The Payments Digital Divide Survey

01 / 06 / 2022

This report sets out a vision for how the payment industry can reduce the payments digital divide by taking action to shape the payment landscape to make it more trusted, inclusive, accessible and convenient for everyone.

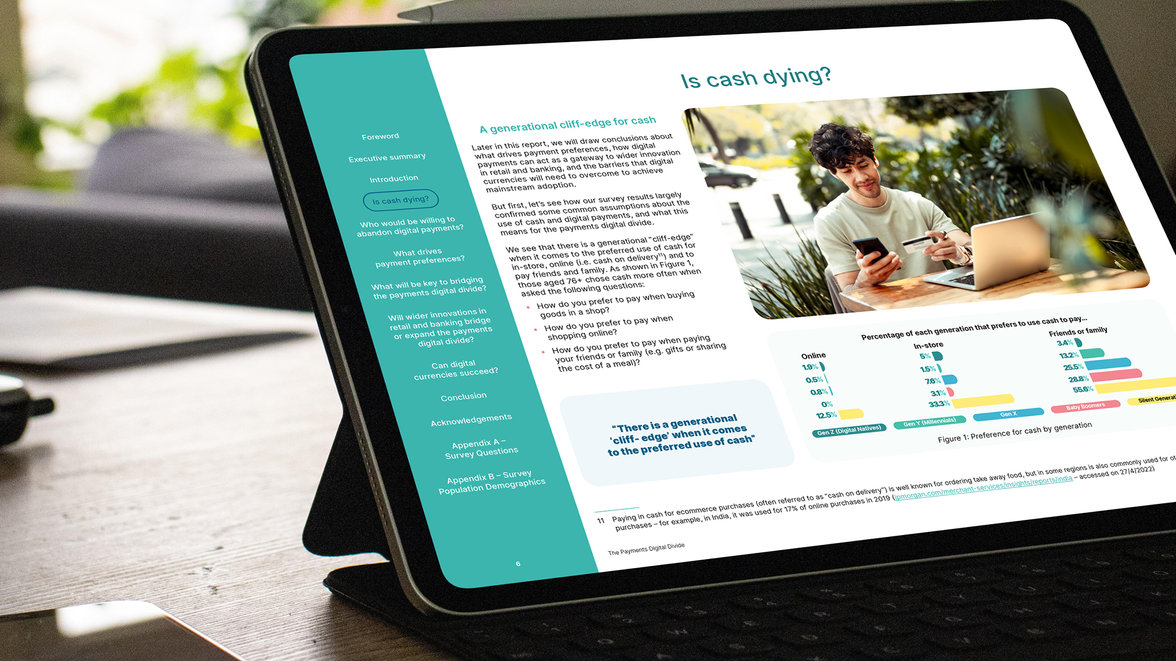

Although most of us have already adopted digital payment methods, some are yet to fully embrace this way to pay leading to a payments digital divide. So, what are the reasons why some people don't wish to make the switch?

To answer this question, the Worldline Discovery Hub conducted a survey to understand how people prefer to pay and, more importantly, what is driving these preferences.

Read our report to discover what the payment industry can do to help to bridge the payments digital divide.

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

What should we expect in 2023?

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business