Consumers notch belts tighter in May but still find the time and money to thank Mum

Auckland — 02 / 06 / 2023

Annual consumer spending growth was up slightly in May, but still made for a challenging trading environment for retailers, with the spending crunch especially evident amongst non-food merchants.

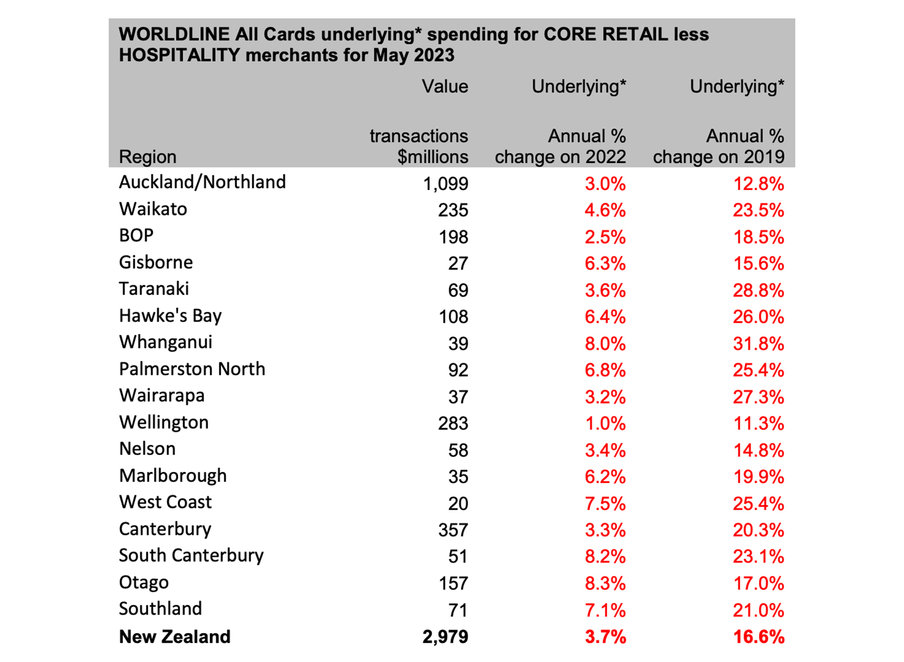

Consumer spending in May 2023 through all Core Retail merchants (excluding Hospitality) in Worldline NZ’s payments network reached $2.979B, which is up just 3.7% on May 2022, and up 16.6% on the same month in 2019.

Worldline NZ’s Chief Sales Officer, Bruce Proffit, says the May numbers show the ongoing influence of inflation made it an especially tough month for retailers selling non-food goods.

“Spending through Food and Liquor stores in May was up 8.3% on the same month last year, which is well below the latest annual rate of food price inflation (12.5% April-April). Meanwhile, spending through the remaining non-food Core Retail stores was down 3.2%,” says Proffit.

“This was especially evident in the major centres, with the combined total spend through food and non-food retailers (excluding Hospitality) up a mere 1.0% on last year in Wellington, 3.0% in Auckland / Northland and 3.3% in Canterbury – all below the national average.”

Proffit says it was not surprising that one of the few positive influences on consumer spending during the month was Mother’s Day. “Nothing is stopping Kiwis showing their mums that they love them, judging by the higher spending on or around Mother’s Day through relevant retailers.”

