Personalisation and an enhanced insurance customer experience are key to positive growth in the insurance sector – but why? | Blog

27 / 10 / 2022

Embracing new customer interaction methods and building positive, genuine customer relationships is key to the business approach of companies across many industries. The financial and insurance sector is no different, with an increasing focus on the process and journey rather than the end sale.

Embracing new customer interaction methods and building positive, genuine customer relationships is key to the business approach of companies across many industries. The financial and insurance sector is no different, with an increasing focus on the process and journey rather than the end sale.

In my last blog, I discussed how open data and open banking is unlocking new ways of customer interaction. This follow-up will explore the benefits of building positive customer relationships and how insurers can potentially benefit from investing in the customer journey.

Personalisation is key As a species, we like to feel a connection, whether that's to our partner, family, or the companies we choose to do business with. This personal connection extends to our devices and even our favourite apps. A common feature now seen among the most popular apps is a high degree of personalisation. Studies have shown that personalisation can substantially impact customer loyalty, indicating that up to 60% of customers are more likely to become repeat buyers or long-term customers if given a personalised shopping experience.

Personalisation can come in many forms and doesn't just mean the ability to change a background wallpaper or adjust display settings. In the context of the financial sector and insurers, personalisation can take the form of specific customer information displayed in customer portals, AI-driven chatbots tailored to each customer, or a setup guide that provides a bespoke introduction to the business during onboarding. Open data is driving an increase in the level of personalisation that can be offered, especially regarding automated services.

Not only can it improve the customer's connection with their insurer or bank, but personalisation can also drastically improve efficiency in customer interactions, making it easier for customers to update information, finalise processes and interact with their accounts and services without the need for service representatives being present. This is most often achieved through a highly customisable and personalised portal or customer app.

Improving customer loyalty The world of banking and insurance is a highly competitive sector, with an increasing number of competitors now diluting the traditional dominance that major banks and insurers enjoyed before the rise of InsurTechs. Businesses must embrace new ways of creating added value for their customers and encourage loyalty.

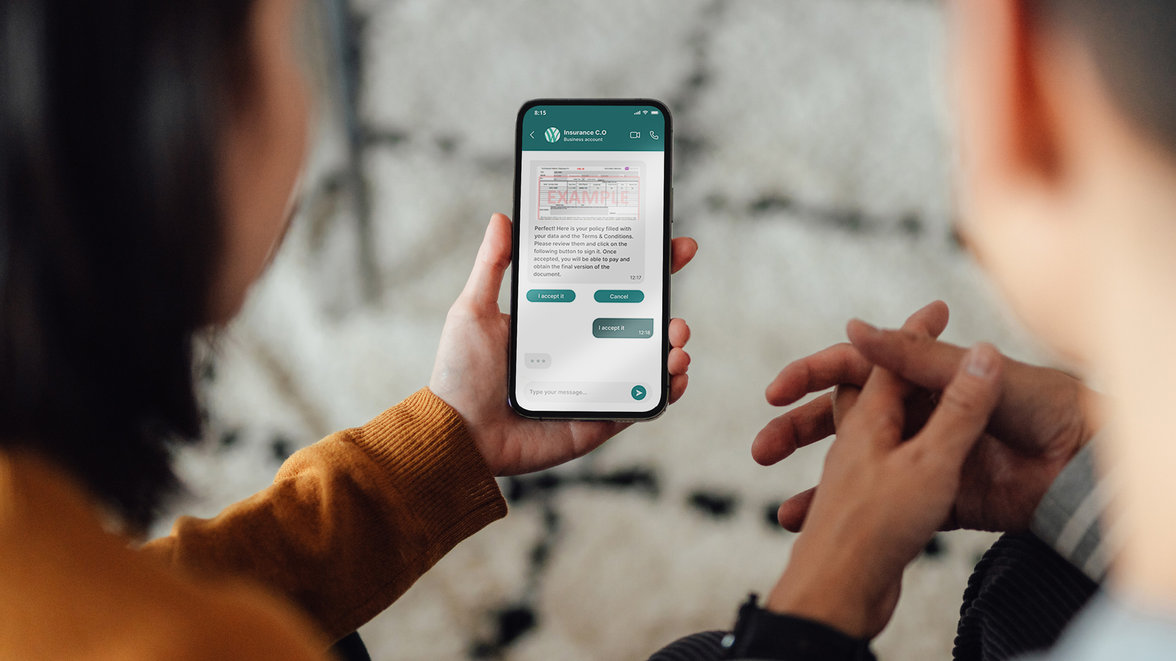

Open data and open banking allow platforms to incorporate personalised data and more novel methods of communicating with customers. By doing so, businesses can take advantage of their clients' favourite social and business platforms to engage them more effectively. Take WhatsApp for Business as an example. In recent years, WhatsApp has become the world's most popular messaging application, with over 300 billion users. This dramatically outnumbers those using more traditional forms of communication, such as email.

Other industries, such as fashion and retail, have already embraced the use of platforms such as WhatsApp to create a seamless, personalised and compelling customer experience. This helps to build brand loyalty and make one-time customers into return customers. Not all insurance customers are the same, and neither are their requirements. By leveraging the power of AI-driven software and the benefits of open data, customers can be more efficiently targeted, rewarded, supported and guided through their stage of life. This also extends to payments, processes and even UX and brand strategy.

Unlocking future potentialA study published by Guidewire indicates that only 15% of UK customers say that they value their insurers' products and customer experience. This suggests there is huge potential to be had from improving customer perception of products and services and investing in a better overall customer experience.

By personalising services and offering enhanced, specific interaction with individual customers, insurers can attract business and create long-term, positive relationships. The modern consumer has increasingly varied needs, with most requiring multiple insurance or banking services. However, an imbalance exists between what the consumer needs and what the consumer can currently be offered. The same report from Guidewire indicates that one in two insurance customers wish to consolidate insurance policies into one centralised insurer, offering personalisation and high service levels.

Clearly, customer demand exists. To maximise this potential, insurers and banks need to make use of all the benefits that open data and open banking offer. By embracing personalised services, such as WhatsApp API, and investing in data-driven services and features, businesses can stand out from the growing number of competitors and offer high-level, centralised services that address the various needs of the modern consumer.

From automated alerts to deeper customer platforms, live chat and rich, proactive engagement, the future of finance and insurance is in personalisation; otherwise, businesses risk becoming indistinguishable amongst a rising tide of competition and new tech.

The What’sApp Insurance revolution is here! Learn more what an insurer can do with WhatsApp for Business.

For more information, check how Open Insurance is driving insurance innovation.