Transformation in the banking sector through Open Banking

01 / 09 / 2019

Open Banking is a systemic and far-reaching change in the banking industry. This transformation has evolved in the last few years due to three main factors.

- The adoption of new regulations aiming at promoting innovation, with the PSD2, as well as consumer protection, with the GDPR.

- The rising competition in the banking industry, especially with the arrival of Fintechs and neo-banks – which have already onboarded millions of users and continue to attract new ones thanks to their innovative and customer-centric approach.

- The evolution of end users’ needs, who expect more from banks, starting with real-time and more personalized digital services.

The Open Banking movement was born in Europe as a result of the adoption of the Payment Service Directive (PSD2) regulation, which entered into application in January 2018. Even though this regulation requires the opening of some core services (i.e. Payment Initiation, Account Information, Confirmation of funds), we already observe that several banks have started to experiment with additional APIs, beyond the regulatory scope, by offering access to cards, loans or branches information for instance. According to market studies, more than two-thirds of European bank executives seem to consider Open Banking as an opportunity rather than a threat (versus 63% in Asia and 60% in North America). However, about 40% of these APIs were available in production in 2018, while the rest was only available in a beta stage. Even though many challenges still have to be answered, we should see an acceleration of the adoption of the Open Banking movement worldwide in the following years, mainly due to the learnings from the European experience in PSD2.

As mentioned, the Open Banking movement was also born following the change in behaviours brought on by the digitalization in all industries. With more than 5 billion people having a mobile device today, this penetration should reach 71% of the world’s population by 2025. In this context, connected consumers are increasingly engaging more and more with digital services and expect to access a wide range of services in every domain: education, health, retail and of course in finance. To answer this trend while promoting innovation by opening up banking resources to Fintechs or other Third Party Providers, Open Banking also aims to bring more protection and security to end users by giving them a way to better control their data. For this last purpose, a clear management of end users’ consent will be the key to success.

The real benefits for consumers will be the access to end-to-endcustomer journeys: identity check, payment, loan subscription, or even currency conversion will be seamlessly included, not-to-say transparently, into the overall journey. Purchasing a good such as a car will become smoother by, for instance, offering the possibility to an end user to directly subscribe to a loan or to access other financing options – such as crowd lending – from the car retailer website, and to easily supplement the purchase with an insurance or maintenance contract. For SMEs and corporations, and as a treasurer, the nightmare of managing tens of accounts in several banks and currencies would thus disappear thanks to the capability to access aggregated financial insights, making it easier to work on capital optimization.

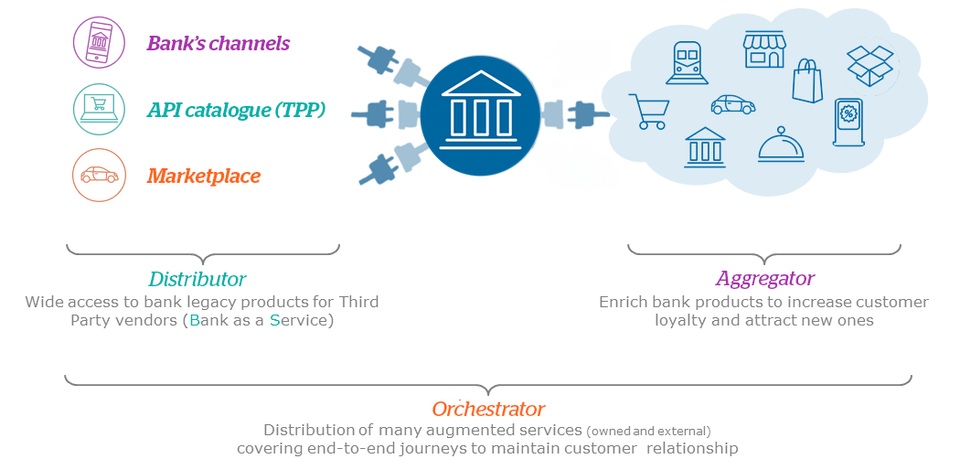

These deep changes require banks to leverage their own resources, and to combine them with assets delivered by third party providers. In this context, ultra-connectivity is a key topic and this is why banks have to develop the APIfication of their systems by following these three possible approaches to create new revenue streams:

- Act as a “Distributor” by opening their legacy services/products in a “Bank as a Service” model.

- Act as an “Aggregator” by enriching their traditional products with services delivered by Third Party Providers.

- Act as an “Orchestrator” by delivering augmented services (owned & external) covering end-to-end customer journeys to maintain customer relationship.

This ultra-connectivity is also beneficial for Third Party Providers (TPPs). Indeed, Open Banking is the opportunity to develop their own businesses either by consuming data and APIs opened by financial institutions, but also by teaming up with banks to bring additional value to end users. There are however two main hurdles TPPs may face.

- The first one is the fragmentation of the APIs opened by financial institutions. Even if several standardization initiatives suggest a potential convergence of standards within Europe (NextGenPSD2 framework issued by the Berlin Group, Open Banking UK, STET…), it still requires significant effort from TPPs to take into account these slight differences. On a worldwide scope, this risk of fragmentation is even higher – with the emergence of some local initiatives making it difficult for TPPs to address all banks without a real international scheme.

- The second hurdle is consumers’ trust. New services’ adoption by end users will require TPPs to be exemplary regarding the management of end users’ consent and data. They will need to be transparent when it comes to security issues, and the implementation of fraud solutions will be key to reach this goal. This will require TPPs to invest more in these fields.

More broadly, Open Banking can be seen through the spectrum of three main challenges. First of all, interfaces (aka APIs) must be standardized as much as possible to allow seamless interactions between banks and TPPs. Additionally, the security of the overall ecosystem must be a priority, by converging on the Strong Customer Authentication approach and putting in place efficient fraud mechanisms. Finally, all actors should manage enquiries and resolve disputes in a consistent way.

To take on these challenges, banks will have to leverage their legacy services thanks to digital platforms. Doing so will enable to design APIs that follow state-of-the-art protocols, to manage the lifecycle of these APIs, to onboard and manage a community of TPPs and their developers, and finally to follow APIs’ usages including the invoicing of TPPs.

Today, Worldline supports more than 25 banks and financial institutions on the PSD2 compliancy topic (in five countries) and also provides a consistent solution for TPPs to ease their connections with European banks as well as solutions for Strong Customer Authentication and Fraud. Our involvement in several standardization groups (workgroup at the European Payment Council, NextGenPSD2 taskforce setup by the Berlin Group, STET, SWIFT…) also demonstrates the care given to promoting this movement with other actors of the market.

To go beyond the PSD2 and support our customers on the Open Banking topic, Worldline offers a Digital Banking platform that includes all the features to help banks to design their APIs and easily include partners in new business models thanks to a powerful monetization engine. The platform also includes a developer portal playing a key role in the management of their TPP community via API documentation, forum and FAQ. To cap it all, the billing topic is also addressed by our platform by providing a way for banks to automatically generate bills and invoice TPPs depending on their API consumption.