Consumer spending lifts slightly over the holidays but quickly returns to the winter norm for retailers

Auckland — 02 / 08 / 2023

Consumer spending through Worldline NZ’s payments network lifted a little across New Zealand ahead of the Matariki long weekend, but otherwise Kiwi retailers continued to face tough trading conditions in July.

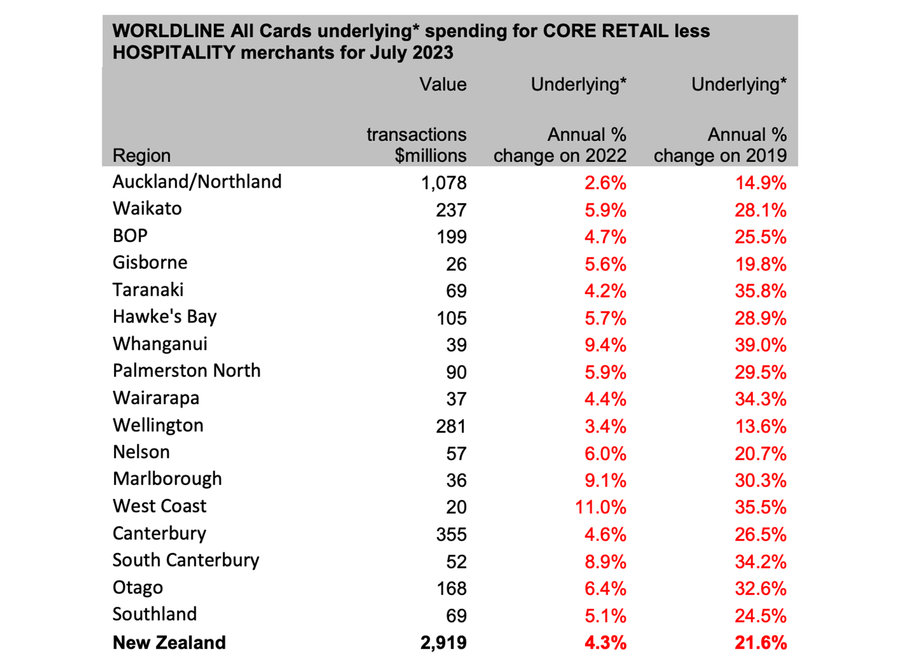

Consumer spending at Core Retail merchants (excluding Hospitality) in Worldline NZ’s payments network in July 2023 reached just under $2.92B, which is up 4.3% on July 2022, and up 21.6% on the same month in 2019.

Worldline NZ’s Chief Sales Officer, Bruce Proffit, says spending patterns differed due to the various holiday periods during the month of July but the overall result suggests little change in what is now four months of slow spending growth.

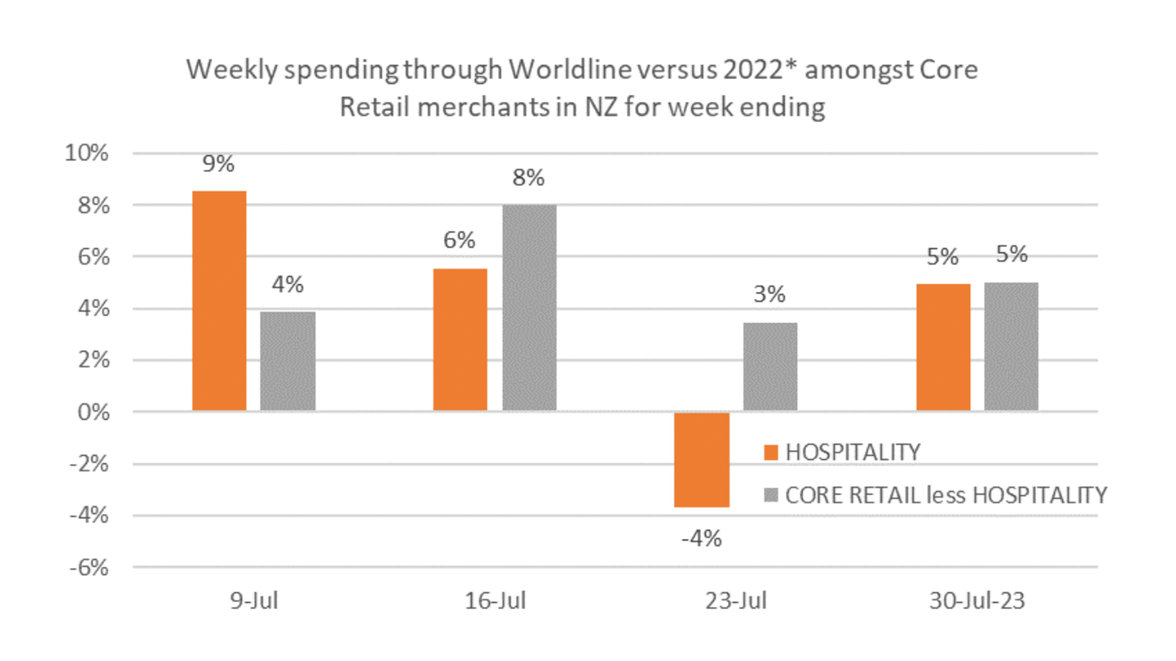

“The combination of school holidays and the Matariki public holiday saw spending growth pick up in the second week of the month at Food retailers and Hospitality merchants, but by the last week of the month annual spending growth was back near the average of the previous three months.

“For the record, there was also more Hospitality spending growth in the first week and less in the third week, but this largely reflects the mistiming of the school holiday period between this year – which was weeks one and two – and last year, which was weeks two and three,” says Proffit.

“While it is promising that the petrol price hike early in the month did not temper the overall spending momentum in July, spending amongst non-food merchants remains below year ago levels. Ultimately, this shows trading conditions remain tough for most Kiwi retailers.”

Figure 1: Daily All Cards NZ underlying* spending through Worldline Core Retail merchants for last 4 weeks ending Sunday relative to the same days in 2022 (* Underlying excludes large clients moving to or from Worldline)

Around the regions, the lowest annual growth rates remain in the three largest regions: Auckland (2.6%), Wellington (3.4%) and Canterbury (8.9%). The highest annual growth rate was recorded in West Coast (11.0%).

Figure 2: All Cards NZ underlying* spending through Worldline in July 2023 for Core Retail (excluding Hospitality) merchants (* Underlying excludes large clients moving to or from Worldline)

Note to editors:

These figures reflect general market trends and should not be taken as a proxy for Worldline‘s market share or company earnings. The figures primarily reflect transactions undertaken within stores but also include some ecommerce transactions. The figures exclude transactions through Worldline undertaken by merchants outside the Core Retail sector (as defined by Statistics NZ).

For more information, contact:

Brandon Boughen

brendon.boughen.external@worldline.com

T 027 839 6044

About Worldline in New Zealand

We are New Zealand's leading payments innovator. We design, build and deliver payment solutions that help Kiwi business succeed. Whether you’re looking for in store, online or mobile payment solutions or powerful business insights, Worldline is here to help with technology backed by experience. www.worldline.co.nz

About Worldline

Worldline [Euronext: WLN] helps businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world. Worldline generated 4.4 billion euros revenue in 2022. worldline.com

Read our 2022 Integrated Report

Worldline’s corporate purpose (“raison d’être”) is to design and operate leading digital payment and transactional solutions that enable sustainable economic growth and reinforce trust and security in our societies. Worldline makes them environmentally friendly, widely accessible, and supports social transformation.

Press Contact