Open Banking for the insurance industry: what's it all about?

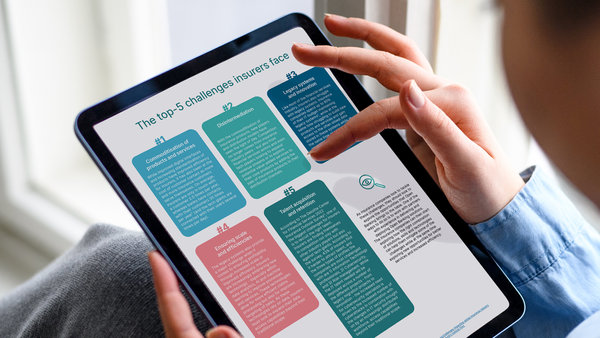

Insurance is the most regulated and competitive industry. Several insurance companies offer a broad range of insurance products and services, resulting in increased competition. Due to old-fashioned and fragmented legacy systems, insurance firms are burdened with high IT costs and poor data use.

There is a lot of movement in the insurance industry at this time. Digital transformation is no longer considered a science fiction concept. As new insurance solutions and open banking technologies develop, insurers understand the need to digitise their business models and operations to increase efficiency.

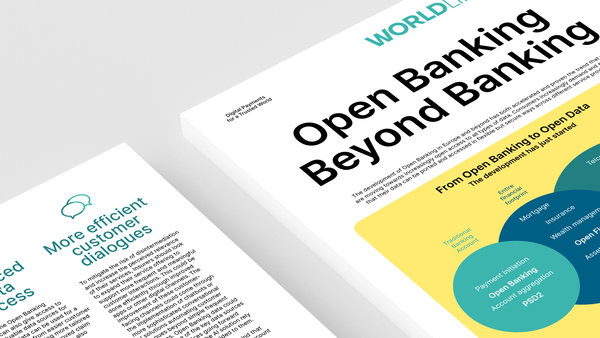

Today's insurance customers are seeking a smooth and personalised customer experience. Insurance companies may get insights into their risk aversion and preferences to learn more about their customers via open banking, which means different insurance products and their willingness to switch providers. When looking for your insurance company's right open banking provider, several open banking providers are available.

The right open banking provider will allow your company access to new opportunities without compromising its data integrity, trustworthiness, or security. Working with an open banking platform may help your insurance company whether you want to verify the identity of your customers or broaden your compensation options to profile them.

Worldline offers digital services and open banking for insurance organisations.

Deliver personalised experiences to create emotions end engagement.

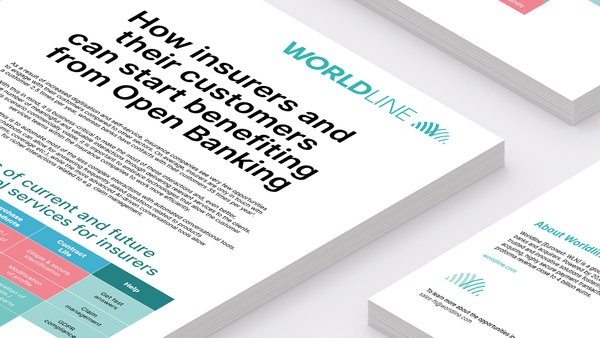

As a European leader in payments, Worldline has more than 50 years of experience in hosting and processing sensitive data. If data is the fuel, we are convinced that mastering Customer Interactions is the key to delivering personalised services in line with end users' expectations and lifestyles. We have developed a comprehensive set of skills and solutions to support financial institutions in their digital transformations to help you take up the challenge of moving towards personalised customer journeys and increased customer engagement.

Our Open Banking services for insurance companies

Open Insurance is driving insurance innovation.

Worldline is ready to help insurers explore and leverage our financial services experience to create better products and services. Get in touch to hear how we can help your company on the next steps of your digital journey.

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

How can we make payments greener?

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business