3 trends in customer relationship in the banking sector for 2021

01 / 01 / 2021

With 2020 behind us, let s look ahead to 2021 in terms of the challenges facing the customer experience in the banking sector Read this article to find out what will be the new trends in customer relationship in the banking sector for 2021

The year 2020 will have profoundly marked our lives and customer relations have had to constantly adapt to changes to meet the constraints of lockdowns and physical distancing. No sector of activity has escaped this observation, and the banking sector has also had to reinvent itself in order to continue to deliver quality service to its customers.

The Marqeta2020 survey of 200 banking executives confirms that all the players are well aware of the upheavals brought about by the COVID-19 crisis: 99% agreed that changes in consumer behavior will have a significant impact on the banking sector in Europe and 75% said that the impact of this crisis has changed their business models.

In connection with the transformations in the banking world, three major trends are emerging for 2021:

- The digitalization of customer relationship is becoming a prerequisite

- Advisors are key to the relationship of trust with clients

- Flexibility must go hand in hand with security

The digitalization of the bank customer relationship becomes a prerequisite

Although the digital transformation has been talked about for a few years now, it is no longer possible for banking institutions to ignore this major change. Omnicanality, automated email processing, self-service on all devices, bots, social networks, messaging, video, electronic signature, mobile application are just a few examples of the evolutions needed to meet the need for remote interactions desired by consumers to reach their bank.

The need to contact their bank remotely in 2020 has finally accustomed users to using the services implemented; and for those with multiple banks to compare and measure the responsiveness and quality of responses as well as the overall experience with each of them.

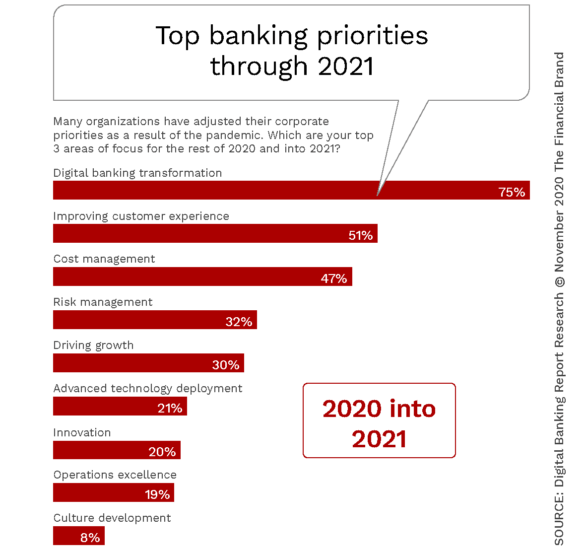

This is why the digitization of customer services in the banking world is becoming a must for 2021. Companies have understood this and as the Financial Brand study shows, the top two priorities for 2021 are the digital transformation of the bank (75%) and the improvement of the customer experience (51%).

If 2021 will therefore be focused on upgrading or investing in new digital channels, it is important to remember that this must be done with flexibility and agility (largely provided by solutions hosted in the cloud) but also with a common vision. The user expects the same customer experience and consistency in the answers given regardless of the channel. It is therefore essential for companies to rely on a truly omnichannel offer that ensures a 360-degree view of all customer interactions.

Advisors are key to building trusting relationships with customers.

While we have highlighted the digitization of customer paths as a prerequisite for 2021, it should also be emphasized that advisors are at the heart of the relationship between the bank and their customers. Advice, even at a distance, is a strong need on the part of a non-negligible number of users who, above all, want a personalized service that corresponds to their needs.

In the ContentStack study, it was noted that 40% of bank customers could switch to more personalized services and 62% of consumers expect their bank to adapt the service according to their behavior.

Finding the right balance between human and digital is certainly a vector of success and a good indicator to measure a successful digital transformation.

The advisor, at the center of the customer relationship is important in the link created between the bank and the consumer, he sees his role and functioning evolve. More and more in a situation of mobility - we talk about virtualization of the work force - he must have all the essential information to respond to customer requests and gain autonomy, he must also be comfortable with digital tools. Many solutions exist on the market, but only clear user interfaces that are easy to access, especially on cell phones, will ensure maximum efficiency for the advisor. Finally, tools and expertise on offers are no longer enough, from now on advisors must still show more empathy and bring that little bit more emotion that automated systems don't have today.

Flexibility must go hand in hand with security

The explosion of digital channels over the last year will continue in 2021, and this movement must be accompanied by confidence in the tools and particularly in the security that is implemented by companies in the banking sector. Many consumers who only contacted their bank by phone or visited a branch have become familiar with online banking tools and have appreciated the flexibility. Nevertheless, information security and authentication processes are essential to ensure trust.

According to the ContentStack study, the main reason why consumers do not switch to a 100% digital bank is related to the major security risk.

Numerous technological solutions (biometrics, digital keys, etc.) exist to secure access, and by 2021 they will be rapidly deployed in the banking sector, as the demand for confidentiality, digital identity management and security is multiplied with the remote relationship.

Finally, like all businesses, banks want to "cloud" their applications to benefit from the flexibility of the model and the possibility of gradually responding to new uses. Here again, flexibility should not be made possible at the expense of data security and preservation. Choosing a private Cloud is often the right solution that combines both flexibility and security.

In 2021, the customer experience will remain a major challenge for the banking sector, which will need to adjust its strategy by finding the right balance between digitalization, human consulting, flexibility and security.

Contact us to learn more about our bank customer relationship solutions !

We will share best practices, key questions to ask and the benefits of a solution to meet your challenges.