Worldline India Digital Payments Report H1 2023 - Key highlights

16 / 11 / 2023

The Worldline India Digital Payments Report for H1 2023 presents a comprehensive analysis of notable trends and shifts within the digital payments landscape in India from January to June 2023.

The report provides some key insights such as the frequently visited In-Store merchant categories and highest online transaction categories. The report also deep dives into various payment instruments to understand the growth of the digital payments ecosystem in India.

Have you read the report yet? If you haven’t, here are some of the report’s highlights that can tell you about the scenario of digital payments in India for H1 2023.

Worldline data trends

We analyzed transactions available in public databases as well as the transactions processed by us in H1 2023 (January – June) and derived some unique insights.

In H1 2023, frequently visited In-Store merchant categories such as grocery stores, restaurants, service stations, clothing stores, government services, pharmacies and hospitals accounted for around 65% in terms of volume and nearly 50% of the total transaction value.

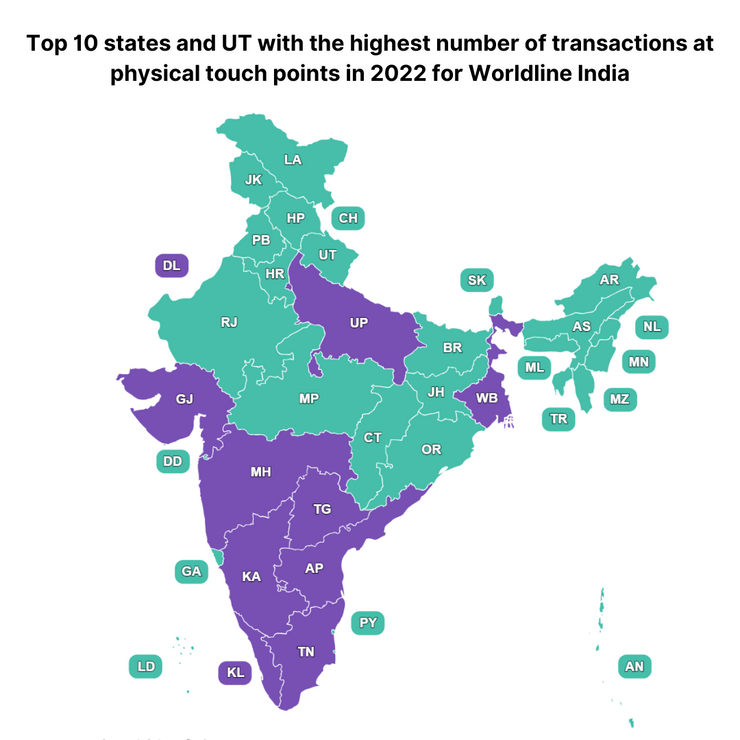

Top 10 states and UT with the highest number of transactions at physical touch points in 2022 for Worldline India: Maharashtra, Kerala, Tamil Nadu, Karnataka, Delhi, Telangana, Uttar Pradesh, Gujarat, Andhra Pradesh and West Bengal.

Here’s what Ramesh Narasimhan, Chief Executive Officer – India, Worldline commented: “Every passing month serves as a testament to the rapid adoption of digital payments. Looking back at the first half of 2023, I find myself even more optimistic about the payment trends unfolding in India; the impressive performance of UPI, the surge in credit card usage, the jump in mobile payments volume, and the uptick in small ticket size of P2M transactions.

All this indicates that broad swathes of the country, rural and urban, are embracing digital payments. The allure of digital payments beckons both consumers and merchants alike, evolving it into an indispensable facet. As the payments landscape of India continues to grow, we at Worldline are enabling secure, hassle-free, and timely payments to suit our customers’ evolving needs”

As the country continues on its digital journey, businesses and policymakers must adapt to this evolving landscape. The report serves as a valuable resource for understanding the current trends and provides a roadmap for the future of digital payments in India. It's clear that the digital payment revolution is here to stay, and its impact on the Indian economy is only set to grow in the coming years.

Are you interested in reading the full Worldline India Digital Payments Report for H1 2023?

Download now>