2023 was another record year for spending, but consumers were more careful with purchases

Auckland — 10 / 01 / 2024

As consumer spending in December ended 2023 on a weaker note, figures released by Worldline NZ today show that while 2023 set a record for consumer spending, average transaction value was down, suggesting shoppers were more careful with purchasing decisions.

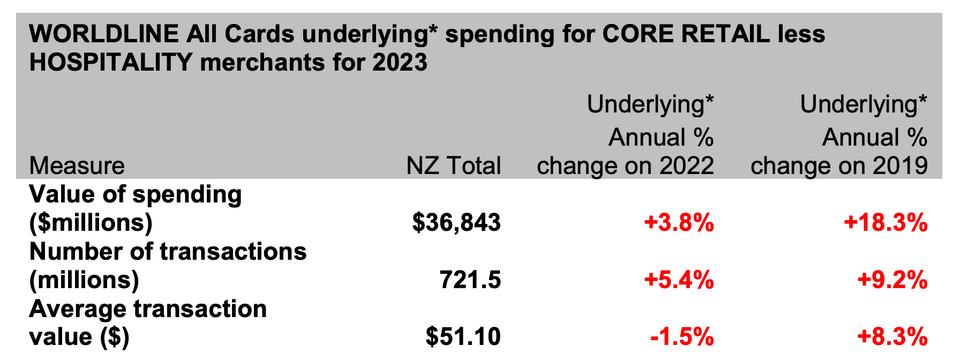

Consumer spending through Core Retail merchants in Worldline NZ’s payments network (excluding Hospitality) set a new high for the full 12 months of 2023, reaching $36.84B, which is up +3.8% on 2022 and up +18.3% on 2019. However, the average transaction size in 2023 was $51.10, down - 1.5% from 2022.

Worldline NZ’s Chief Sales Officer, Bruce Proffit says that despite the record spending volume, costof-living challenges undoubtedly made 2023 a tough year both for consumers and retailers.

“Consumers may have made more transactions through retailers in Worldline NZ’s payments network in 2023 than in the previous year – as is the usual pattern – but the average transaction value declined, in spite of general consumer price inflation,” says Proffit.

Proffit says the lower average transaction value was against a trend of generally rising consumer prices, suggesting consumers were being more selective, possibly bypassing higher value products or replacing them with cheaper alternatives.

“That said, they were also spending more often, so the net effect was another year of record spending,” says Proffit.

“There was also a tendency towards more spending at Food & Liquor stores (up +8.0% for 2023) but less in other retails sectors, such as Clothing & Footwear (-0.1%) and across a range of Hardware, Garden & Furniture stores (-6.2%).”

Figure 1: All Cards NZ annual underlying* spending growth through Worldline in 2023 for Core Retail (excluding Hospitality) merchants (* Underlying excludes large clients moving to or from Worldline)

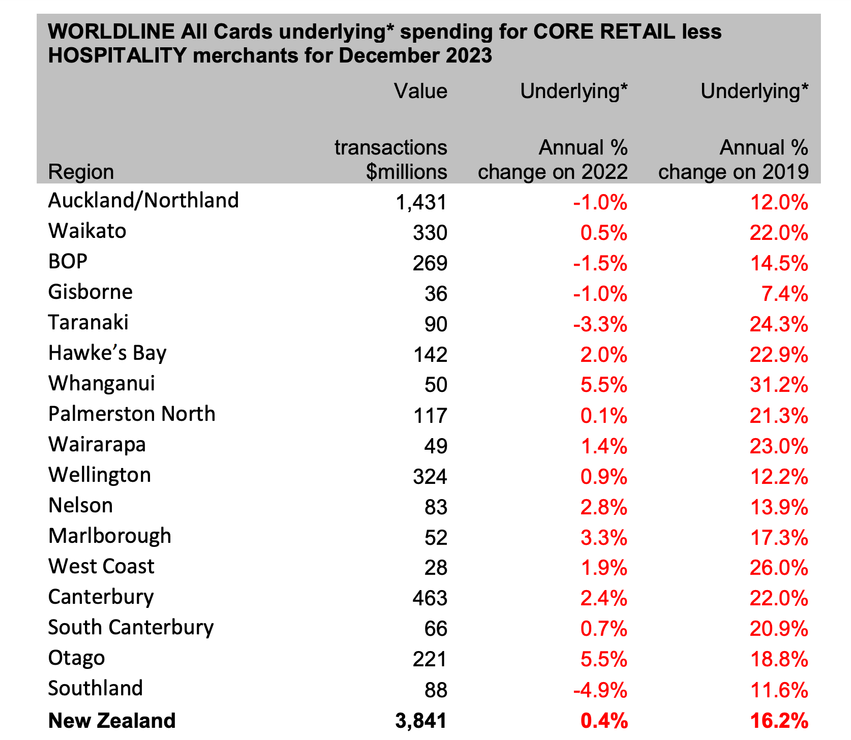

Looking at December 2023 on its own, consumer spending through Core Retail merchants (excluding Hospitality) in Worldline NZ’s payments network reached $3.84B for the month, up just +0.4% on December 2022, and up 16.2% on 2019.

Proffit says that while Christmas spending exceeded 2022 levels, this low growth amounted to a slow end to the year.

“We previously reported a rising spend – seasonally and annually – ahead of Christmas Day, but the annual growth rate was weak in December overall, especially in the last week of the month which saw spending fall below year-ago levels, including on Boxing Day,” says Proffit.

“To some extent, pre- and post-Christmas spending may have suffered on account of consumers doing this shopping in November’s Black Friday sales. However, the bigger picture is that spending growth was simply modest over the latter months of 2023, with annual growth over the last four months slowing from earlier in the year to average only 1.9%.”

In the regions, the annual growth rate in December 2023 was highest in Otago (+5.5%) and Whanganui (+5.5%) and lowest in Southland (-4.9%). Spending growth was below year-ago levels in Auckland/Northland (-1.0%).

Figure 2: All Cards NZ underlying* spending through Worldline in December 2023 for core retail excluding hospitality merchants around (* Underlying excludes large clients moving to or from Worldline)

While 2023 may have ended on a quieter note, consumer spending in the Core Retail sectors (excluding Hospitality) through Worldline NZ’s payments network was $674m in the first seven days of 2024, up 4.5% on 1-7 January 2023 and up 25.4% on the same week in 2019.

“While it is promising for retailers to see that consumer spending has picked up slightly in the first week of 2024, this is too short a time period to make definitive inferences on how trends will continue in the coming months,” he says.

Note to editors:

These figures reflect general market trends and should not be taken as a proxy for Worldline‘s market share or company earnings. The figures primarily reflect transactions undertaken within stores but also include some ecommerce transactions. The figures exclude transactions through Worldline undertaken by merchants outside the Core Retail sector (as defined by Statistics NZ).

For more information, contact:

Brandon Boughen

brendon.boughen.external@worldline.com

T 027 839 6044

About Worldline in New Zealand

We are New Zealand's leading payments innovator. We design, build and deliver payment solutions that help Kiwi business succeed. Whether you’re looking for in store, online or mobile payment solutions or powerful business insights, Worldline is here to help with technology backed by experience. www.worldline.co.nz

About Worldline

Worldline [Euronext: WLN] helps businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world. Worldline generated 4.4 billion euros revenue in 2022. worldline.com

Read our 2022 Integrated Report

Worldline’s corporate purpose (“raison d’être”) is to design and operate leading digital payment and transactional solutions that enable sustainable economic growth and reinforce trust and security in our societies. Worldline makes them environmentally friendly, widely accessible, and supports social transformation.

Press Contact