Verification of Payee

Your solution for secure transactions and implementation of the upcoming instant payment regulation.

Get in touch Explore our APIs Opens in a new tabDo you want to fight against upcoming fraud and comply with the regulatory obligation?

Stay ahead of the curve and ensure compliance with the upcoming Instant Payment & Payment Services Regulation with our cutting-edge Worldline Verification of Payee which verifies if the beneficiary's name matches the account holder name of the provided IBAN.

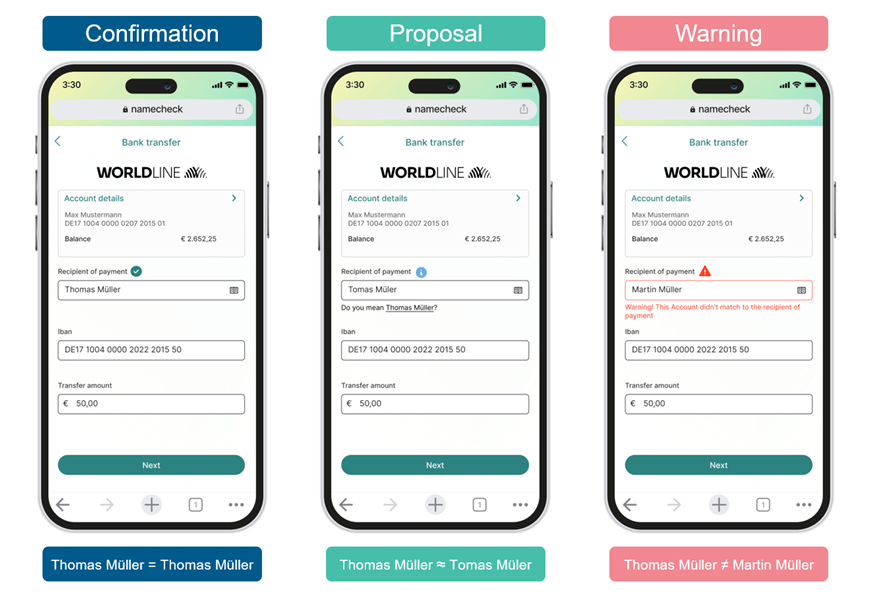

End-Customer Experience

The Verification of Payee will be integrated into the payment application of the respective payment service provider. The following image shows an example of its use within a banking app to initiate a credit transfer. It shows the three different types of IBAN Name check results (match, close match and no match).

This is an example how the service can be used by the payers bank to inform the payer about the results.

Benefits from the Verification of Payee

Further resources

Start building with

Worldline Verification of Payee APIs.

Get ready to fulfill the regulatory requirements.

Subscribe to the Worldline Financial Services newsletter.

Learn more about Verification of Payee.

Get in touch with our specialists to schedule a meeting.