming. It generated $9.13 billion of revenue in 2022 and is projected to reach $76.36 billion by 2030.. In terms of content, the VR software market is projected to reach $3.34 billion in revenue in 2023, most of it generated by games and the digital content sold in games. Plus, users are expected to reach 156 million by 2027. These numbers show the VR market's substantial size and potential.

Around VR gaming, we observe that the addition of digital assets is already a reality. Going a step further, we imagine full VR-commerce, where the user buys physical goods by using VR. For example, along with the photos and product videos through which we usually see products on web pages, virtual reality allows you to see the real size of furniture (fig1), to see your sports shoe from every angle, to open the door of a fully stocked fridge to check its capacity, or to put the new TV that you intend to buy on your furniture to see if they fit together.

Fig1 : Worldline VR-commerce with real size furniture

Whether it is for digital or physical goods, these new practices generate payment transactions which require authentication. They could rely on classic methods like payment cards with multifactor authentication via a smartphone. However, to allow the user to fully enjoy an immersive Xperience, payment in virtual reality (VR payment) needs to transform. For example, it’s cumbersome to use a mobile for strong authentication whilst wearing a headset, because of the need to remove the headset which takes you out of the immersive Xperience.

There are several ways to design VR-payment. They can be familiar or highly innovative. They can be silent/invisible or involve deliberate, explicit consent. In all cases, the experience needs to be immersive and adapted to different user profiles. Here are three interesting personas to consider:

- Jack is the most conventional as he usually uses passwords and PIN codes everywhere

- Hugo does not understand why there is a PIN code on a payment card since he always pays with mobile biometry

- Emily who, when she is playing video games, is frustrated when she can't buy directly in the game.

So for Jack, we need to transfer a well-known payment method from the physical world to the virtual one. To complete his payment, Jack needs to enter a secret code onto a PIN pad that appears in the palm of his hand (fig.2). This first solution shows a familiar technique translated into virtual reality in an innovative way. One advantage here is that users already know how to use a PIN pad, except here the PIN pad is easily reachable in their hand and in a virtual world. Using the second hand to hold the PIN pad allows the user to aim well to type his secret code, but also to have haptic feedback when the finger touches the key and his second hand.

Entering a PIN on palm is also an unambiguous way to authenticate a payment.

Fig2: Pin on palm for an instant end-user’s adoption

What experience would suit Hugo? Remember, when you put on a VR-headset, you are in an immersive world, you can see your hand interacting and manipulating virtual assets, but you do not have any keyboard directly at hand. It’s why, naturally, you are invited to use your voice to interact and speak with your friends or other people. The obvious next step is then the use of voice biometry as a possible means of verifying a payment, and that is the ideal match for Hugo. Hugo must say a one-time passphrase to authenticate (fig. 3). When used with a VR headset, voice biometry provides a novel way to authenticate a payment in a simple and explicit manner. By using voice recognition, users can pay frictionlessly and without having to remember any codes. To push even further this idea for research purposes, we can add a second factor of authentication, without requesting an additional action from the end-user. During the voice biometry recording, based on Artificial Intelligence, it’s also possible to recognize the characteristics of the microphone embedded into the headset (called "hardware-biometry”) as a second factor of authentication.

