Can you trust devices with your private data? Beyond the obvious smartphone, more and more devices are extending our digital reach, our digital footprint, our digital identity, becoming a digital extension of ourselves:

- Your TV is using your Netflix subscription

- Your car gets access to the parking lot based on your license plate

- Your smartwatch records and uploads your workout data

They are sharing your data, they are paying with your money.

If you are worried and wonder how you can trust such empowered objects, I’ll try to provide some answers in the following few paragraphs.

As more and more services get digitised and become richer and more personalised, everybody gradually gets used to the convenience of automatically executed operations.

Autonomous payments have been around for ages in multiple forms of recurring payment solutions, from direct debit to recurring credit card transactions to paying for a subscription.

If we trust a Direct Debit of our accounts by our utility providers, where’s the difference with a more personalised and granular approach where devices trigger the payment for the services consumed or the supplies ordered?

Of course, these convenient services seem more intrusive and come with a cost of privacy: the smart devices enabling them are part of your household, and you are sharing information about you and your life via those objects.

If, for example, you would have a smart washing machine or printer that can order supplies when needed, you share your home address via them – how else could your supplies be delivered to the right home?

And the Netflix account that you assign to your TV for your child should know that your daughter or son is not yet 18 (to filter out inappropriate content) or that you give your consent for them to use your full subscription, paid by your credit card.

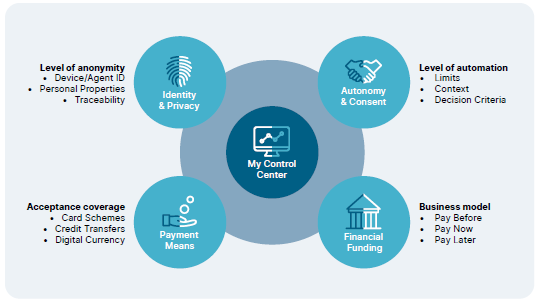

In this way, you can see every object you own as just another impersonated avatar of yourself. Smart objects typically need to know a limited amount of private stuff about you to be able to act on your behalf and ease your life.

These utility avatars that represent you are designed to serve their specific purpose and in order to make life more convenient, you do entrust them with parts of your identity and access to your payment means.

You can see every object you own as just another impersonated avatar of yourself.

You either need trustworthy providers or must rely on avatars using the latest privacy-preserving techniques that can help to share relevant data without revealing information you don’t want to disclose. In a world where people like you and me are becoming more aware of our data rights and value, this could enable new income streams or interesting “pay with data” business models without losing control.

Of course things can, should and will get even better when these privacy preserving solutions become more widely used and integrated in those personal devices containing parts of your sensitive data and personal information.

When it comes to payment, even today there are many trustworthy payment providers using payment schemes that allow you to revert any unrightfully executed transaction, keeping you (not your avatar) in ultimate control.

And then your Avatars of Things become anonymised extensions of yourself, disclosing no private data whatsoever. They’re just your happy washer, your crazy TV and your careful car that make life more convenient.

![]()

As fundamentally changing user’s habits is extremely difficult – especially when it requires giving away control – one advice for businesses that want to launch autonomous devices: start with a training phase. Not for your AI models, but for the users of your new services, so they can get hands-on experience and get used to the behaviour of their Avatars. It is difficult for many people to imagine that a fridge is suddenly able to create a shopping list more accurately than they would themselves.

Starting with a less seamless experience, providing insights into how a new autonomous service functions and decides, but keeping an explicit validation step, can be the stepping stone to changing social habits and building the trust needed for us to hand over some control.

But as most users keep looking for more convenient and personalised experiences, bringing intelligent and personalised devices into people’s lives, can really make a difference.

As long as you and your smart objects are working with trusted and regulated payment service providers like Worldline, you can rest assured that any autonomous payment is made in the most secure way, in line with the rights and limitations you have defined. And on top, know that you can challenge what was done and dispute or revert the executed payment at any time.

So let your watch, your car, your washing machine perform those micropayments and start enjoying the convenience of a more autonomous future.

If you would like to know more about why you can start trusting device driven payments for everyday convenience, check out the autonomous payment solutions section of our Navigating Digital Payments publication.