EMV tokenization for streamlined payment processes.

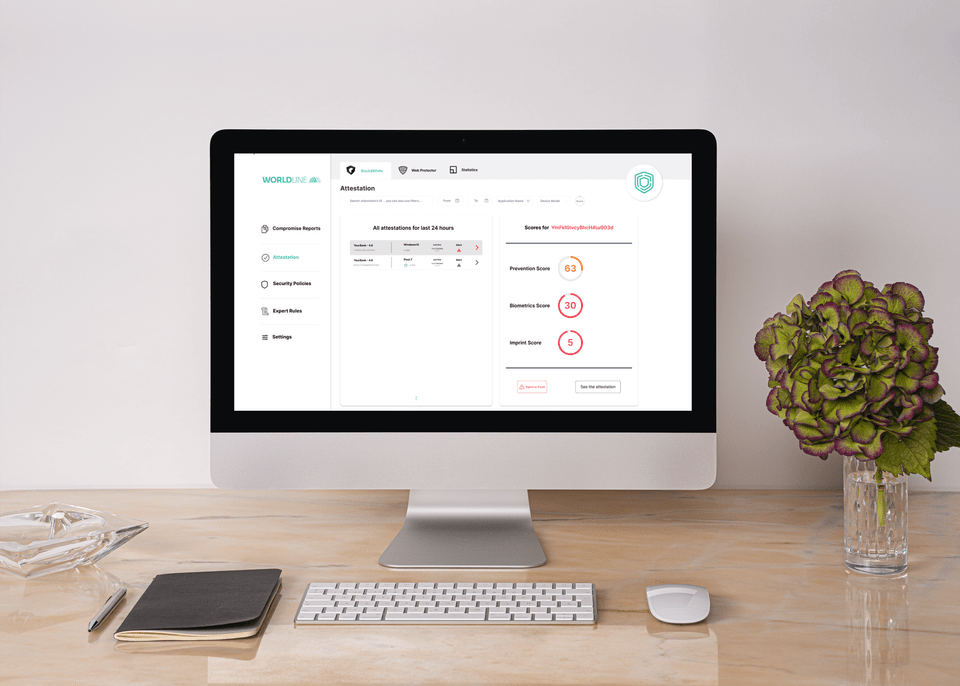

With the pace of technology adoption constantly accelerating, digital payments and tokenization have become key enablers allowing banks to stay in the race for innovation. Tokenization benefits both issuers and consumers by increasing approval rates, diminishing transaction time and reducing fraud-related costs while offering convenience, simplified user experience and increased card security.

Token Management

Token Management is a solution for issuing banks to act as an “Issuer Token Service Provider” and enable their cardholders to benefit from token-based payments in stores, in apps and on the web. As a token orchestrator service for ITSP, Token Management provides a wide range of offerings and options to meet the business needs of our clients.

Why Token Management?

Choose your solution

E-commerce and Card-on-File

One card scheme Visa or MasterCard , 1 country, 1 issuer, 1 deployment phase

Provisioning/orchestration of cof/ecom token (I-TSP roll)

Automated Card and Token lifecycle management: blocking, renewal, replacement of a card is reflected in real time on the tokens

Business KPI reporting

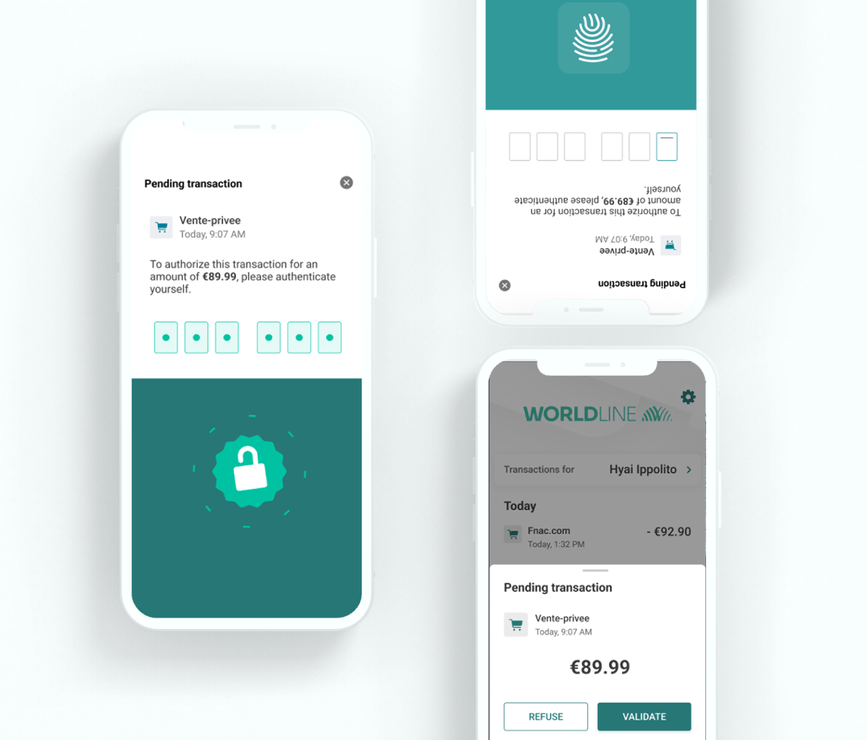

Mobile Payment

Links with the schemes (Visa VTS or Mastercard MDES) in a secure and compliant manner (PCI)

OEM-Pay enablement (Apple Pay and Google Pay or Samsung Pay)

E-commerce: Card-on-File (CoF)v

In-App provisioning

Wallet provisioning

Cardholder identification & verification (ID&V)

Cardholder notification

KPI and OEM reporting

Additional options

Automated Card and Token lifecycle management

SMS sending costs (on top)

Additional consultancy for OEM certification

Multi-country, multi-language

Additional Token advice service to inform about lifecycle events

Consultancy, additional support

Subscribe to the Worldline Financial Services newsletter.

Fast and convenient token-based digital payments.

Worldline offers end-to-end, flexible solutions for secure and convenient digital payment experiences.