Account-to-Account Payments

Expand your payment options in the checkout with Bank Transfer by Worldline, our secure and convenient payment method.

Discover nowYour benefits by accepting Bank Transfer by Worldline

Offer your customers the new alternative payment method "Bank Transfer by Worldline" in your checkout as part of the Worldline Account-to-Account Payments solution. Instead of needing a mobile wallet or physical card, customers only need a bank account to make a payment. It works by securely connecting to banks using APIs to transfer money electronically from one bank account to another. Whether your customers are online, in-app, through pay-by-link, or cross-border, it can be easily integrated into your existing services. A quicker checkout experience for your customers and faster payments for you.

To enjoy the full experience and watch our videos, please accept the cookies.

FAQ

-

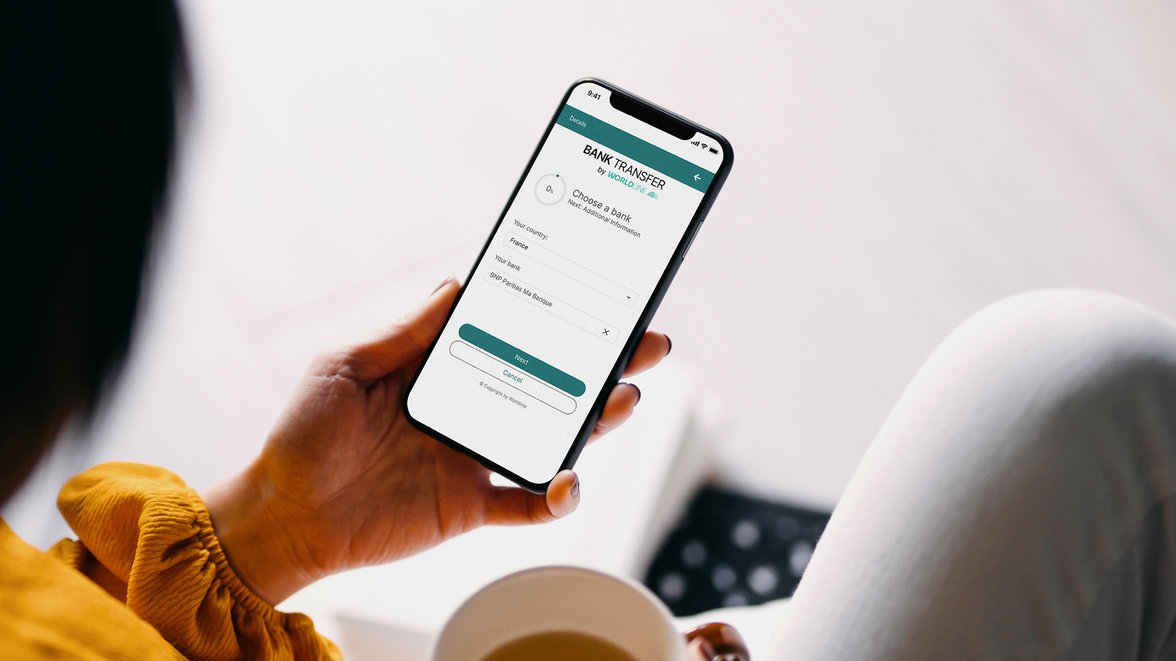

Account-to-Account Payments is a new payment solution offered by Worldline based on the Payment Services Directive 2 (PSD2). The customer-facing brand is Bank Transfer by Worldline and allows customers to initiate payment orders directly from their bank account without using a payment card.

Account-to-Account Payments are carried out with both classic bank transfer as well as instant payment transfer, depending on the availability of the payer's bank. Standard credit transfer has an expected completion time of 1-3 workdays. Instant payment transfer provides a faster payment confirmation in just a few seconds, but fewer banks are available and a fee may be charged to the payer. We offer the option to have Account-to-Account Payments exclusively with instant payment transfers.

-

Account-to-Account Payments transactions processed by Worldline are equally secure as 3-D Secure card payments and pay buttons due to strong customer authentication. Account-to-Account Payments transactions are more secure:

- than non-3-D Secure cards, cheques, SDD

- when associated with instant payments

-

Saferpay Payment API integration is required. Please make sure that your interface is updated before the activation. For more information, see our Saferpay Payment API specifications. If you need help, please contact our Saferpay Integration Support:

-

Account-to-Account transactions are charged a commission-rate of 0.35% + 0.20 EUR. There are no setup costs for you.

-

The default payment method for Account-to Account Payments is standard credit transfer, which has an expected processing time of 1-3 working days. If you require immediate confirmation of payment completion, we can switch to instant credit transfer, which typically completes in just a few seconds. Please contact cs.ecom@worldline.com to activate only instant payment transfer or to get further information about this option.

-

Yes. Account-to-Account Payments are available for all Saferpay solutions. Saferpay Secure PayGate is needed to handle Single- and Multi-Use Payment Links. The link can be sent via e-mail or QR code and it can also be scanned by the payer instore.

-

The payouts will be received in one payment including all other payment methods (for which Worldline is your acquirer) according to your contract.

Interested?

Learn more about Worldline Account-to-Account Payments by contacting us.

Are you an existing customer and do you need terminal support, do you have questions about your transactions or do you want to change your contract? Please contact our Customer Service / Terminal Support.