Navigating the Mobility Landscape: Insights from TTG

05 / 03 / 2024

Sébastien Givry, Head of the transportation market within Worldline Merchant Services, shares in this article his views and convictions after visiting Transport Ticketing Global (TTG 2024) in London on March 5-6, 2024.

Shifts in Transit Trends: The Decline of MaaS and the Rise of Open Payment

Missing MaaS

MaaS (Mobility as a Service) remained a prominent topic at TTG, featuring at least six related conferences. However, the term "MaaS" was notably absent from exhibitors' booths.

Why?

Despite being once hailed as a solution by transportation authorities, the influence of the MaaS concept is diminishing. Economic and technical realities are challenging the feasibility of centralised, multi-modal mobility. The bankruptcy filing of Whim, a pioneering MaaS company, underscores this shift. While there may still be some inertia in the public sector, leading to occasional calls for tender, we believe the concept still needs to find its right operating model to flourish.

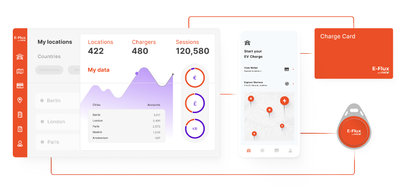

Prominent Open Payment

Open Payment is currently at the forefront of discussions, resonating strongly with ticketing companies, hardware, and software solution providers. Success stories from numerous cities are not only highlighting its importance but also advocating for its adoption in medium-sized and smaller urban areas.

Why?

According to TfL, a leading urban authority with extensive experience, Open Payment is encouraging greater reliance on schemes such as Visa and Mastercard. However, the surge in their fees in recent years is bringing the issue of fraud back into focus.

Open Payment specialists are increasingly exploring diversification and alternative revenue streams. They recognise that while transaction volumes may be substantial, they are insufficient to sustain platforms within an increasingly stringent regulatory environment, highlighting the reappearance of economic realities.

Transitioning to Open Payment involves a significant overhaul, including changes across ticketing systems, equipment (validators, gates, etc.), and the selection of acquiring banks. Some cities are now reconsidering adoption after carefully weighing the benefits and drawbacks.

From personal observation, many projects labelled as "Open Payment" in France and elsewhere are, in reality, mostly fixed fare systems. This observation extends to experiences such as the express line at Milan's Malpensa airport, which I utilised three weeks ago. Despite widespread usage, the full potential of Open Payment, including capped multi-trip fares, remains largely unfulfilled, often resulting in underwhelming outcomes.

Further Insights

- The abundance of Ticket Vending Machines (TVMs) at booths highlights the enduring need for basic infrastructure in the transportation sector. With a decline in physical agencies, it's crucial for authorities to prioritise accessibility for users who haven't shifted to digital platforms yet.

- The expansion of validators goes beyond Open Payment solutions. As a key player in the payment industry, we consistently focus on equipping our terminals with two essential features: compatibility with closed-loop cards as the primary requirement and potential EMV integration for the future. However, navigating these challenges can be daunting, often leading to consultations initiated only after significant hurdles.

- Partners aiming to venture beyond domestic markets encounter formidable obstacles, including fragmented market landscapes and regulatory frameworks that frequently hinder their commercial endeavours.

- Consumer behaviour in railway, taxi, and parking sectors is shifting towards e-commerce and smartphone usage. We envision the future of mobility as seamless accessibility to all transportation services, including public transit, via digital platforms, enabling paperless solutions. Examples like the Navigo card in Paris and initiatives in Toulouse and Montreal showcase the potential of Calypso and Mifare technologies.

- One notable absence from discussions: SoftPos. Apart from Ubirider and Coppernic, there's been limited discourse on this potentially disruptive concept. Imagine payment transactions facilitated through any Android terminal with NFC support, challenging traditional market standards.

In short, transportation may be at a strategic turning point: Open payment is an undeniable success but still remains overall just one consumption channel among others, without necessarily delivering on its promised range of fare products. MaaS (Mobility as a Service) has experienced strong enthusiasm but likely needs to adapt and transform to meet market’s future expectations. And we still purchase tickets from vending machines; admittedly, these are increasingly rechargeable tickets.

The digital future is upon us: consumers increasingly demand comprehensive mobile experiences, from journey planning to payment processing. Embracing digitalization can liberate ticketing companies from the burdens of managing intricate hardware payment systems, while also empowering them to expand omnichannel capabilities. With the technology readily available, it's imperative to have faith in its potential and prioritize its integration into the heart of the customer journey.

Sébastien Givry

Related articles

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

Fintech interview: Can data drive sustainability? | Podcast

-

-

Worldline launches “Bank Transfer by Worldline”, a new account-to-account payment method in 14 European countries by end of 2024

Learn more -

Learn how NFC payments empower your business