Green (and Open) Banks: the Key Role of Financial Institutions in Environmental Sustainability

17 / 03 / 2021

Open banking gives banks new opportunities to increase awareness on environment beyond green banking by using the financial data. The Covid crisis has made evolve end users’ consciousness regarding sustainability and also in this area, the open banking ecosystem has a key role to play by orienting end users towards a more sustainable consumption lifestyle thanks to the analysis of banking data.

The new role of banks beyond banking

Since the Payment Services Directive 2 (PSD2) has entered our lives in 2018, many things have changed. End customers can now manage their account more freely and securely, while being able to give access to their accounts to chosen Third Party Providers (TPPs). They can more intuitively decide which data they would like to share with which TPP; so the term open banking was born.

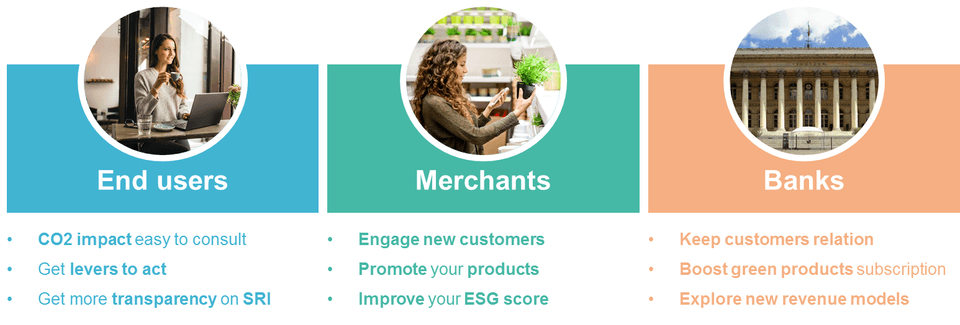

Banks, Fintech companies and Third Party Providers have used the opportunity to re-think their customer experiences and create new business models. Thanks to open banking, data from multiple financial institutions can be aggregated by using a single application. Customers can gain back control over their finances with new services, e.g. analysing and summarising their operations to give them a clear picture of their situation. It enables the creation of an ecosystem of new players, leveraging the data coming from banks to bring more value to end users through more opened and seamless payment experiences, tailored and contextual advices to make the decisions, and product alternatives more in line with end-users’ lifestyle.

In fact, open banking allows banks to get a better overview of their customer behaviours through the access to an extended amount of data. As a consequence, banks can offer specifically tailored products to their customers whom are able to receive financial services adapted to their personal preferences more conveniently via digital channels, in return.

The meaning of green banking

The term green banking came up with the concern for environmental sustainability by the banks. Banks and Financial Institutions will play a key role in the ecological transition by being able to lead more and more investments towards the green economy (energy providers, greener transport solutions…). However, it is important to understand how to steer investments into these directions. Several studies have shown that end users want to invest into social and responsible investments but they are lacking of information and knowledge to take the final leap.

In that context, banks have to take a popularization role by explaining what these new banking products are and why these letters match with end users’ needs.

The popularization of “green banking” also relies on the rise of consciousness of end users on their environmental impact and open banking can be used for this purpose by combining transactional data coming from banks to CO2 indexes managed by governmental organizations and other federations.

