In-vehicle commerce is growing rapidly, but who owns the car-wallet?

01 / 11 / 2022

In-vehicle commerce is emerging. The market for in-vehicle commerce is growing rapidly. It is estimated that 600 million connected vehicles will generate $537 billion of in-car transactions by 2030. In particular, the value of in-car payments is expected to reach $1 billion in 2023 from less than $100 million in 2020. Today, car makers are accelerating the development of in-car payment services to benefit from the emerging in-vehicle commerce.

Car makers continue to build siloes

Every time the topic of in-vehicle commerce pops up, I cannot resist thinking about R-Link, one of the first in-car appstores released in 2012 on the Clio IV and the Zoe, with the ambition to bring the apps to cars. The fact that Worldline managed to bring credit card payment, allowing for R-link apps download, gives me a big smile.

The last decade has brought many advancements in the world of connected vehicles, ranging from technologies such as 4G/5G/6G, AI and self-driving to services such as telematics, infotainment and data monetization. Today, almost every car brand comes with their own appstore, and their -service platforms have the bridge to mobile apps via CarPlay, AndroidAuto or MirroLink.

In-vehicle commerce combines all of these aspects mentioned above to reinvent business models. For example, Mercedes partners with Visa to launch in-car payment. Mercedes car owners using this service are able to purchase services through the onboard unit and conduct payment with fingerprint authentication.

So far, car makers continue to build closed ecosystems of in-car apps and commercial success has been absent. General Motor (GM) rolled out its in-vehicle marketplace, which had the potential to break siloes with the open marketplace concept. For example, petrol merchants are able to offer services with an in-vehicle app to attract drivers to their service stations; these services can be seamlessly integrated with a payment solution.

Unfortunately, GM decided to discontinue this service at the beginning of 2022 due to the lack of user adoption. The current development of in-vehicle commerce shows that launching an open ecosystem takes more work.

Consumers are still driving on the bumping roads

There are many reasons why in-car commerce has not yet reached mass market adoption. The first reason remains the lack of a proper ecosystems and the involvement of key stakeholders. The second issue is the lack of users benefits: what’s in it for the consumers? The third issue is the lack of user friendly in-car applications allowing for a smooth customer experience during the journey, taking into account a seamless integration between those services and payment.

Nevertheless, the industry is paying good attention to potential use cases and to the improvement of user experience. For example, in collaboration with Worldline, Total has launched the TOTAL eWallet[1][2] in 2018, creating a simpler and smoother drivers experience at service stations. The TOTAL eWallet is still serving high volume of consumers today.

This development is a good start with a potential to expand to broader user adoption, but bringing an initiative such as TOTAL eWallet to the entire energy retail industry (i.e. petrol and electricity), beyond one single service provider, is a different ballgame. It requires a fundamental change in the business model, and therefore, a fundamental change in the ecosystem.

Now is the time to establish open ecosystems

To start with the consumers, the time to silently use connected car data without rewards is over. We should start providing fair benefits to drivers to incentivize vehicle data sharing such as location and battery or fuel tank level. Using real-time contextual data, merchants would increase the acquisition rate tremendously by guiding drivers to their shops with attractive offers. In return, consumers are more willing to share data and benefit from a rewards program, which can be loyalty points or a voucher for beverage.

For a long time, the automotive industry has been struggling with the right business model for car data monetization. Many neutral data brokers such as Octonomo, Wejo, TomTom, High Mobility, etc. are buying data from car makers and then resell it to service providers. To this extent, car makers have the full control over car data and they are self-protective. The common missing part of current data monetization models is the true consumer economic benefits and privacy protection.

The EU announcement of the Data Act suggests data to become a common good, which hopefully will convince car makers to be less conservative in sharing data. This will certainly help the automotive industry to achieve a breakthrough in car data economy.

