Central banks take up the cryptocurrency baton

01 / 03 / 2021

Today the main drivers of the digital currency phenomenon are the central banks That is quite a change from the situation a decade ago, when trailblazing cyberpunks and Bitcoin led the way into the cryptocurrency world Read our article to learn more

Today the main drivers of the digital currency phenomenon are the central banks. That is quite a change from the situation a decade ago, when trailblazing cyberpunks and Bitcoin led the way into the cryptocurrency world. Nevertheless, while they may no longer be in the driving seat, some of the ideas of the cyberpunks are still very much alive.

Bitcoin may not have the reach to replace the global monetary system. Yet while the cyberpunks may have lost the battle to impose bitcoin infrastructure globally, some of their ideas may well survive the war.

Once the stablecoin concept was proven and Facebook [1] had joined the game with its billions of users, the stage was set for central banks to join the race with a stablecoin of their own, backed by sovereign power: the Central Bank Digital Currency (CBDC). The CBDC is a stablecoin issued and backed by a central bank. It is the digital representation of the state’s fiat currency.

Before looking at the benefits of CBDCs, let’s quickly remind ourselves of the basic roles of central banks in the economy.

Central banks have the legal monopoly to create money and regulate the creation of commercial money by high-street banks in the form of loans. Central bank money is only a small proportion of the money in circulation in the economy, the vast majority of which is created by commercial banks.

Commercial banks hold accounts with the central bank, which they use for carrying out transactions between themselves.

Ordinary people do not have central bank accounts. For us to store and access money, we use commercial banks, pay for the service they provide to us, and we rely on them to take care of the money they hold for us.

CBDCs would be a revolutionary change in paradigm. Wholesale CBDCs will transform operations between banks. Retail CBDCs, in one possible implementation model, could give consumers an account at the central bank and access to very easy-to-use online and offline central bank money.

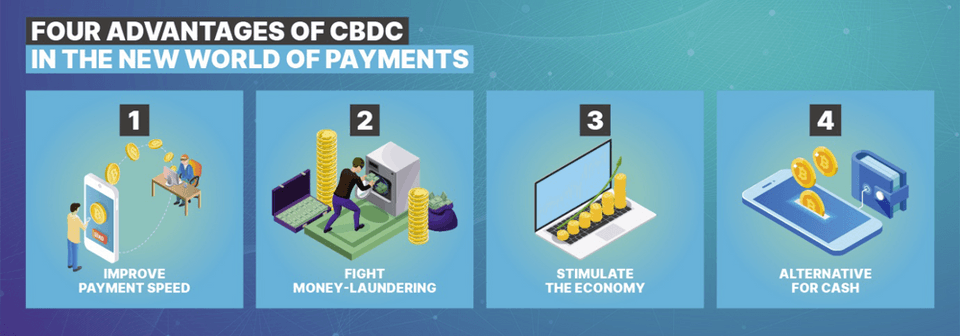

With simpler infrastructure, CBDCs aim to:

- Improve the speed and convenience of central bank money for end-users

- Rationalise payment processing for banks, in some models

- Help states fight money-laundering and tax evasion, track cash flows better and make better economic estimates

- Enable new ways for central banks to directly stimulate the economy

- Be a cheaper alternative to cash, which is decreasing in use.

First out of the starting blocks in the CBDC race was the Bahamas, which issued its Sand Dollar at the end of 2020.

Much larger countries are also close to going live with CBDCs. According to a survey by the Bank for International Settlements, more than 80% of central banks are working on CBDC. China has recently concluded its largest pilot project for the digital yuan, involving 50,000 consumers. The Riksbank in Sweden is testing the e-krona. The Federal Reserve Bank of Boston is working with MIT on CBDC research. Meanwhile, the European Central Bank is intensifying its work on a digital euro and has received more than 8,000 responses to its public consultation.

Financial expert David Birch characterises these developments as a new Space Race, with a digital euro and digital yuan potentially challenging the global role of the dollar. The jury is still out on which of the many proposed designs for CBDCs will work best, or which digital currencies will emerge as winners of this race and what their long-term impact will be.

One thing is for sure. Digital currencies will play an important part in the new world of payments.

To learn more: https://worldline.com/en/home/knowledgehub/stablecoin.html

[1] At the time of writing Facebook’s partners seem to have abandoned the Facebook proposal for a global stablecoin, previously known as Libra and now known as Diem