How IoT is shaping future payment models

01 / 07 / 2020

IoT devices are increasingly becoming a part of, as well as revolutionising, the payment landscape In this context, contactless transactions can be made through wearable objects such as smartwatches, rings, and key fobs, amongst others.

IoT, changing the payment world

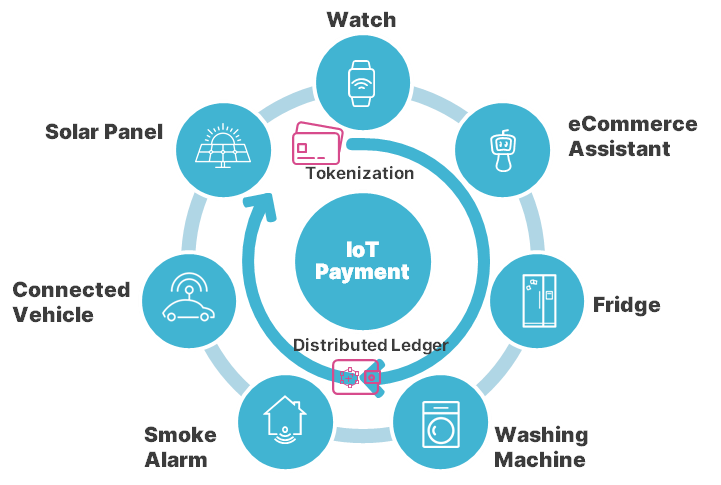

Nowadays, IoT devices are increasingly becoming a part of, as well as revolutionising, the payment landscape. In this context, contactless transactions can be made through wearable objects such as smartwatches, rings, and key fobs, amongst others. Consumers can make purchases and payments with Alexa or Google Assistant simply by using voice commands. Some home appliance manufacturers have experimented with embedding shopping apps in smart refrigerators, allowing consumers to buy groceries and pay right from the fridge’s door. Homie, a spin-off company from Delft University of Technology, offers pay-per-use washing and drying services. Once the laundry is done, customers automatically receive a notification with a payment request. All of these examples represent payment methods based on card payment schemes, often enabled by tokenisation. The evolution of IoT payment does not only involve card schemes but also alternative trials that are based on bank payments and distributed ledgers. For these reasons, IoT providers are seeking new ways of cross-selling products and services that automatically trigger product order and corresponding instant payments. In the automotive industry, Daimler Truck and Commerzbank are testing digital currency to facilitate autonomous payments at electric charging stations. In the utility industry, numerous start-ups are deploying Blockchain technology that features autonomous buying and selling of renewal energy between peer-consumers.

IoT, opening up alternative payment models

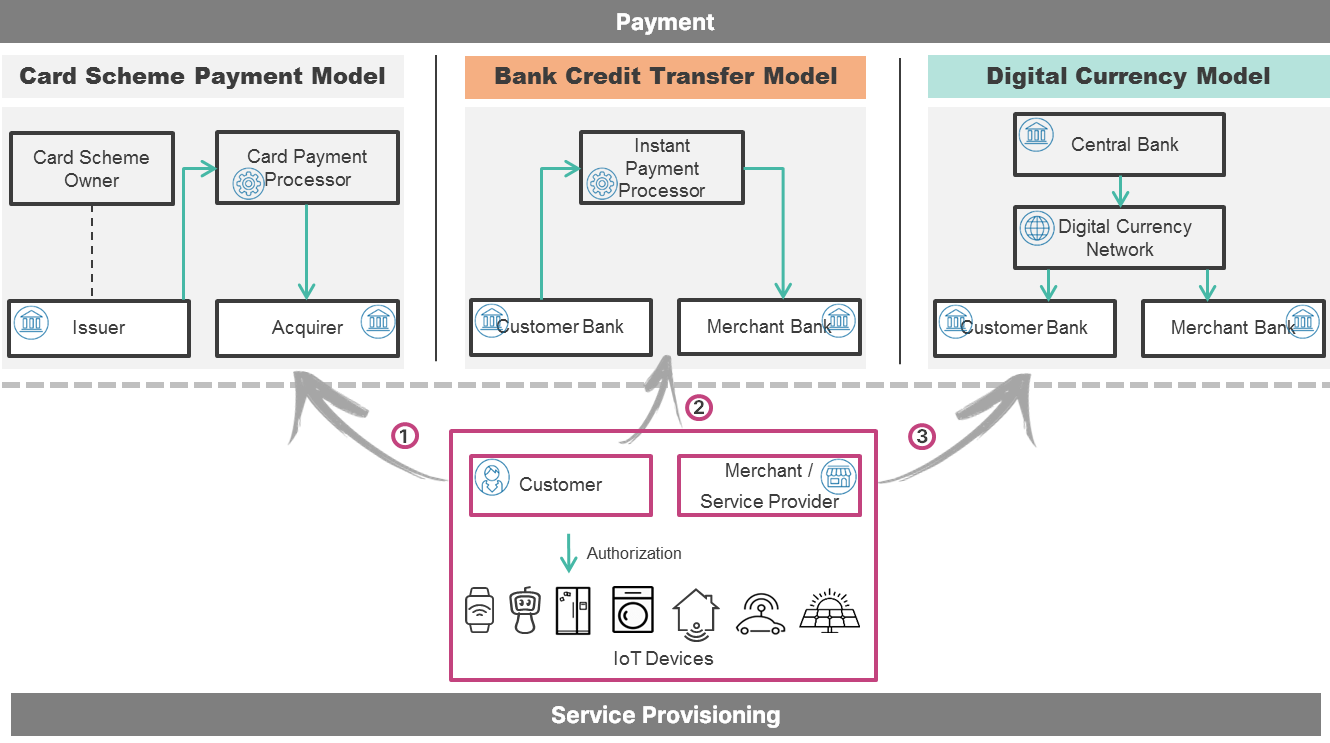

The advances of IoT are opening up alternative payment models that are interesting to observe as well as important to understand possible fundamental changes in the future of autonomous payments. Assuming the consumer is able to authorize IoT devices to trigger or conduct payments, we identify three alternative payment models:

