Why insurance companies should look to Open Banking

01 / 09 / 2021

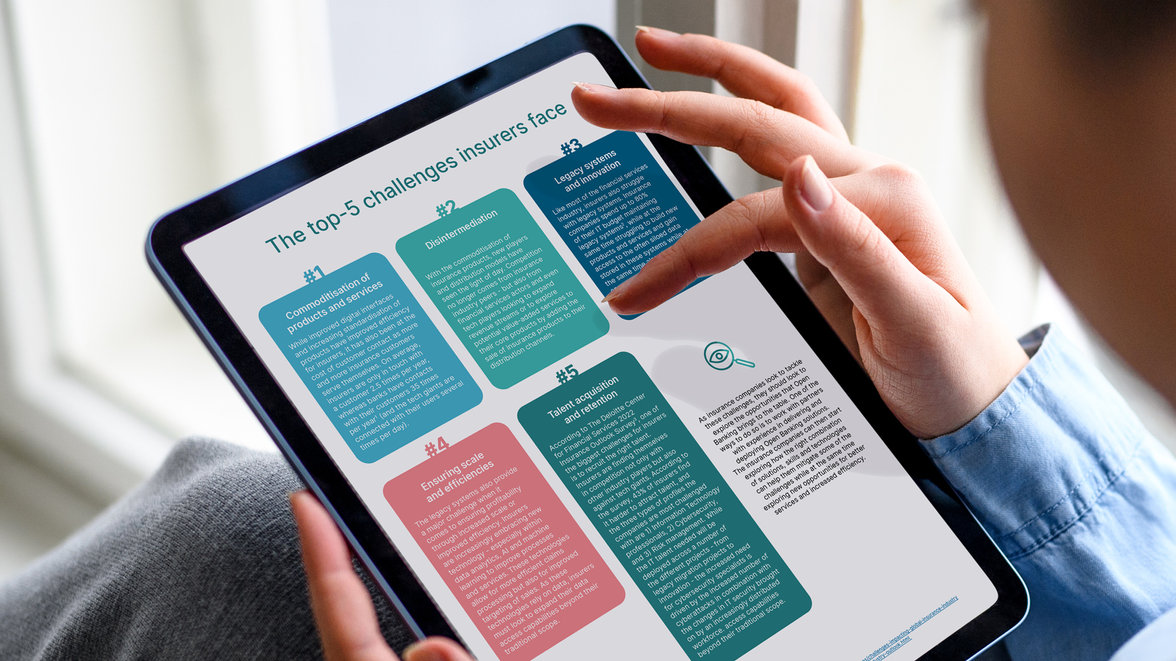

The insurance industry faces many of the same challenges as banks and can benefit from the learnings and technological advancements made through Open Banking for insurance companies.

When the EU Commission introduced the Revised Payment Service Directive - PSD2 - it kickstarted the acceleration of open banking in Europe and indeed the world. Open Banking is not a result of PSD2 but a culmination of much more significant and more long-lasting trends across the digital economy. These trends are fuelled by innovations made by small and large tech companies in close combination with changes in consumer behaviour and expectations. Furthermore, these trends have also been further accelerated by the innovation and proliferation of financial services through the fintech boom of recent years. But development and digitisation will not end there - as we move towards Open Data, it is clear that the insurance industry is indeed facing many of the same challenges as banks, but at the same time stand to benefit from the learnings and technological advancements made through Open Banking.

In this white paper you can read about the opportunities Open Banking offers the insurance industry.