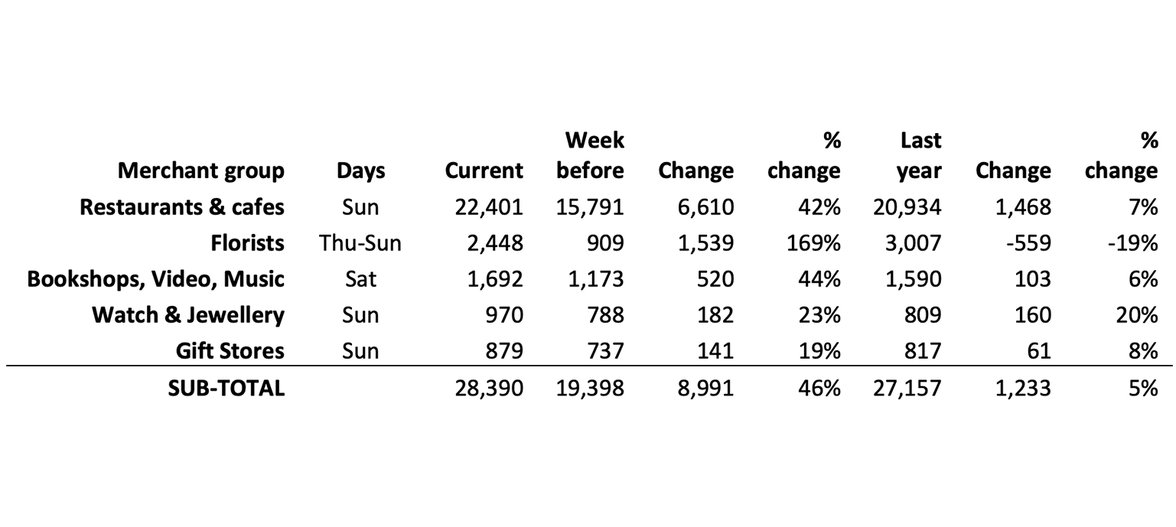

Proffit says spending on Mother’s Day (14 May) was strong at Restaurants and Cafés, with the nationwide spend through these merchants in Worldline’s payments network reaching $22.4m, up 42% on the previous Sunday (7 May) and up 7% on Mother’s Day last year (8 May 2022).

“There were also higher sales at Florists on the four days (Thursday to Sunday) ending on Mother’s Day than the same four days a week earlier (+169%), although flowers were not as popular as last year (-19%). Add in extra spending in Book stores (on the day before), Jewellery, and in other Gift Stores and the extra spending for mum was almost $9.0m, which is up 5% on last year.”

Figure 1: All Cards NZ underlying* spending ($000) through selected Worldline merchants on or about Mother’s Day, compared with same days a week earlier and last year (* Underlying excludes large clients moving to or from Worldline)

Proffit says amidst the overall tough retail month, there were still some positive signs evident in the monthly figures of several regions.

“Consumer spending through Core Retail merchants is running higher than last year in the storm-hit regions of Gisborne (up 6.3%) and Hawke’s Bay (up 6.4%),” he says.

“The Hospitality spend in these regions is also showing positive signs, with Hawke’s Bay up by 3.5% on last year, while spending through Hospitality merchants in Worldline’s network was only down 2.1% in Gisborne.

“Meanwhile, the fastest annual growth in Hospitality spending was in Otago, up 11.9% on the same month last year.”

Nationwide, spending in May 2023 through Hospitality merchants in Worldline NZ’s payments network totaled $0.925B, up 4.2% on May 2022 and up just 6.3% on the same month in 2019.

Figure 2: All Cards NZ underlying* spending through Worldline in May 2023 for Core Retail (excluding Hospitality) merchants (* Underlying excludes large clients moving to or from Worldline)

Note to editors:

These figures reflect general market trends and should not be taken as a proxy for Worldline‘s market share or company earnings. The figures primarily reflect transactions undertaken within stores but also include some ecommerce transactions. The figures exclude transactions through Worldline undertaken by merchants outside the Core Retail sector (as defined by Statistics NZ).

For more information, contact:

Brandon Boughen

brendon.boughen.external@worldline.com

T 027 839 6044

About Worldline in New Zealand

We are New Zealand's leading payments innovator. We design, build and deliver payment solutions that help Kiwi business succeed. Whether you’re looking for in store, online or mobile payment solutions or powerful business insights, Worldline is here to help with technology backed by experience. www.worldline.co.nz

About Worldline

Worldline [Euronext: WLN] helps businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world. Worldline generated 4.4 billion euros revenue in 2022. worldline.com

Read our 2022 Integrated Report

Worldline’s corporate purpose (“raison d’être”) is to design and operate leading digital payment and transactional solutions that enable sustainable economic growth and reinforce trust and security in our societies. Worldline makes them environmentally friendly, widely accessible, and supports social transformation.

Press Contact