Map processes with customer references and transaction labelling

15 / 12 / 2022

You always have an overview of all your web shop transactions in the Saferpay Backoffice. Delve into the latest Backoffice functionalities and learn how you can assign transactions to customers in a targeted way (customer references) and how you can categorise transactions and map processes (labelling).

How can I use customer references and transaction labels in the Saferpay Backoffice?

Did you know that you can use Saferpay to map your customer-specific workflows in the Backoffice? As a Saferpay customer, you might know how it works: the Saferpay Backoffice offers you a complete overview of all of your transactions in the web shop. For example: How many transactions took place in the past week, which means of payment were used and in which currency were payments made, what is the status of your transactions, which were declined and for what reason?

The Saferpay Backoffice can do much more! In this blog article, we delve even more deeply into the latest Backoffice functionalities and, based on examples of specific use cases, we explain how you can assign transactions with customer references to customers in a targeted way and how you can categorise transactions with labels.

In the blog, learn how you can use both functions in your daily business and how you can map processes.

Customer References

Until now, individual transactions could only be manually assigned to specific customers, for example by searching for a unique e-mail address.

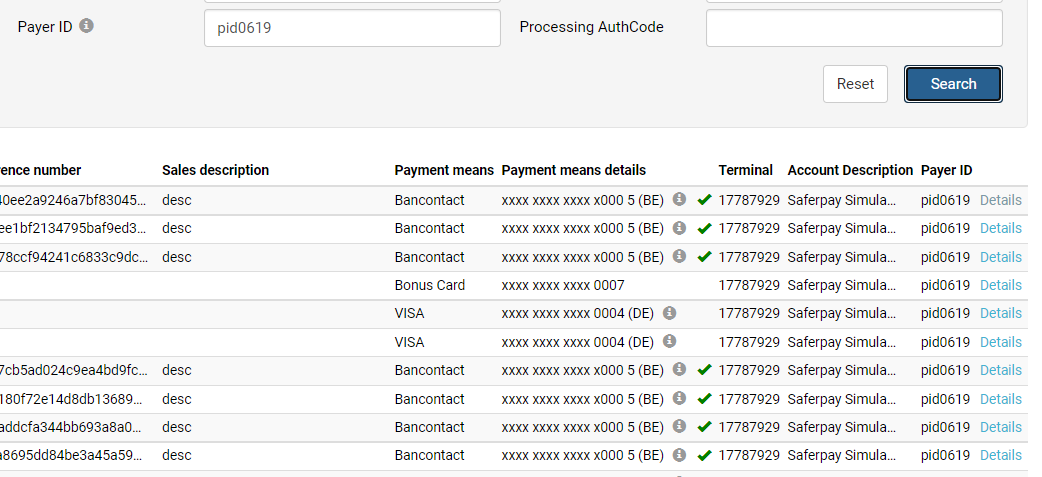

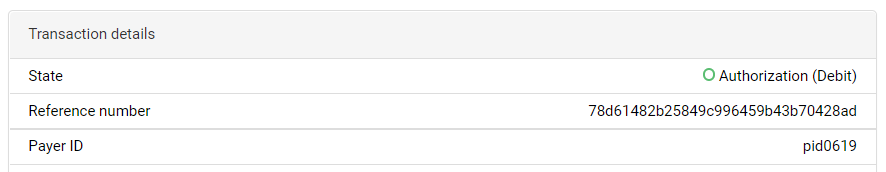

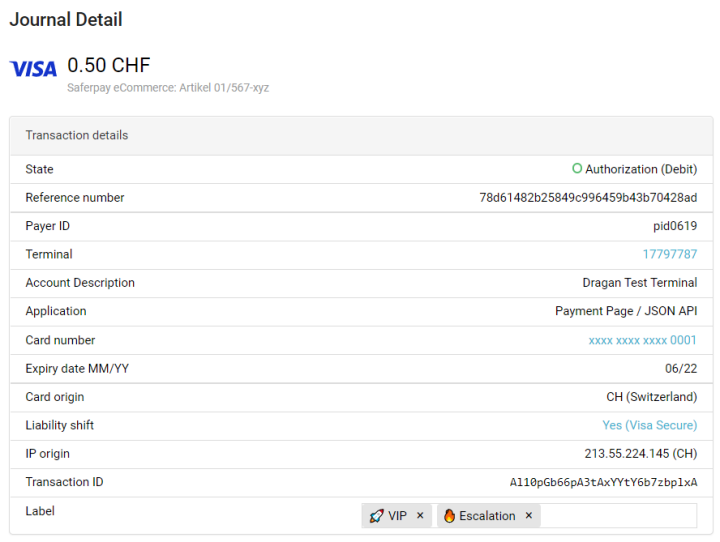

This missing function was added when customer references were introduced: With the “Payer ID” field, all transactions can be clearly assigned to customers.

