Payment Gateway

14 / 03 / 2023

Payment gateways are an essential component for any e-commerce business that wants to enable its customers to pay through credit cards or other online payment methods. The technology communicates the relevant data to the various entities involved in a transaction to authorize the payment.

What is a Payment Gateway?

A payment gateway is a technology that allows you to process transactions on your website or app. It enables your customers to conduct online transactions through different payment modes like net banking, credit card, debit card, UPI, or the many online wallets that are available these days.

Payment Gateway transmits the payment data to the processor. It authenticates the digital credentials before forwarding the payment details to the payment processor. It acts as a facilitator to connect the payment processor to the merchant account and schemes.

How Does the Payment Gateway Ecosystem Work?

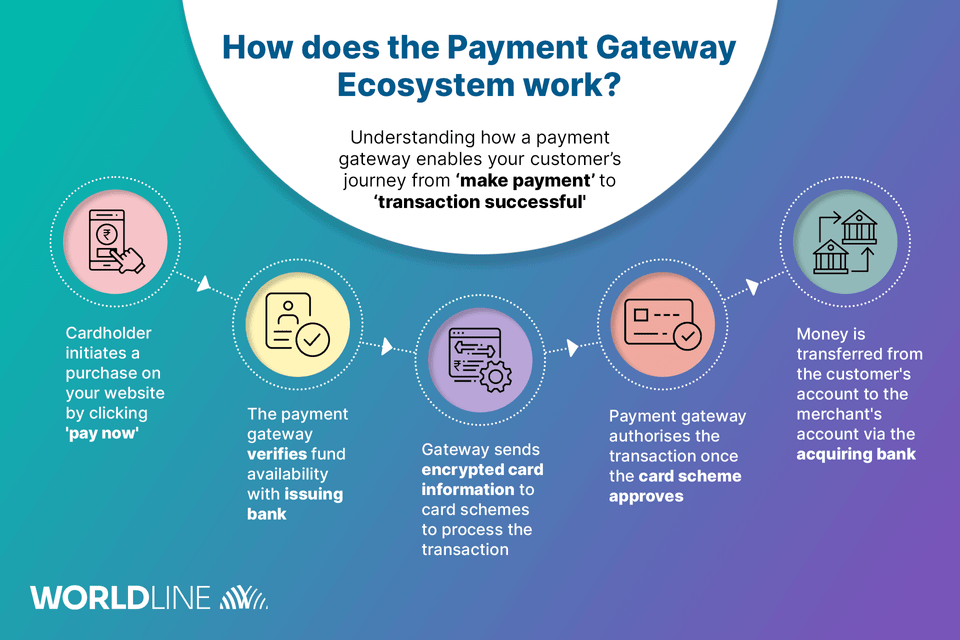

Online transactions take place so smoothly and quickly that one would be surprised to know that there are several components involved for an online payment to be conducted successfully.

From clicking on the ‘pay’ button to seeing a ‘transaction successful’ message, your customer’s payment goes through several steps and involves various key players.

A Payment Transaction Involves the Key Stakeholders:

- Merchant: The business or any person like you making the sale.

- Cardholder: Your customer who will purchase on your website.

- Issuing bank: The financial institution that holds the customer’s account, either a credit card account or a savings account connected to a debit card.

- Card schemes: The card companies that manage the cards such as RuPay, Visa, Mastercard or American Express.

- Acquiring bank: The financial institution that holds the merchant’s account.

Let us Look at the Various Steps that Enable your Customers’ Online Payments:

- The cardholder initiates a purchase from your website and clicks the ‘pay now’ button.

- Now at the backend, the payment gateway integrated with your website will check with the issuing bank on the availability of funds.

- The payment gateway will send encrypted card information to the card schemes to process the transactions.

- Once the card schemes approve the transaction, the payment gateway will send the communication to your website to complete the transaction.

- The payment gateway also sends information to the acquiring bank to transfer money from the customer’s (issuing bank) account to the merchant’s account.

While this all takes place behind the scenes, a good payment gateway gives your customers a smooth and seamless checkout experience. Check Worldline's Payment Gateways, to provide the best payment experience to your customers.

Types of Payment Gateways

Three main types of payment gateways can enable you to receive payments from your customers:

- Hosted payment gateway: The payment gateway simply takes your customer to a secure payment page after the checkout, and it is hosted and maintained by the Payment Service Provider (PSP).

- Self-hosted payment gateway: The entire transaction happens on your website and gives your website and gives you better control over the complete checkout and payment experience for your customers.

- API-hosted payment gateway: In this type of payment gateway, your customer can also complete the entire transaction on your website. It processes the transaction with the help of HTTPS queries or APIs. Here the entire payment security measures lie on you to maintain as per the regulations.

How to Choose the Right Payment Gateway for Your Business?

By now we know very well that a payment gateway is a service that facilitates the flow of transaction information to authorize payments in your customer's preferred mode of transaction.

Choosing the right payment gateway for your e-commerce environment is often the key to constructing a seamless buyer journey. And a smooth checkout experience directly impacts the conversion rate of your customers. That is why you must assess the following elements and pick the right payment gateway for your business:

- Security: Your customers expect a high-quality website that uses the most secure payment methods. Different payment gateways run on different security standards. The onus lies in you to choose a gateway which is 3D secure and compliant with PCI data security the highest level of security.

- Modes of payment: A payment gateway should provide sufficient choices of payment modes to your customers such as debit and credit cards from leading banks, digital wallets, net banking, UPI, BNPL, and wallets. Customers tend to abandon their cart if they are unable to find the mode of payment that they seek.

- Affordability: Estimating the total cost that you will incur is the most crucial aspect of a payment gateway induction strategy to ensure its viability in the long term. Prices of payment gateway solutions are calculated on the type of your business transactions, sales volume, revenue flows, transaction frequency, and of course, your target markets. While selecting a payment gateway, it is essential to determine how your business model aligns with the product’s fee structure.

- Multi-currency Support: While expanding your e-commerce business beyond borders, you will need a payment gateway that can seamlessly handle payment in multiple currencies. It is essential to provide your customers across geographies with the convenience of paying in their local currency without going into the regulation complexities. Ideally, to be future-ready and globally competitive, you should be looking for a payment gateway that can handle transactions in all the major currencies.

- Easy System Integration: It is convenient to have your payment gateway plugged into your invoicing or accounting system. Instead of manually keeping track of your transactions, the corresponding invoices will be automatically updated in your books whenever an online payment is completed. Also, look for payment gateways that have hassle-free integration kits and can be quickly integrated into your existing system.

Watch this space to learn about other aspects of digital payments, such as the Point of Sale system, subscription payments, integration kits and the role they play in the digital payment process. With more than two decades of experience, Worldline India is the preferred partner for businesses across industry verticals for their payment needs.

Frequently Asked Questions

-

Selecting the best payment gateway or payment service provider (PSP) will depend on your business requirement. The best payment gateway will be the one that will provide you with multiple payment modes, unmatched security, affordability and most importantly, seamless integration.

-

Payment gateway costs depend on the service provider that one selects. You may pay set-up fees, transaction fees, merchant discount rates and additional fees for things like chargebacks and cancellations.

-

A payment processor is a service that handles your customers’ transactions and enables them to buy your products and services. It acts as a mediator between the cardholder, business, acquiring bank, payment gateway, and issuing bank.

On the other hand, a payment gateway is a technology that allows you to process transactions on your website or app. it authorizes you to conduct an online transaction through different payment modes like net banking, credit card, debit card, UPI, BNPL or online wallets.

Read our blog to know more about the difference between a payment processor and payment gateway.