Why is Accessibility necessary ?

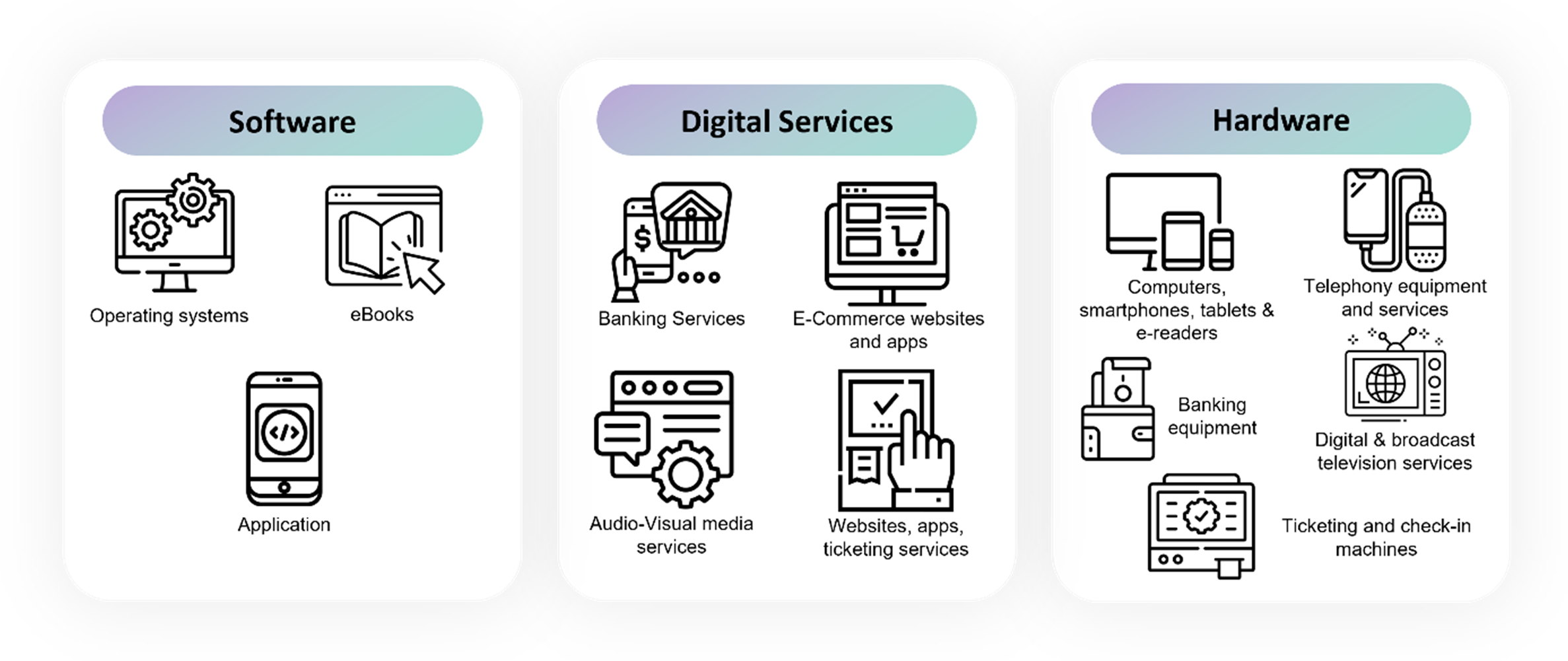

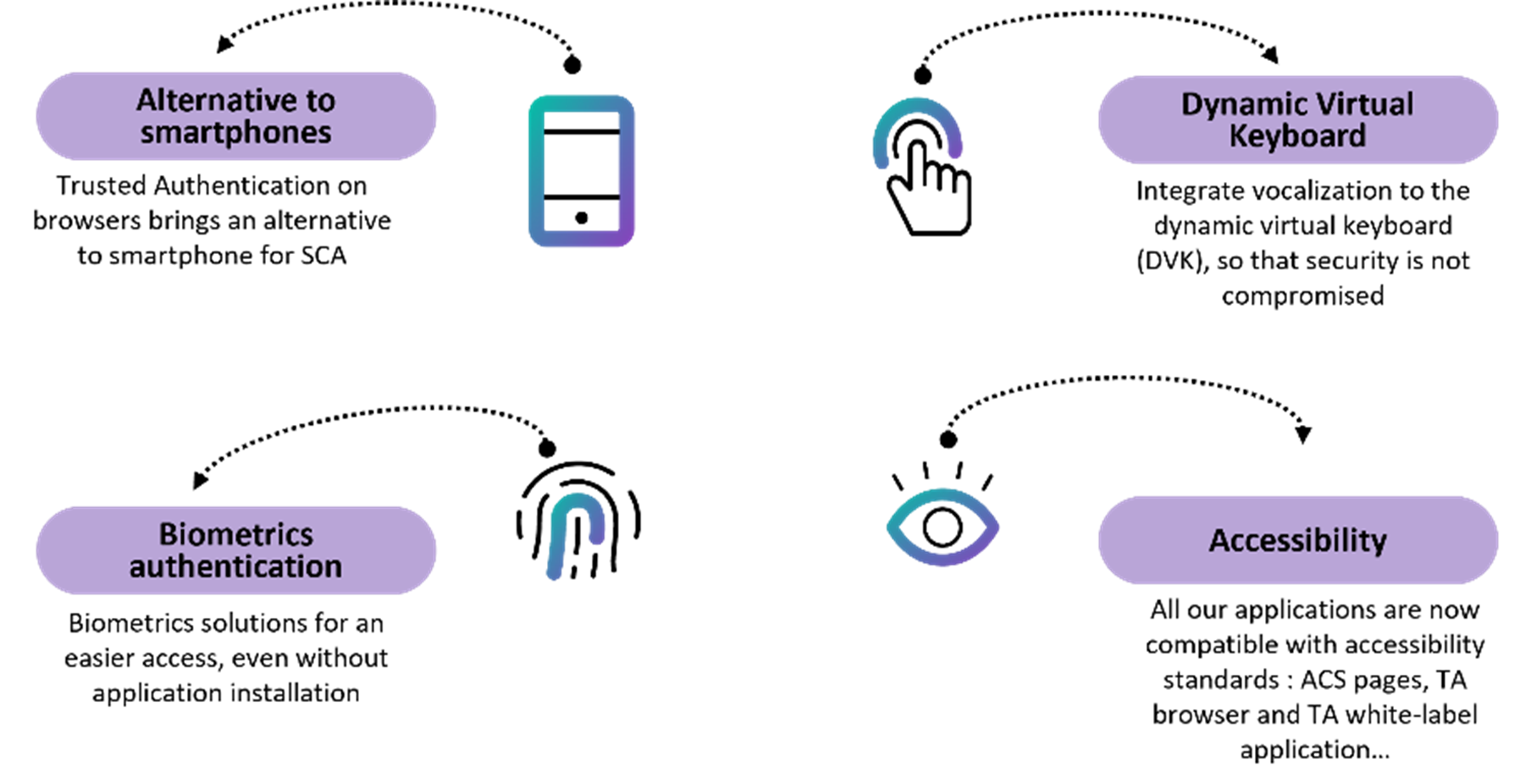

Accessibility means removing barriers or obstacles that prevent people with disabilities from accessing products, services, and information available to others. Ensuring accessibility enables full participation in society for everyone and granting people with disabilities or impairments equal access to information, goods and services.

Today, 15% of the world's population, equivalent to 1 billion people, experiences some form of disability (Source: The World Bank) and 80% of those disabilities are not visible. Disabilities include visual, auditory physical, and cognitive impairments, sometimes in combination. Offering accessible products, services, or information is not just an option; it is a necessity. Failing to do so excludes people with disabilities, hindering their full participation in society.