The idea behind is simple: If you want to use the functionality, assign a Payer ID in the API call relevant to you, which uniquely identifies the customer. For example, this could be the customer e-mail address or the customer ID of the web shop or the merchandise management system. Payer IDs of this kind can then be filed in the “PaymentPage/Initialise”, “Transaction/Initialise” or “Transaction/AuthoriseDirect”.

Et voilà – you’ll now be able to search the transaction journal for the corresponding customer reference and find all of the transactions relating to this customer:

Transaction Labels

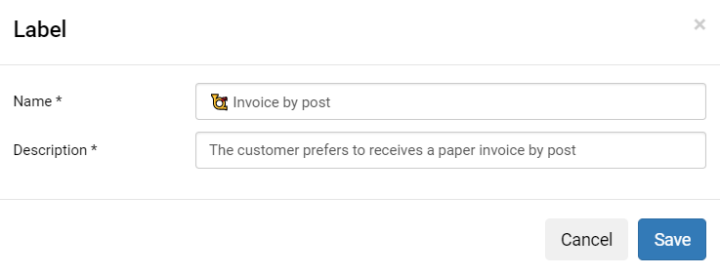

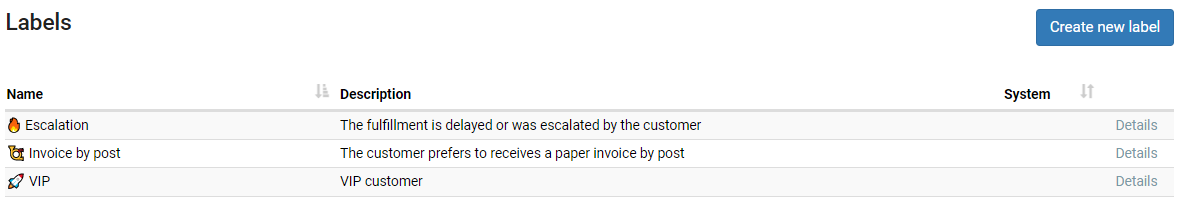

Labels give you the option to categorise and group transactions. In order to use this labelling function, first of all you need to define the labels that you wish to use. Under “Settings/Labels”, you can create as many labels as you wish in the Saferpay Backoffice:

The name of the label can be freely allocated – emojis or icons are also a possibility to allow your label to be recognised more quickly.

In the payment details, you can then add one or several labels for the transaction in progress:

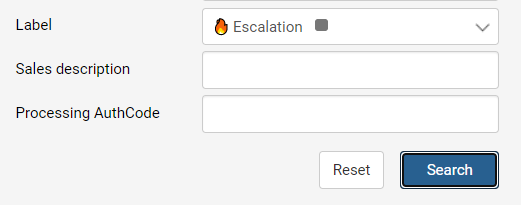

You can then request a list of all transactions which have been assigned to a specific label in the transaction journal by filtering for the respective label:

Use Cases

There are a wide variety of different use cases. Below we will describe two general examples of how labels and customer references can be used.

Example 1: Approval process for refunds

For security reasons, the (fictional) Hotel Refundus Maximus only wants to allow refunds to be processed by managers in the Saferpay Backoffice; other employees are not authorised to process refunds in the Backoffice and instead can only attach a “Refund” label to the respective transaction. Managers regularly look at newly labelled transactions, check and authorise the credit and then remove the “Refund” label.

Example 2: Labelling of transactions for manual risk assessment

The (fictional) gold dealer Alibaba wants to protect itself and its web shop from cyber criminals (“robbers”) and against their attempts to commit fraud and manipulate. In order to separate real transactions from fake transactions, every order received is first checked for any discrepancies. By means of a search for the customer reference, it is possible to check whether the customer is already known and whether they paid for previous orders. For new customers, or if the order has other suspicious characteristics, the label “Suspicious” will be assigned to the transaction. Transactions bearing this label will then be subjected to a thorough manual investigation for fraud. If the result of this manual risk assessment shows that it is probably a fraud attempt and the risk is therefore too high, the authorisation for the transaction will be cancelled. If it is in fact a legitimate order enquiry, the “Suspicious” label will be manually removed and the order can then be processed in the regular way.

How can you use the customer references and transaction labelling for your own benefit?

Perhaps you are now feeling enthusiastic about trying out these functionalities and to adapt your processes in the web shop?

Please note that transaction labelling as well as customer references are pure metadata that do not change the user authorisations and transaction processing in Saferpay.

If you want to use the functionalities for your own benefit, you can design the process freely and thereby ensure, for example, that transactions are not automatically posted if you wish to check them manually prior to posting. Take a look at the Saferpay Backoffice now!

If you’re not yet a Saferpay customer... No problem. Please get in touch with us.