Uncovering the future of private banking and wealth management industry

Contact usThe digital revolution is bringing significant changes

The finance market is changing, more and more end customers are looking for more versatility and innovation in the services they receive. With investors expecting digital access and tailored service, finacial institutions must invest in the appropriate technology solutions such as mobile apps, online portals, or real-time portfolio monitoring tools.

To meet these evolving demands, private banks and wealth management firms must adapt without leaving aside their essence of exclusive and personalised attention.

Optimizing Wealth Management

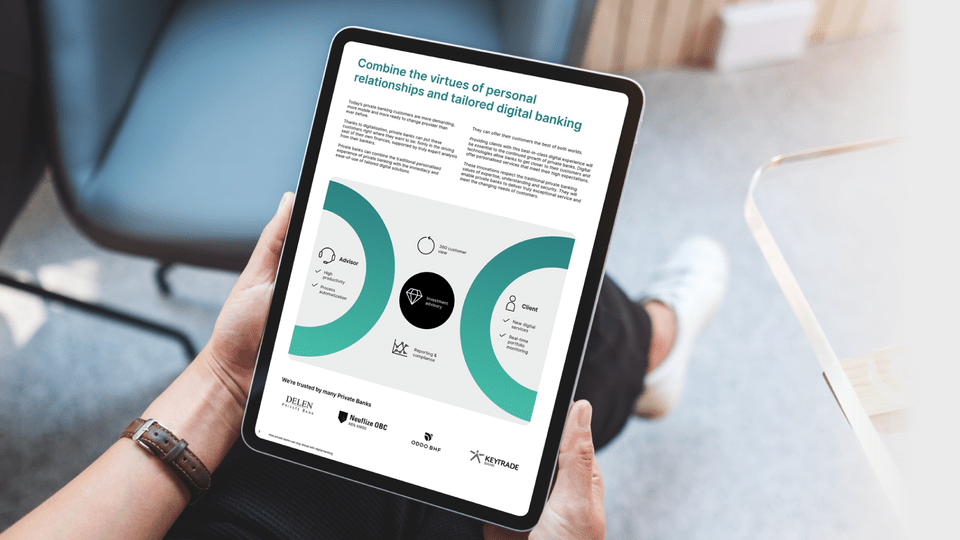

The right mix of technology and human touch can result in a more effective and efficient wealth management process that benefits both advisors and clients.

We're trusted to get the job done.

Our team of experts has years of experience helping private banks navigate digital transformation, and we are excited to share our insights with you on how to improve investment decisions, streamline operations, and enhance client engagement.

Digitalise the daily life of private banking

Preserve the best of two worlds, personalized approach, and digitization.

Why choose Worldline?

We create tailor-made solutions based on the latest technologies to deliver the operational efficiency and reliability that private banks require.