With accelerated digitalisation, new risks of cybercrime are emerging as fraudsters find new ways to make financial gains.

Financial institutions aim to develop systems that are fraud-proof. However, not all fraud modus operandi can be prevented by financial institutions alone. Governments also have a key role to play.

The impact of fraud

Fraud impacts the consumer experience in two ways. Firstly, consumers face more complex and stringent payment processes, leading them to abandon their transactions. Secondly, they may have to contend with a complex process to report fraud and recover stolen funds.

Financial institutions are also financially impacted due to the increased complexity of fighting fraud and managing compliance with stringent security regulations. As a result, they are exploring the use of Machine Learning (ML)* to fight it. ML will not prevent fraud from occurring, but it will detect it quickly, raise the alarm and enable financial institutions to proactively make checks instead of merely waiting for a consumer to notify a fraud. ML helps to limit their losses.

The future of early detection

It is challenging to predict how, in the future, fraudsters will obtain data and steal identities and how they might use these to trick merchants and financial institutions out of goods and funds. Today, the cost of fraud per consumer is set to increase to a projected cost of $40.62 billion in 2027 (25% higher than in 2020)

"Global losses from payment fraud have tripled from $9.84 billion in 2011 to $32.39 in 2020"

History shows us that fraudsters will always find new ways to commit crimes, but history also tells us that early detection can prevent fraud or limit losses. Future developments in the early detection of fraud using ML will be based on applying modular algorithms inspired by the latest scientific understanding of how the human brain operates.

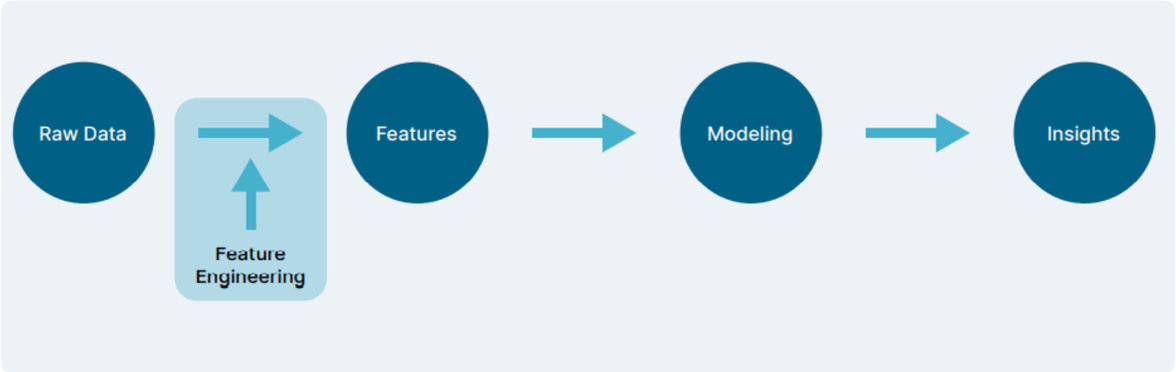

ML feature engineering

Modular algorithms, AI, quantum computing, and technologies like homomorphic encryption, which allows for computation directly on encrypted data, will all help fight fraud.

* Machine Learning (ML) describes subset of Artificial Intelligence (AI) algorithms which work by being trained using (usually large) sets of labelled data