Central Bank Digital Currency (CBDC): The Future of Money

Contact usUnlock a new level of payment efficiency

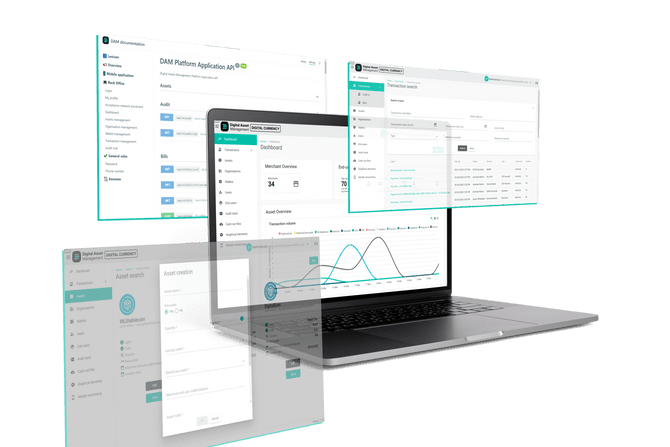

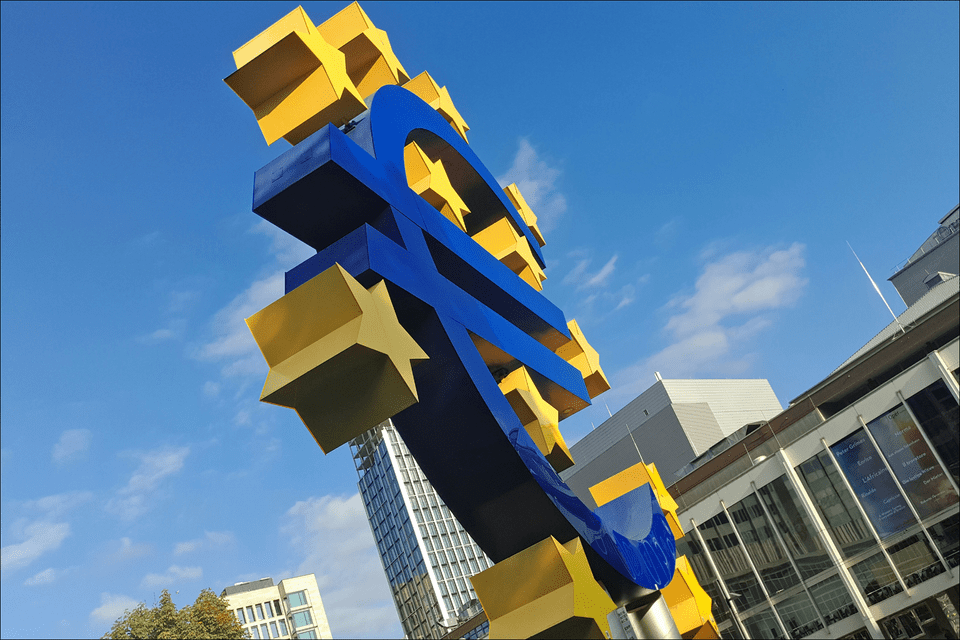

As the digital economy matures, Central Bank Digital Currencies (CBDCs) are being recognized as a valuable addition to the traditional payment system. This is due to their fast, secure, and convenient nature, which has the potential to enhance the way payment networks operate and increase transparency in the system.

How Central Bank Digital Currencies could reshape the global economy

Further resources

Central Bank Digital Currencies

Fast time-to-market, tailored-made payment network, secure and resilient, deploy innovative payment solutions with ease.

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

What should we expect in 2023?

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business