PSD2 opportunities and Instant Payments regulation – What they mean for e-merchants?

04 / 01 / 2018

The payment ecosystem is constantly changing: developments in consumer uses, the profusion of new technologies, new entrants, and even the introduction of new regulations, e.g. SEPA, MIF, EPAS, PSD2, Instant Payment. Let's take a closer look at the PSD2 and Instant Payment and their implications for e-merchant activities.

The new role of the Payment Initiation Service Provider (PISP)

This new service – Payment Initiation Service (PIS) – introduced by the PSD2, is based on this new regulated role. It can initiate bank transfers on behalf of others, provided that prior consent has been received. An e-merchant is able to offer its customers an alternative payment experience using bank transfers. E-merchants can either rely on the PIS of a third-party provider, or can themselves become a PISP and offer their own proprietary payment solution. However, the latter option is better suited to e-merchants with a large customer base, providing them with high flows and a quick return on investment.

For consumers, this payment solution is simpler because they no longer have to enter their card number for every purchase; they just need their online banking login, which many already know by heart. In addition, by giving their consent for every payment, they retain control over their account, which will ultimately facilitate the service’s adoption.

"Banks and e-merchants are the two players capable of gaining the consumers’ trust for the adoption of the Payment Initiation Service."

The customer experience: a major challenge for e-merchants

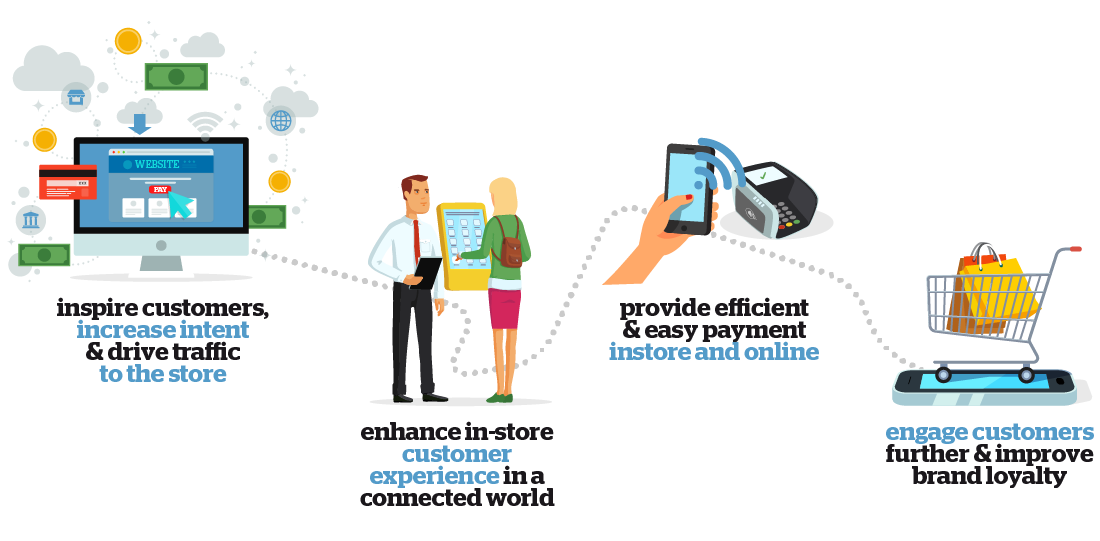

By offering new payment methods, e-merchants must provide a solution in line with the new requirements set by consumers and be at the same service level as the bank card. These days, consumers are more and more demanding when it comes to the customer experience: it has to be simple, omnichannel and secure.

Simple and omnichannel: the PIS customer experience must be homogenous across all sales channels (online and in-store).

Secure: the right balance must also be found between regulatory requirements for strong authentication, security and customer experience.

Finally, the adoption of this alternative payment solution also depends on the value-added services attached to it, such as loyalty programs and payment facilities.

According to an Accenture study, 50% of adult consumers would be comfortable with the idea of having their payments initiated by a third party. However, this suggests that while consumers are open to using PISP services, it is the players already established in payments such as banks or large e-merchants that will have the greatest success in attracting consumers.

Head start for e-merchants in developing a proprietary PISP solution

E-merchants certainly have a head start in this regard because their customers are already accustomed to using different payment solutions. Even so, e-merchants will have to quickly rethink their payment strategies to take advantage of this new opportunity. With the PSD2, e-merchants have the option to be their own payment processor as a PISP, and connect directly to banks through APIs. In this way, e-merchants will be able to ease the payment process by offering one-click payments for repeat customers and improve the customer experience. Several e-merchants have already deployed this type of card-based solution and could upgrade it to adapt to the PISP service, which is based on bank transfers.

The logical follow-up to PSD2: Instant Payment

Instant Payment, or instant transfer (SCTinst, the European Central Bank's European scheme for instant payments), is set to be implemented at the European level very shortly. This will involve new technical and organizational challenges for e-merchants. By relying on third-party providers or by being PISPs themselves, e-merchants can more easily upgrade their payment offering to an instant payment service integrated within a digital customer experience. The advantage for e-merchants is the near-instant availability of funds, which protects them from the risk of unpaid bills. This is especially beneficial for small and medium-sized companies, whose business may be at risk due to payment defaults.

The PSD2 will allow e-merchants to boost their offering and provide innovative payment methods that can be adapted to the uses and needs of consumers. This new Directive comes, however, with new regulatory constraints given the need to ensure strong authentication. This option will certainly be more beneficial to major e-merchants with large transaction flows. Their payment processing costs will thus be reduced compared to those of bank cards. In this case, the investment to ensure compliance with the PSD2 will be justified.

Learn more about what are Instant Payments.