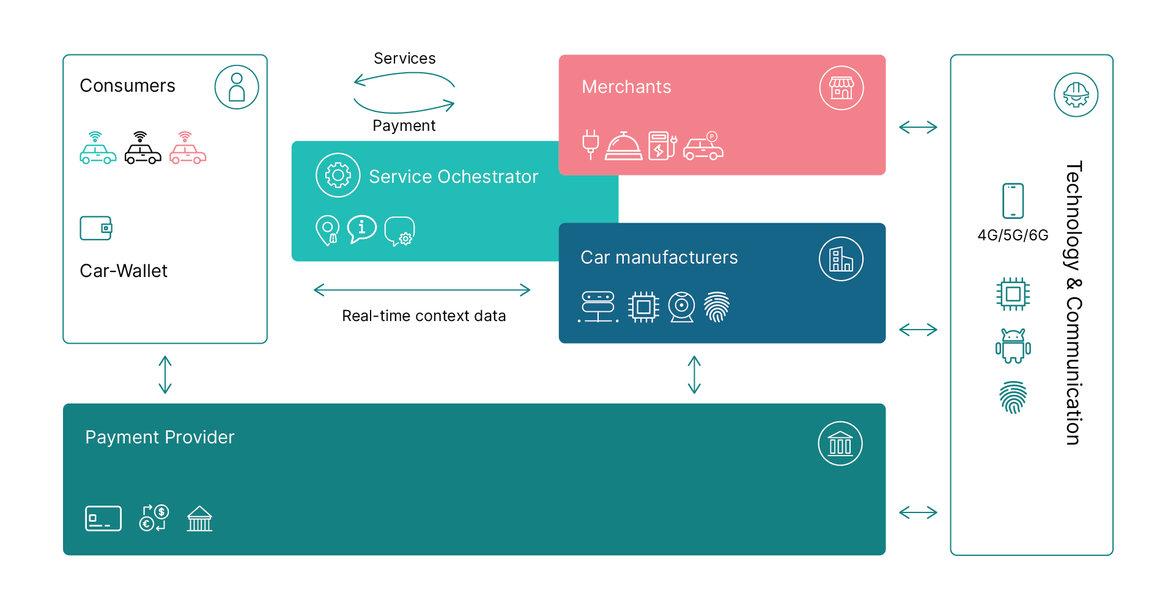

The second part of the ecosystem is a bit more complex, requiring open collaboration of the stakeholders. The figure below illustrates a simplified ecosystem with the involved key stakeholders: car manufacturers, merchants, service orchestrators, technology & communication providers, and payment providers. There are many other imaginable actors not shown in this example, such as banks and card scheme owners.

Obviously, there are many questions to ask ourselves while developing a business framework for in-vehicle commerce.

Choosing the right use cases – A consumer centric approach is necessary to define and prioritize the use cases that bring a better driving experience. The acceleration of Electric Vehicles in conjunction with sustainable smart mobility open many exciting opportunities around EV charging, Tolling (pay-as-you-drive, pay-when-you-drive), Smart Parking (just park and go, finding free parking spot with available EV charging station), ordering services during the journey (voice command order of fast food to pick-up) and many more.

Well-balanced revenue sharing model – A fair revenue sharing model driven by the data economy should be fundamental. Fair sharing also means that the consumers are in the driver seat, being part of the data economy.

Choosing the right payment schemes – Depending on the market region, appropriate payment means need to be considered. The consumers should be offered the choice of debit cards, credit cards, account-based payment, or even stable coins in the future. From this perspective, in-vehicle commerce provides ultimate opportunities for the PayTech industry to innovate.

Choosing the right partners – Right partners covers both business and technology. A wide spread merchant network, accepting in-vehicle commerce transactions is a must in order to achieve mass adoption. At the same time, choosing the right technology to enable in-vehicle commerce is key. To warranty driving safety, voice command can be a good solution to trigger a service. For payment authentication, many options are possible, including voice recognition, face recognition and fingerprint.

Open Car-Wallet is the way to go

One of the key element enabling the success of in-vehicle commerce is the “car-wallet” where the “battle” is expected to happen. Unless we are repeating the same failures from the past, learned from the payment industry, the best is to consider open and independent car-wallets. An open car-wallet would allow the consumers to assign different payment means. At the same time, it can be evoked by any in-car apps to render payment services.

Suppose car makers, merchants, banks, telco’s and payment service providers are not moving quickly enough in finding strategic positioning in the in-car commerce space. In that case, they risk facing an aftermath where dominant tech players would take over the in-car commerce market.

The future is in the hand of the key stakeholders, and they need to act now.

To discuss the ideas expressed in this article, contact me at Minh Le

Learn more about:

· How IoT shaping future business model

· Avatars of Things: Can you trust devices with your private data?

[1] https://play.google.com/store/apps/details?id=com.total.totalservices

[2] https://apps.apple.com/us/app/totalenergies-e-wallet/id1368096796

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

What should we expect in 2023?

-

-

Worldline launches “Bank Transfer by Worldline”, a new account-to-account payment method in 14 European countries by end of 2024

Learn more -

Learn how NFC payments empower your business