It is time for us to take action and provide accessible digital services to cater to the needs of the entire population.

European initiatives to ensure access to digital services for all

The European Union is leading the way in insuring accessible online services.

The European Commission has implement a directive on accessibility, initially for public services, and soon for the private sector.

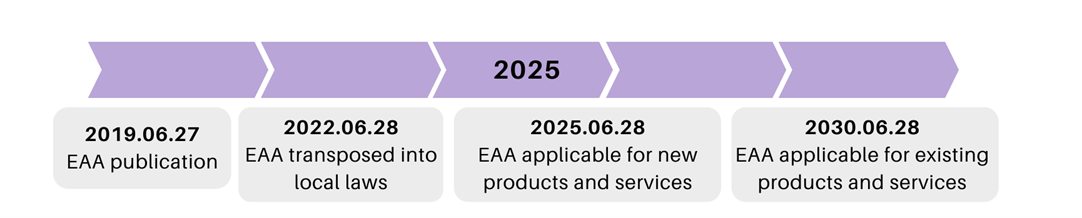

The EU Web Accessibility Directive (EU) 2016/2102, required all public sector websites and mobile apps to comply with accessibility requirements by 2020 and 2021 respectively. Now, private sector companies must also heed the call following the enactment of the EU 882/2019 Directive: European Accessibility Act (EAA) in April 2019.