▪ Card Scheme Payment Model – Major international card schemes have been successfully deploying noncard payment through payment tokenisation. Today, one of the most common uses of credit card tokenisation is Near Field Communication (NFC), which is replacing a Primary Account Number (PAN). In addition, the card emulation software (i.e. residing in a smart phone or in the cloud) generates a dynamic card verification value, which is uniquely bounded to a single transaction. The card tokenisation can be used to turn IoT devices into payment-enabled devices. For example, a connected car can host a tokenised payment card, which enables cars to pay for all kind of surrounding services at gas stations, tolling, parking, drive-in restaurants, etc. The standardisation of this model is mainly driven by card scheme owners.

▪ Bank Credit Transfer Model – Instant Payment is currently an exciting development in Europe. With Instant Payments, banks are able to execute payments in real time. This means that if a payer wants to pay someone in Europe, the beneficiary is able to receive the money within a few seconds, assuming that both the payer and the beneficiary are customers of participating banks of the SCT Inst (SEPA Instant Credit Transfer) scheme. The SCT Inst covers both person-to-person payments and person-to-business payments. The integration of Instant Payment systems with open APIs, enabling the mandatory services for third party access to bank account (XS2A), could bring tremendous opportunities, along with most of the IoT payment scenarios that are today already possible/imaginable with card scheme payments.

▪ Digital Currency Payment – One of the most discussed IoT payments today is the distributed ledger technology thanks to its attractive technical capability for IoT environment (i.e. highly distributed).Since ledgers are distributed, they allow IoT devices to have direct transactions with or without the involvement of a trusted third party. It is still uncertain how current development of numerous digital currency initiatives will lead to some main streams in the future. Nevertheless, a possible scenario would be the move towards regulated digital currency networks where central banks will play a crucial regulating role, and where interchange of different currencies will be possible. The G7 is investigating the economic impact and potential of global stable coins. In parallel, the Dutch Central Bank has strongly expressed its ambition to play a leading role in the development of its digital currency in a recent publication. From a technical angle, the payment workgroup at the W3C (World Wide Web Consortium) is currently developing new standards to help facilitate interoperability of digital currency networks.

No one can predict what the future IoT payment landscape will look like. However, it is certain that Card Scheme Payment is being challenged by alternative payment models. Bank Credit Transfer can be considered as a serious performer because banks are catching up with scale and speed. Digital Currency is an innovative challenger, driven by many players in the manufacturing, banking and payment industries. Hence, IoT will drive new business models, supported by regulations, allowing new players such as token service providers and digital exchange providers to be part of the tokenized economy.

It is expected that the three models mentioned above will co-exist in the future. The level of adoption of each model will depend on payment characteristics that are essential for the IoT environment such as scalability, security, responsiveness, cost efficiency and ease of use.

Implication of the IoT on the payment value chain

IoT payments bring along new opportunities but also new challenges. In order to better understand that, the following topics should be taken into account:

Device ownership

As mobile wallets are growing in popularity, smartphone manufacturers are doing everything in their power to protect their business in the payment value chain. Since January 1st 2020, Germany has implemented a new law that allows Payment Service Providers (PSPs) to access to the iPhone’s NFC antenna so that a new kind of wallet can be developed next to the native Apple Wallet. This is a small step toward “liberalisation” of NFC-enabled smartphones. However, similar legislations toward IoT emerging devices need further investigation. The question is: who owns the device? It is fair to say that consumers should own the device as they buy it. In practice, manufacturers also have their good arguments to control the devices.

Device security

Distributed objects in an IoT environment are vulnerable to security breaches. A typical IoT device needs to go through different stages of the manufacturing process during which different suppliers are involved in the delivery of different components. Operationally, IoT devices can be “out-of-reach”, where they become vulnerable to brute force attacks. It is important to consider the end-to-end device security including hardware, operating system and software modules. It is crucial that all components of the supply chain are subjected to a security audit in order to ensure trust. To this extent, the IoT Security Foundation has published the IoT Security Compliance Framework to help develop security solutions for IoT devices.

Device life cycle management

IoT devices can move from one owner to another. This has consequences on the way payment credentials are managed. The last thing you want is to continue paying for services used by another person. Therefore, device life cycle management should take care of revocation of payment credentials before a device changes owner. This must be effortless and clear to provide consumers with confidence and trust in IoT payments.

In conclusion, IoT payments are paving their way toward the future cashless society. We expect the acceleration of IoT payments in the near future, where payments empowered by IoT technology will gain more ground. However, there is still a long way to go in order to tackle the numerous challenges related to payment models, regulations, technology, security and trust.

Worldline is a front runner when it comes to innovation of future payments. We collaborate with customers, financial institutions, start-ups and technology partners to drive the true purpose of payments, which is to best serve consumers by making payments frictionless, secure and trusted.

Interested in a unique opportunity to co-innovate with us at the 2020 Worldline e-Payment Challenge?

You can visit our dedicated website to learn more.