Mixed spending patterns in February 2005 show continuing adjustment to higher cost of living

Auckland — 04 / 05 / 2024

Consumer spending patterns through Worldline NZ’s payments network were mixed in February with some merchant groups up and others down, but the overall trend still indicates slowing growth due to the higher cost of living.

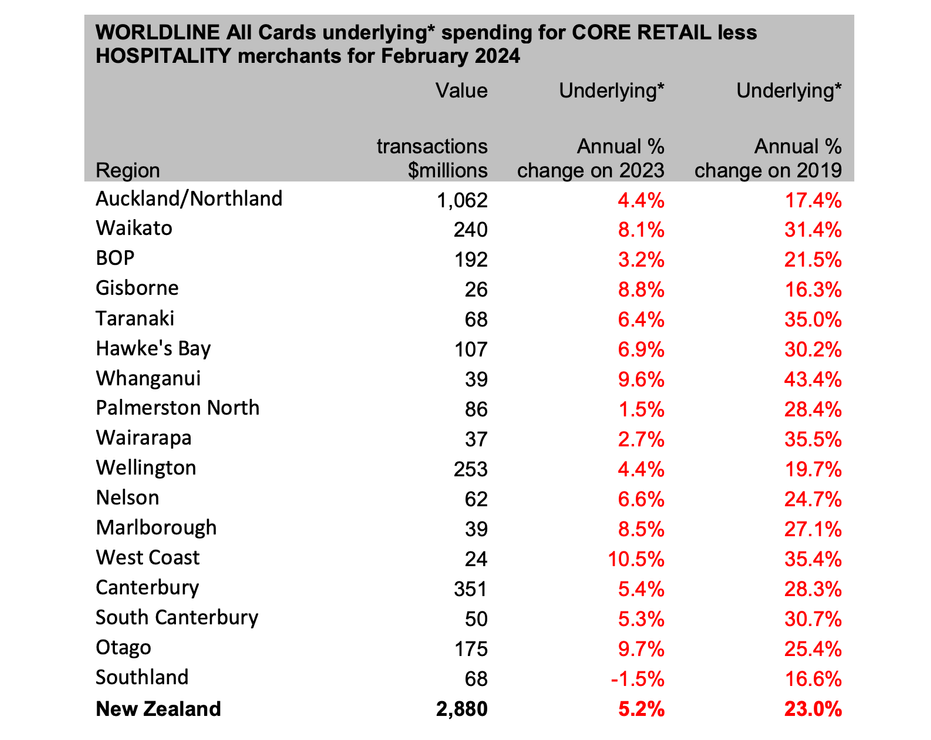

Data released by Worldline NZ today shows consumer spending through Core Retail merchants (excluding Hospitality) in its payments network reached $2.88B in February 2024, which is up +5.2% on February 2023.

However, it should be noted that the extra day in February this year inflates the annual growth rate. Removing the effect of the leap day gives an annual growth rate of +1.6%, which is below the average annual growth rate of the previous six months (+2.8%).

Worldline NZ’s Chief Sales Officer, Bruce Proffit, says the adjusted figures show the retail environment remains tough, especially outside the large non-discretionary sectors.

“The underlying growth rate has slipped a little more over the last four weeks, and the trend appears to still be consumers adjusting to the increased costs of many goods and services since 2020,” he says.

Proffit notes that spending is up on the same month last year through merchant groups such as Food & Liquor stores (+7.8%) and chemists (+10.3%) within the Core Retail sector. Outside this group, lifts in spending were also seen through Dentists (+8.1%), Doctors (+13.2%), Auto-repair/service shops (+11.6%), Lawyers & Accountants (+14.4%), and Government/Education (+10.3%).

Conversely, spending is down on February 2023 for groups such as Electronics/Computer stores (-16.4%), Department stores (-26.1%), Clothing shops (-1.5%), Furniture outlets (-6.0%), Appliance stores (-9.3%) and wholesale/retail Hardware merchants (-0.6%).

“Care is required when inferring total market changes from these figures as Worldline NZ does not process all transactions, but the figures do suggest that discretionary spending, especially on large ticket items, is being reduced,” says Proffit.

“That said, some things are still important even in tough times, as we saw a large lift in spending on Valentine’s Day this year, although the growth rates are exaggerated by the fact that Cyclone Gabrielle hit around that same day last year.”

Proffit says spending at Florists in Worldline’s payments network on 14 February 2024 was up 33% on the same day in 2023, while spending at Jewelry stores rose 79%. Similarly, wining and dining out at Restaurants & Cafés on Valentine’s Day this year was up 54% on last year.

“Looking across the whole month, another major pattern is the mixed regional growth, where some regions appear to be benefiting from higher tourism activity,” says Proffit.

Regional growth for Core Retail merchants (excluding Hospitality) across all days in February 2024 was highest in West Coast (+10.5%), Otago (+9.7%) and Whanganui (+9.6%) although it was also lowest in Southland (-1.5%). Meanwhile, growth in the large regions of Auckland/Northland (+4.4%) and Wellington (+4.4%) remains below the national average.

Figure 1: All Cards NZ underlying* spending through Worldline in February 2024 for core retail excluding hospitality merchants (* Underlying excludes large clients moving to or from Worldline)

Note to editors:

These figures reflect general market trends and should not be taken as a proxy for Worldline‘s market share or company earnings. The figures primarily reflect transactions undertaken within stores but also include some ecommerce transactions. The figures exclude transactions through Worldline undertaken by merchants outside the Core Retail sector (as defined by Statistics NZ).

For more information, contact:

Brandon Boughen

brendon.boughen.external@worldline.com

T 027 839 6044

About Worldline in New Zealand

We are New Zealand's leading payments innovator. We design, build and deliver payment solutions that help Kiwi business succeed. Whether you’re looking for in store, online or mobile payment solutions or powerful business insights, Worldline is here to help with technology backed by experience. www.worldline.co.nz

About Worldline

Worldline [Euronext: WLN] helps businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. With advanced payments technology, local expertise and solutions customised for hundreds of markets and industries, Worldline powers the growth of over one million businesses around the world. Worldline generated 4.4 billion euros revenue in 2022. worldline.com

Worldline’s corporate purpose (“raison d’être”) is to design and operate leading digital payment and transactional solutions that enable sustainable economic growth and reinforce trust and security in our societies. Worldline makes them environmentally friendly, widely accessible, and supports social transformation.

Press Contact