Banking and Payments as a Service – the way forward for financial institutions?

14 / 06 / 2022

Global trends such as changing customer demands, new entrants, emerging technologies, regulatory pressures, rising costs, and lower profit margins are driving significant changes in the financial services market. To keep up with rapidly evolving customer expectations, new digital standards for financial services are increasingly being met by agile fintech companies leveraging technological advances to improve customer experience. Simultaneously, traditional banks are finding themselves at a crossroads; either they align their offerings with customers’ digital expectations or face a decline in their customer base. Discover more about Banking and Payments as a Service – the way forward for financial institutions?

Increasing customer demands

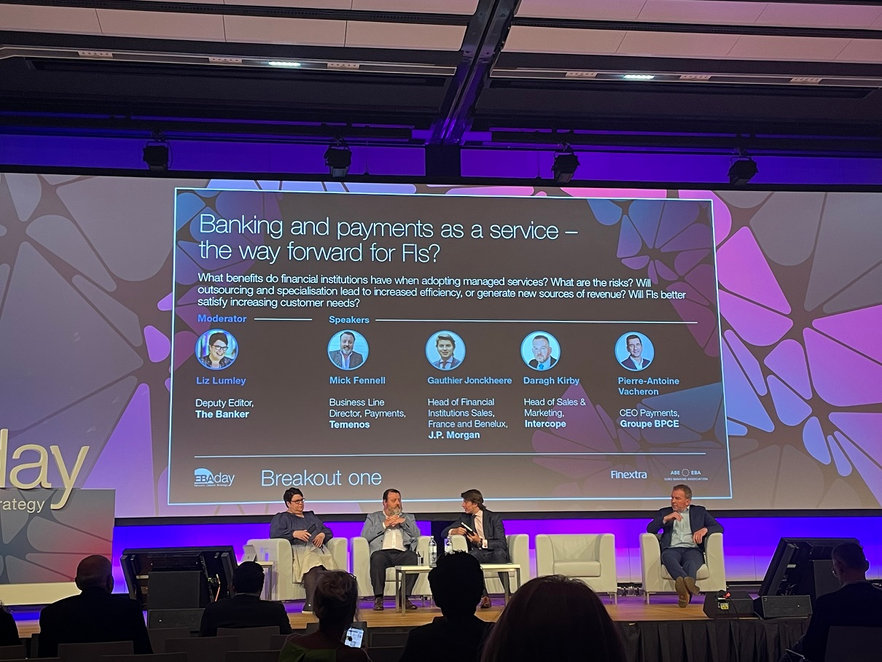

Banking as a Service (BaaS) is gaining ground as a familiar model for optimising the financial customer experience. In one of this year’s EBAday sessions, Mick Fennell, Business Line Director Payments at Temenos, Gauthier Jonckheere, Head of Financial Institutions Sales France and Benelux at J.P. Morgan, Daragh Kirby, Head of Sales & Marketing at Intercope, and Pierre-Antoine Vacheron, CEO Payments of Groupe BPCE examined if by implementing managed services, financial institutions would be better equipped to keep up with enhanced customer demands. Will banking and payments as a service be the way forward for financial institutions?

“As a Service” in the financial world

If it exists, it is – or will be – probably available “as a service”. But according to the panel, everyone has a different definition of “as a service”. To me, in this operating model, a company offers a ready-to-use service via the cloud to which a customer can subscribe. As a service is also becoming an increasingly popular solution in finance. It gives companies the ability to easily scale up and down and quickly respond to fluctuations in supply and demand. That last word – service – is the essence of the model. It allows companies and end-users to entirely focus on their business and ensure better insight into financial data, fast onboarding, and self-monitoring. What’s more, it enables financial institutions to become more agile.

The objective of the BaaS platform model is for applications to be seamlessly integrated via Application Programming Interfaces (APIs). By doing so, banking becomes more approachable and user-friendly to consumers and becomes more embedded into their daily lives. Additionally, BaaS allows banks to access new value, as it offers unprecedented opportunities for collecting data through ecosystems. This can then be harnessed to improve and tailor customer experiences.

According to the panellists, BaaS is already a reality and will become more prominent in the future. So why don't traditional banks implement BaaS to keep up with current customer expectations? What are they afraid of, was asked by moderator Liz Lumley? Although banks have already made considerable strides in digital innovation, many still face serious legacy challenges. Over time, banks have kept the original ledger for their regulatory and reporting needs and built new products on top of it. The result is that they are left with legacy systems that prevent them from quickly and easily rolling out the services their increasingly digitally-savvy customers demand. BaaS could be seen as an opportunity to overcome these challenges, but as Gauthier Jonckheere of J.P. Morgan pointed out, many financial institutions don’t have the resources available due to many other priorities (e.g. regulation).

The power of platforms

Spending on maintaining and upgrading existing IT infrastructure limits the resources that banks can devote to innovation and investment in new digital technologies. This is forcing them to look for alternatives. And it is here that the power of as a service platforms shows its value. Banks need to decide which services they want to promote. As a service models allow banks to pick and choose, where front-end applications are key and partner for other services. It is not necessary to buy everything at one provider. Many businesses partners do clever things. They enable financial institutions to replace services, or add services.

By partnering with specialised payment service providers, banks ensure a stable, scalable, and flexible payment environment. This environment is fully compliant and accommodates modern payment requirements like instant payments and fast time-to-market capabilities. By doing so, banks will be able to free up resources to focus on core business strategies and differentiating activities that will help them compete in the new, digitised financial era.

The way forward

Banks that want to retain their customers need to focus on adding value. Is BaaS the way forward for financial institutions? By platforming and leveraging data through implementing BaaS models, banks can better meet the modern customer’s needs and create new revenue streams. Optimising customer experience is the only way to survive as a financial institution. The technology train isn’t slowing down anytime soon; you must keep up with it to avoid going under.

Worldline is offering a modular banking proposition to generate new revenues revenues and provide a superior customer experience. The Worldline Digital Banking platform empowers banks to accelerate their digital transformation. Find out more!

Edward van Dooren

-

-

-

Consumer Finance: The Transformative Impact of Open Banking & Open Finance

Learn more -

Elevating Service Efficiency: Boscolo Hôtels & SPAS Group's transformation with Worldline’s Integrated Payment Systems.

-

Will digital currencies take over the world?

-

-

Worldline enables GarantiBBVA International N.V. to comply with EU Instant Payments Regulation with cloud-based solution

Learn more -

Learn how NFC payments empower your business