What can Semantic Analysis and AI bring to the email channel?

14 / 11 / 2023

Artificial Intelligence can help us a lot in our daily work: it can do tasks for us and speed up our work. Companies can decide to deploy it with the use cases that deliver the most value. When it comes to digital banking, the use of AI can and must be leveraged because it helps both with personalisation of exchanges and with automation and instantaneity, two essential criteria for retail banking customers. Changing the mindset of both customers and advisors will be the other challenge with AI.

Possible use cases with AI on the email channel

In the digital communication and specifically on the email channel, banks are challenged with the number of emails they receive, the quality of the answer they provide and the time they take to respond. Artificial Intelligence can help banks in these three categories with semantic analysis as a first level and then Generative AI as a second step.

What is Semantic Analysis?

Semantic analysis is a method used in linguistics, computer science, and artificial intelligence to understand the meaning of words and sentences in context. It examines relationships among words and phrases to comprehend the ideas and concepts they convey. In natural language processing, semantic analysis helps machines grasp the nuances of human language, such as irony, sarcasm, or ambiguity. It is a critical component of technologies that rely on language understanding, like text analysis, language translation, and voice recognition systems.

We will describe in the following paragraphs three use cases, where AI and sematic analysis can improve the email channel:

- Direct answer gives instantaneous inputs to customer emails.

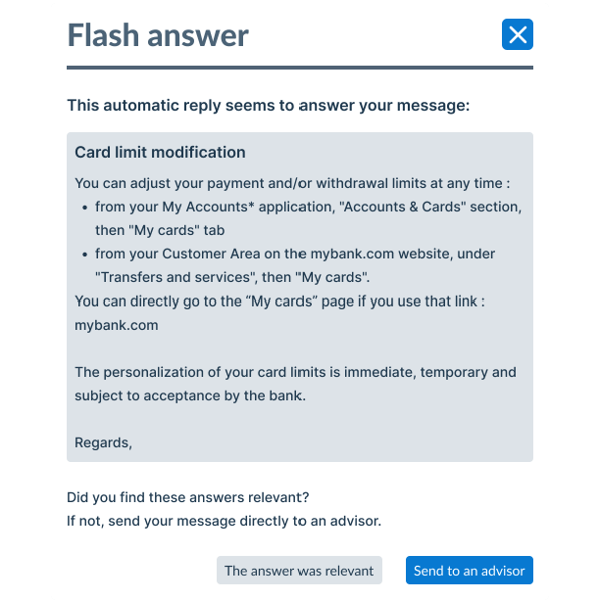

To reduce the number of emails received, AI can answer customers’ emails directly when they ask trivial questions, frequently asked questions, or questions where a self-service option is the solution.

AI can scan the email before the email is sent and suggest a direct answer. The customer can then choose to accept the direct answer by acknowledging the reading or leveraging the self-service option provided.

With this feature, low-added-value questions are automatically answered by AI and only subjects that need true expertise reach advisors.

Semantic analysis can be the first step of direct answers: an intention is detected in the customer’s email and a preformatted answer is presented to the customer depending on the intention detected.

Generative IA can enhance this first step by creating an original answer based on: the customer exchange history, the preformatted answer and the bank’s knowledge base.

Direct answer is clearly the best way to reduce the number of emails received by banks.

- Routing enhancement to prevent loss of time.

It is hard for advisors to rapidly answer emails if the email does not reach them directly, or only reaches them at a later stage. Sometimes with regular routing system, customers choose a theme for the email and then write the main body of the email about a different topic.

Unfortunately, most routing systems will send the email to an advisor who is an expert on the topic in the title and not on the topic in the body of the email, which is often the main issue the customer is reaching for.

So, time is already lost between the moment the customer sends the email and the relevant advisor receives it and starts working on it.

With AI, both the body of the email and the title can be analysed to detect the customer’s intention and if their respective intentions match. If both the title and the body are aligned, the email is sent. If the semantic analysis detects different intentions between the title and the body, rules can be set so that the intention detected by the body prevails over the title intention.

With AI enhanced routing, banks can ensure that emails are routed to the right team of advisors, reducing wait times, and improving the overall customer experience.

- Suggestion of answer to gain to time and enhance quality.

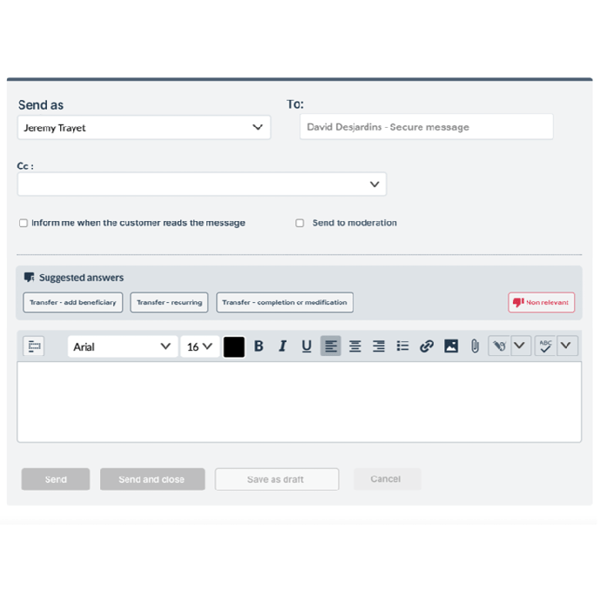

Finally, when advisors receive the email, answering with speed quality information is their main goal.

Each customer situation can be unique or generic and most of the time it is both. So, answering quickly is a challenge where knowledge and adaptation are key. AI can enhance the advisor’s answer by providing suggestions.

Semantic analysis can detect the intention within the customer’s email and suggest one or several answers from a set of preformatted answers. Advisors can then select the suggested answer, modify, or adapt it if needed a send the response to the customer.

With Generative IA, advisors can write a prompt, a short description of the answer they want to create. Generative IA then creates an answer based on the customer’s email, the conversation and the bank’s knowledge database. The suggested answer is unique but customised by the advisors and brings clarity and speed to advisors’ answers.

How Worldline assists its customers in the implementation of AI

Today Worldline already leverages AI on email through two ongoing projects with major French banks.

In the first project, semantic analysis is helping the bank with direct answers for customers and suggested answers for advisors. Each time a customer creates a new conversation and wants to send it, semantic analysis scans it first and suggests an FAQ answer or a self-service option if possible.

With this implementation, the bank aimed to reduce the number of emails received by 5% and the results are above that figure.

In the second project, Worldline is leveraging generative AI to suggest the best email answer to advisors from another major French bank.

As depicted, advisors write a prompt to describe how they want to answer a customer request, then generative AI suggests an answer based on every information available about the customer and its relationship with the bank. A pilot is currently conducted on a selected geography. After confirmation, this option will be deployed over their entire French network.

Semantic analysis and generative AI bring new ways to enhance quality and responsiveness of advisors’ email answers. What’s more, they also allow them to focus on value-added exchanges between a bank and its customers as a substantial number of questions no longer needs to be handled by advisors.

These technologies not only help to optimise the email channel but also have applications in the entire digital communication such as content summarisation, smart database, etc. And most probably, more use cases will appear and reinvent the customer-bank relationship soon.

Learn more about Worldline Trusted Interactions and all Digital Banking solutions.

Clément Noel

Related articles

-

-

-

Modern Slavery Statement

Learn more -

How Kamera Express reinvents itself and grows internationally

-

The importance of customer experience

-

-

Cassa Centrale Banca Group and Worldline Italia conclude agreement on strategic partnership in merchant acquiring

Learn more -

How Payment Orchestration is staying ahead of the curve