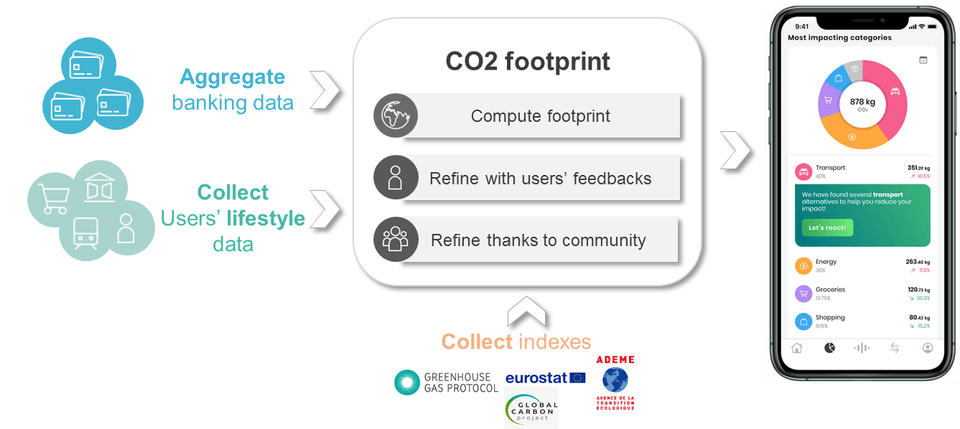

How this CO2 footprint is computed concretely? As mentioned earlier, everything starts from collecting end users’ account information as first step which has become real thanks to PSD2 (and the Account Information Service). Having access to transactions done by end users, it is hence possible to use transaction’s label but also merchant’s information (name, merchant category) to properly categorize a transaction and calculate its related CO2 impact based on CO2 indexes referential (ie. EEA (European Environment Agency), Eurostat (European Statistical office) …).

In reality and to refine the calculation, algorithms also include lifestyle data usually shared by end users such as the diet followed or information on the car used, to control the footprint.

It is a first step to act in environmental matter by reducing end customers´ carbon footprint and helping them to switch to cleaner energy resources. Therefore, financial service providers and banks are playing an important role in incentivising ecological consumerism by investing in socially responsible and sustainable products and encouraging their customers to be social responsible and a part of sustainable initiatives such as green bonds.

The main objective of a carbon footprint tool is to support lifestyle changes, by setting a carbon budget and saving money by categorizing the consumptions done by end customers while helping the world to be more sustainable and leading to lower CO2 emissions. There are campaigns by the European Commission that encourage people to take action for building a greener Europe e.g. Green Consumption Pledge and the European Climate Pact in order to achieve footprint reductions and increase the sale of sustainable products and services to help consumers to make more sustainable purchases. equensWorldline is in line with the new EU trends and supporting the EU initiations by offering a carbon footprint tool that allows consumers to reduce their CO2 emission in order to create more transparency of their consumption and a more sustainable Europe.

Challenges and opportunities

Challenges

Opportunities

The new role of banks beyond banking

It is a part of our Open Banking Platform, which reaches banking data and identifies the merchant by retracing the merchant category code with the consent of end customers. The payment of the customer is converted in CO2 emissions. After calculating the average CO2 emissions paid to the merchant, the software notifies the customers about their consumption to increase spending awareness.

How does it work?

By aggregating the transaction data directly from end customers´ bank accounts, it is possible to track the impact of every expense, quantify the environmental impact per purchase, categorize the spending and present the results in a dashboard in order to support the customers in reducing their carbon footprint. Our solution promotes different challenges for different use cases, for instance a home cooking challenge. 82% of GHG (Greenhouse gas) emissions from EU food consumption come from animal products. End customers are able to control their sustainability by reducing meat consumption, purchasing local products and reducing waste.

Transport represents around 25% of EU’s GHG emissions. The solution also provides an overview of chosen transportation method. For instance, calculating the mileage while driving a car, then deciding to switch to an electric car or to ride a bike or instead to live a healthier lifestyle and have a clearer knowledge of the impact of their activities on the planet with the help of equensWorldline Carbon Footprint Solution.

Sustainability: An ecosystem for all

equensWorldline is committed to utilise its technological capabilities, supporting clients to empower their customers with a tool, which contributes to a higher ecological consciousness. Based on our Corporate Social Responsibility (CSR) ambition, sustainability is in the heart of our business model. Worldline contributes to the carbon neutrality of its activities as a first company in the payment industry.

We are happy to announce our partnership with the Impact Challenge. From March 1 – April 23, students from around the world are teaming up to compete and create a winning sustainable business model and prototype during the Impact Challenge hosted by @TechQuartier. Five selected teams are going to present their ideas in front of investors and business leaders during the @Impact Festival in September. More info: https://techquartier.com/impact_challenge/

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

Greener Payments - Do payments need to be greener?

-

-

Worldline launches “Bank Transfer by Worldline”, a new account-to-account payment method in 14 European countries by end of 2024

Learn more -

Learn how NFC payments empower your business