Fig3: Voice biometry to pay

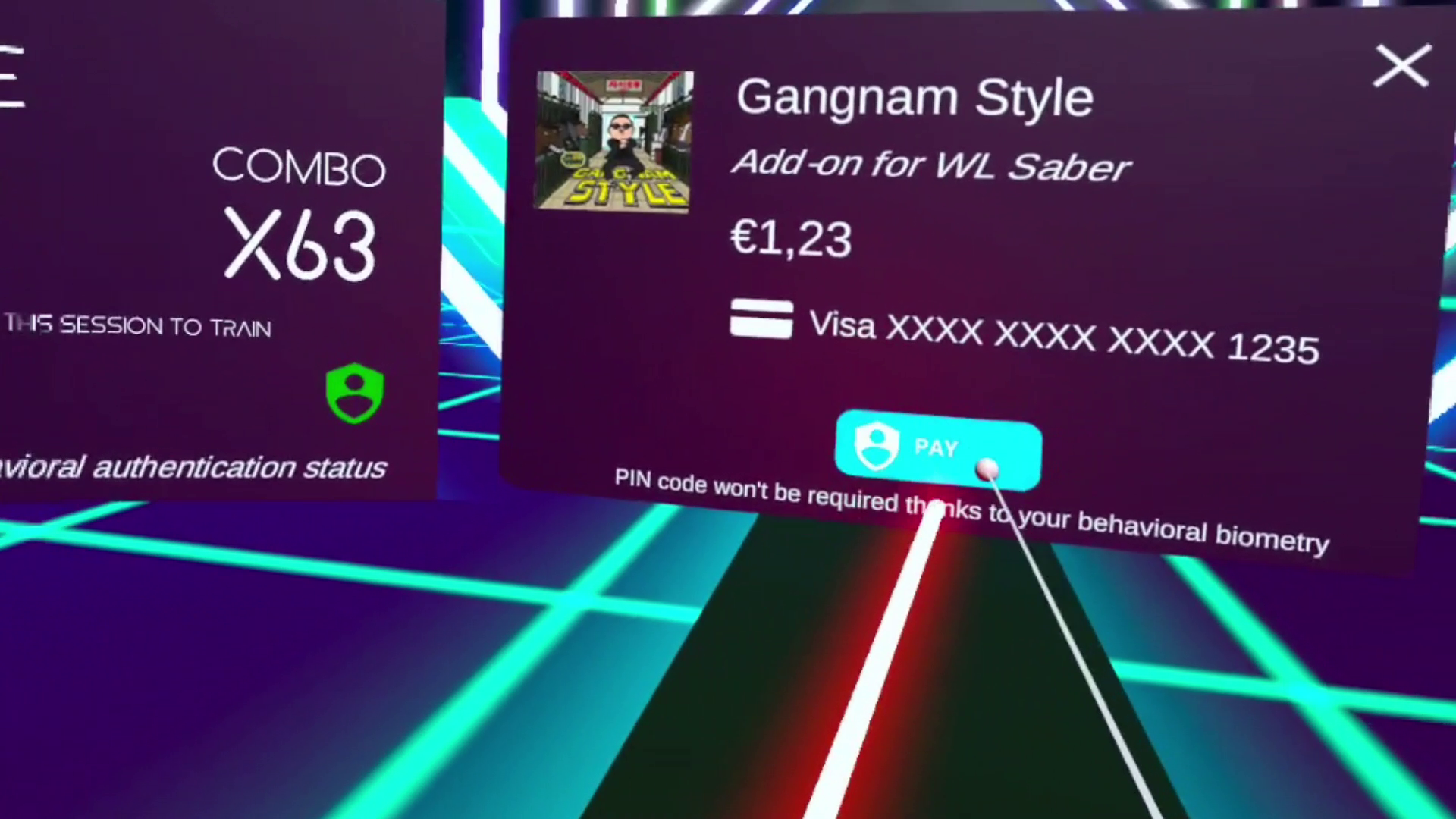

Finally, for Emily, to maintain the immersion, we need to tackle the in-game payment Xperience with an instant in-game validation. The immersion of playing a game can be broken, causing frustration if Emily is forced to go into a payment funnel to make in-game purchases. By leveraging the game mechanics and virtual reality gear, payment for Emily can be authenticated through a different approach. Emily’s gestures and body posture are analysed and processed in real-time by a Machine Learning (ML) model to authenticate her (i.e. it is a behavioural biometric). Players can be continuously authenticated and, when they want to buy an item in the game, they just need to click on a simple button to consent and pay for it: biometric authentication has already been done even before they want to pay! (fig 4) This method facilitates in-game purchases by removing authentication steps so that players can easily remain enthralled by the game.

Fig4: behavioural biometry continuously done before the Pay button

By understanding these different expectations and experiences, we are convinced that it is mandatory to provide immersive payment Xperiences far from the classic 2D webpages that we know today. These solutions are a few of the many payment possibilities in virtual reality. With gaming, virtual reality is already an important market, and it will expand to XR-commerce applications in the future. Complementary to Virtual Reality, all these solutions are also fully relevant for existing and future Mixed Reality (MR) headsets and spatial computing. As these new contexts are likely to sell virtual and physical products, new payment Xperiences will need to be developed accordingly. They will need to integrate into the Immersive Xperience of the user. Time will tell what those experiences will be but, nonetheless, now is the time to prepare for the payment Xperiences of the next form of digital life.

If you want to discuss or test in real life these payment Xperiences in our Innovation Experience Center, feel free to reach out: https://www.linkedin.com/in/hanaerateau/, https://www.linkedin.com/in/guillaume-lefebvre-wl/

Guillaume Lefebvre

Hanae Rateau

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

Tech4Good: Can roundup donations make a difference? | Podcast

-

-

Worldline launches “Bank Transfer by Worldline”, a new account-to-account payment method in 14 European countries by end of 2024

Learn more -

Learn how NFC payments empower your business