Are Instant Payments and Request to Pay Solution on their way to becoming mainstream?

20 / 06 / 2022

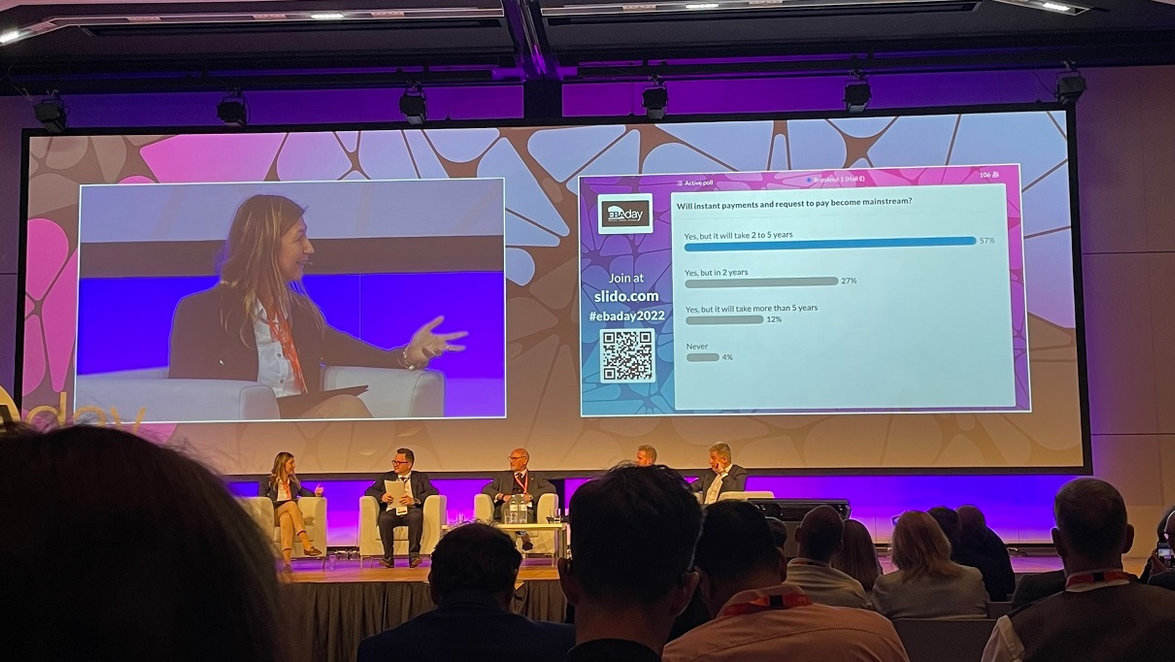

What elements are missing and what barriers need to be overcome to increase further the number of transactions using instant payments (IP) and Request to Pay (RtP)? On the first day of EBAday 2022, Tanja Konrad, Head of Daily Banking Services at Erste Group, moderated a discussion panel on IP and RtP. An important question soon surfaced: do all payments need to become instant and how do financial institutions need to respond?

In this panel discussion, Konrad was joined by Massimo Agostinacchio, Head of Clearing & Settlement Solutions at Nexi Payments, David Chance, Vice President of Strategy and Innovation at Fiserv, Richard Stansbury, Head of Payments Commercialisation and Propositions at HSBC and Heimo Tiefenboeck, Cash Manager at Porsche Corporate Finance. Together they discussed the status of IP and RtP, their similarities and the vital role of regulators.

Increasing popularity

Previously, Instant Payments usually worked within the same banking environment: it opens the possibility to immediately transfer money from one account to another so that the recipient – the payee – instantly has the money at their disposal. This fast payment method is now also possible between different banks with IP. Within seconds the transferred money is credited to the payee's account, who can immediately access the amount – even if it concerns a payment between different banks. The panel members emphasised the significance of this development.

We strongly encourage the further adoption of IP, which will allow European payment service providers to contribute to more significant innovation and harmonisation of payments in Europe. That is why Single Euro Payments Area (SEPA) Instant Credit Transfer (SCT Inst) was launched almost 4.5 years ago. After the initial take-off, growth has levelled off and the question is whether legislation is needed to take the next step in the adoption of IP in Europe.

Request to Pay is often described as the 'missing link' in the world of IP. RtP is a framework containing digital messages from the payee to the payer, including a commercial transaction and the possibility to initiate a payment. Several use cases can be built on this framework, different for each industry. RtP has been on the rise for some time now as the principles of Open Banking and PSD2 encourage direct and frictionless payments within Europe. IP is desirable for RtP as instant is the expectation of most customers today.

Closely connected

The characteristics of Request to Pay immediately showcase the possibilities this payment method offers banks and their customers. For instance: it makes a real-time dialogue possible between the payer and the payee, thus creating a new communication channel regarding payments. With RtP, all payment details, including invoices, can be sent along and read into the recipient's payment environment. This means that no mistakes can be made due to, for example, a typing error when entering payment details.

According to the panel, the elements missing to increase the use of Request to Pay, are stronger industry collaboration and standardisation. I can only agree with that sentiment. Awareness has yet to grow. There is no recognisable brand yet and that is why, instead of competing, industries should work together to improve brand recognition. If not, it will be a challenge for RtP to make a breakthrough.

Looking towards the future

We see more regulation and structure around RtP. SEPA Request-to-Pay (SRTP) is one of the most recent schemes of the European Payments Council (EPC). It comprises the set of operational rules and technical elements (including messages) that allow a payee to request a payer to initiate a payment in a wide range of physical or online use cases. The first participants have joined the scheme, and undoubtedly more will follow.

It is safe to say that RtP is interesting for consumers and offers possibilities for use cases between all conceivable parties: manufacturers, retailers, and even governments can enter a payment dialogue. As mentioned, RtP has been around for a while, but making RtP services instant is the next step for banks to meet the expectations of today's consumers.

It is clear that IP and RtP are gaining ground. However, according to the panel, it will take some time before these frameworks become mainstream. The expectation is that this will take two to five years. I remain optimistic about this occurring before five years are up.

Learn more about what are Instant Payments.

Edward van Dooren

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

Will digital currencies take over the world?

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business