Wordline's high-performance payments benchmarks

01 / 03 / 2021

Results and proven benefits of high-performance payments benchmark by Worldline

The number of electronic payment transactions continues to rapidly increase globally due to factors such as cash replacement, e/m commerce expansion and the introduction of new payment instruments such as contactless cards, mobile wallets and instant payments. Whilst this represents a significant opportunity for financial institutions, payment processors and fintechs, the transactional increase also puts a commoditization strain on the electronic payment business.

To be successful, financial institutions must focus investments on proven and scalable high-volume processing platforms from a capable vendor, with a critical emphasis on efficiency and total cost of ownership over the expected lifespan of the investment.

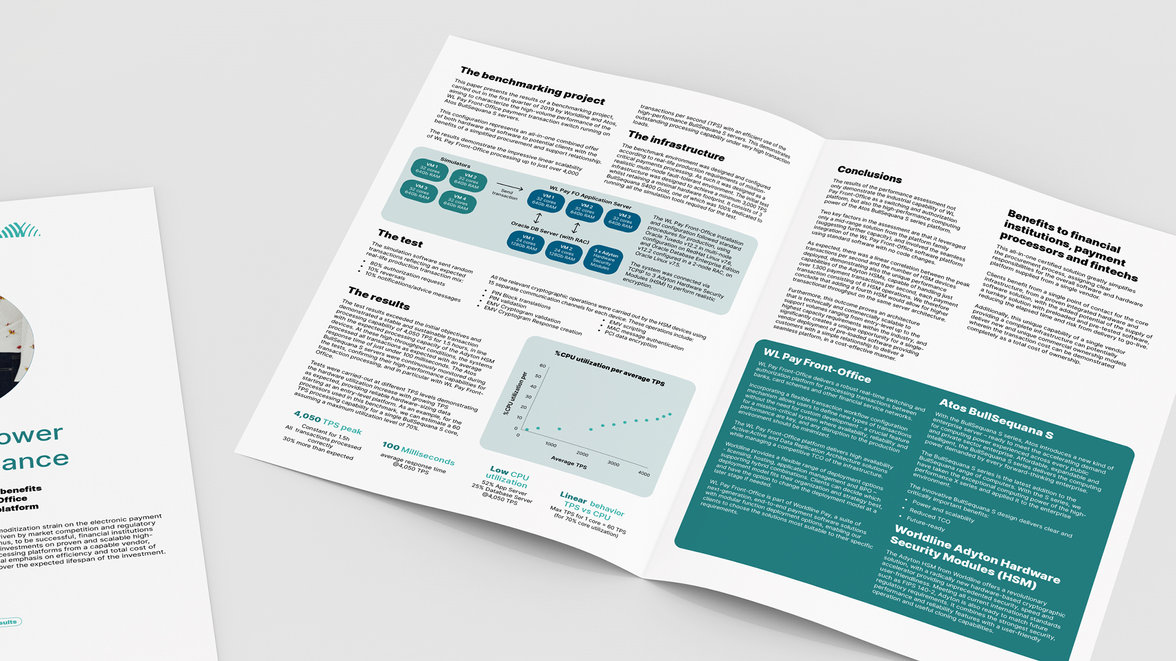

This paper presents the results of a benchmarking project, aiming to characterise the high-volume performance of the Worldline Pay Front-Office payment transaction switch running on Atos BullSequana S servers (more than 4000 transactions per second). This configuration represents an all-in-one combined offer of both hardware and software to potential clients with the benefits of a simplified procurement and support relationship.

The results demonstrate outstanding processing capability under very high transaction loads.

Don’t miss the valuable insights provided by this expert paper.

-

-

-

Unlocking the potential of the Commercial Cards Markets

Mehr erfahren -

Wie BNP Paribas den Lastschriftbetrug bekämpft

-

-

-

Worldline: Cloudbasierte Lösung ermöglicht GarantiBBVA International die Einhaltung der Instant Payment-Regulation

Mehr erfahren -

Sibos 2024: Gemeinsam die Zukunft des Zahlungsverkehrs neu gestalten