Overview

Collection is the most important parameter in the insurance industry. However, problems like customer segmentations and channel behaviour make the entire concept of collection and how to productively run it becomes an enormous challenge within the industry. To tackle this, the recurring and the digital flows of recurring is what get us the stickiness.

Let’s know more about these challenges and how we can tackle them in the insurance sector.

But first, let’s meet the industry magnates who have got their minds dug deep into the insurance industry; the ones who’ve been weaving a seamless & successful insurance business.

Speakers

- Aditya Chatterjee, Vice President | Enterprise Sales, Ingenico ePayments India

- Gaurav Sadana, Vice President & Head | Central Retention and Customer Experience, Bajaj Allianz Life Insurance Company

- Ramakrishnan Ramamurthy, Executive Vice President | Service Delivery, Ingenico ePayments India

- Manish Kumar Sachdeva, Senior Vice President & Head | Digital Products, Max Life Insurance Company Ltd.

- Ramu Gudimetla, Vice President | Claims, SBI Life Insurance

LET’S BEGIN

INSURANCE AND RECURRING PAYMENTS GO HAND IN HAND

(Gaurav Sadana)

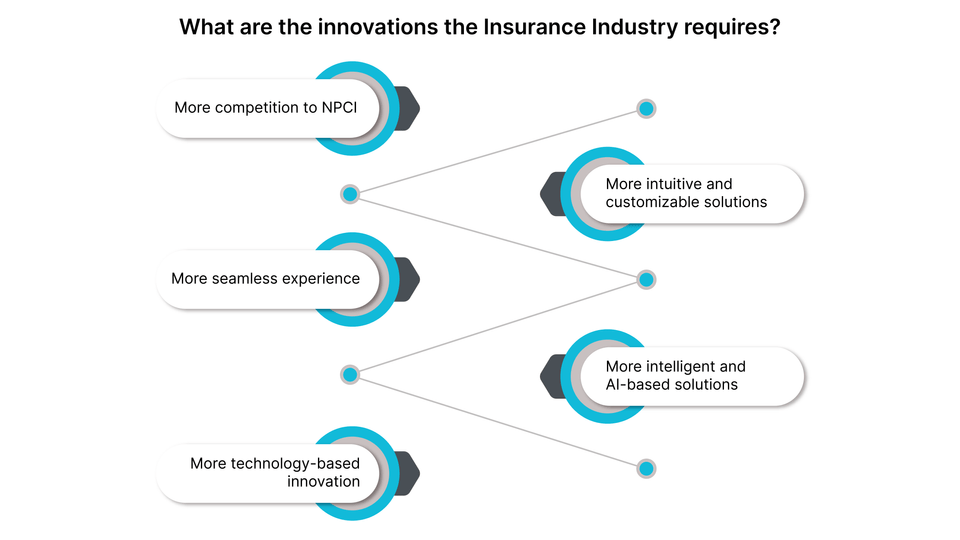

We all know, digitizing every organization has become a necessity today. The insurance sector is a long-term contract or a product by nature. It requires targeted marketing and a ring-fencing strategy starting from the organizations to the customers for better retention and a longer stickiness.

In the Recurring payments ecosystem, insurance looks at it in two ways-

- Business-prompted / Business-led Recurring payment methods

- Customer Led Recurring Payment methods

Business Recurring Payment is when the company prompts insurance to a customer. It has two funding options at the backend i.e. pay via credit card or link it with the bank account via NACH. Customer Recurring Payments are when the customers themselves hop onto a recurring payment method. It is still evolving to be picked up. Example: Bank applications.

To summarize, insurers are primarily looking at the business prompted mechanisms because that gives us better control in terms of driving customers to the payments.

SEAMLESS AND RELIABLE USER EXPERIENCE

(Manish Kumar Sachdeva)

Recurring payment for the insurance industry is extremely important. To put it in simple terms, it is a push business more than a pull business. Because agents solicit, advocate, and sell this business. Seldom do the customers come hunting for insurance. To create a constant touchpoint with the customer and retain them for a longer period, Customer Experience plays a major role. Seamless interaction and customer service enhance one’s experience and reminiscence.

DIGITAL PHASE

COVID is pushing people to a digital space rapidly, which has led to increased use of Credit Cards than net banking. Credit Cards have become the best optimal solution because of their standing instructions, reliability and one-click journey. This has given a higher bitrate and success rate in this sector.

Why you ask? Customer Experience and Reliability we say.

The seamless payment journey of the customer is what attracts them to opt for this payment method. Also, reliability plays an important role that enhancing the longevity of customers. There are high chances of error rates, backend nuances, and tedious action of adding the details in Net Banking. Therefore, people lean towards a better and a reliable user experience.

ENHANCING CUSTOMER EXPERIENCE

(Ramakrishnan Ramamurthy)

“If there is a lack of conviction, there is a lack of commitment. That in itself influences persistency.”

Indian demographic is vast and varied. And each tier has a different behavioural experience. For instance, tier 1 & tier 2 are more financially enabled. Therefore, for these customers, the company needs to create a bouquet of experiences they could choose from and take the process ahead. For tier 3, the company needs to know what segments it is touching. In essence, for the rural audience the company could create an experience using Aadhar and physical biometrics; and ensure consistency on authorization rather than registration perspective.

Therefore, a blend of experience is paramount to cater to different sets of audiences.

DRIVING PERSISTENCY

(Ramu Gudimetla)

“Persistency has been the most critical parameter that insurers have gauged on.”

The total composition of any insurer comprises 2/3rd of renewal premiums rather than the new policies which are sold. Therefore, the ability to collect premiums with the right experience at all touchpoints helps maintain persistence. It is also important to give a wide array of products to choose from. Especially for the new customers who see a wide range of payment methods to choose from, it instils confidence in the company. Which drives persistence in the long run.