How to get harmonised collateral management system in the eurozone | Blog

31 / 01 / 2022

Is your bank ready for the Eurosystem Collateral Management System (ECMS)? By now, all banks in the eurozone should be preparing to meet the next European Central Bank reform: a single platform to manage central-bank collateral in the eurozone. In this blog we explain what’s at stake and how Worldline can help.

In a market flooded with central bank liquidity, collateral is becoming more and more of a scarce resource. The increased value of related assets requires additional attention to collateral management whilst the post-trade environment is still very fragmented. Managing and monitoring collateral allocations is becoming more and more complex.

Multiple collateral requirements to address

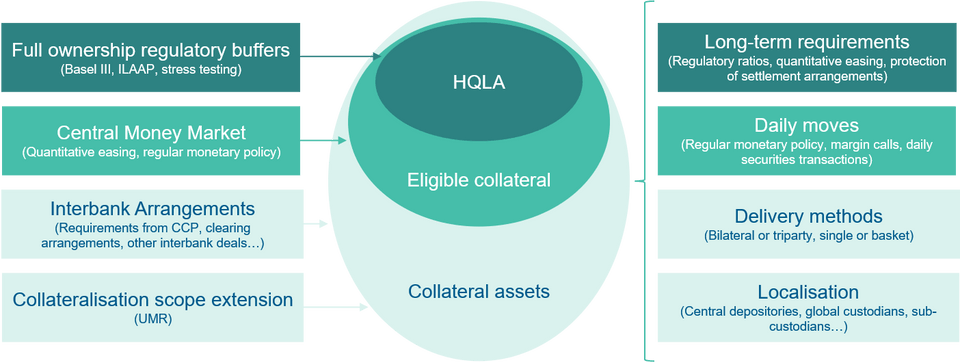

There are several requirements that banks must meet regarding collateral. Banks must maintain full ownership over the amount of High-Quality Liquid Assets required by the Basel III liquidity ratios and proven through regulatory stress tests. Banks also leave eligible collateral with Central Banks as guarantees for the liquidity distributed through the current quantitative easing monetary policy. Additionally, regulations to protect settlement finality have led Central Counterparty Clearing houses (CCPs) and other clearing arrangements to increase their collateral requirements. Additionally, as the interbank money market has moved to repo, uncollateralised transactions have become less and less used. Finally, the extension of collateralisation scope along with the Uncleared Margin Rules (UMR) regulation’s phased implementation is gradually driving additional players to become collateral givers who look for precisely such valued assets.

On the other side, the allocation of collateral assets for these various requirements is becoming more and more complex. Assets must be distributed according to long-term requirements, but banks must also be able to manage the daily changes induced by day-to-day activity in several compartments. There are also numerous collateral management service providers and tools that vary across the localisation of collateral assets. Methods to manage and deliver assets to the various collateral takers have become highly sophisticated. The whole allocation system lacks efficiency.

Projects to harmonise collateral management in Europe

The situation is made even more complex by the addition of credit claims as eligible collateral under central bank monetary policy. Each National Central Bank has implemented one or more domestic procedures and systems through which banks may mobilise these credit claims. To improve market efficiency and reduce complexity in central-bank collateral, the European Central Bank (ECB) has initiated the SCoRE and ECMS projects.

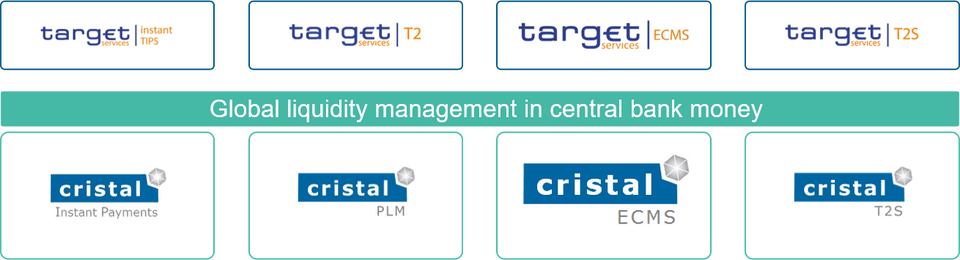

The Single Collateral Management Rulebook for Europe (SCoRE) aims to standardise rules, format standards and procedures for managing collateral across the eurozone. The Eurosystem Collateral Management System (ECMS) is part of the ECB goal of implementing a single “TARGET Services” euro-wide platform to manage settlement with finality in central bank money and the associated liquidity. The platform will provide unified access to all banks operating in the euro area.

The platform has an underlying complexity and liquidity fragmentation: separate systems and accounts for instant payments (TIPS), high-value payments (RTGS) and securities settlements (T2S). Plus, an overarching liquidity consolidation system (CLM) acts as the “global” buffer in euro central bank money that also concentrates liquidity from monetary policy.

ECMS will be the final component, managing guarantees deposited at Central Banks, credit claims and eligible securities. It will also generalise the use of collateral pool instead of earmarking assets to specific transactions.

Solution for managing central bank collateral throughout the eurozone.

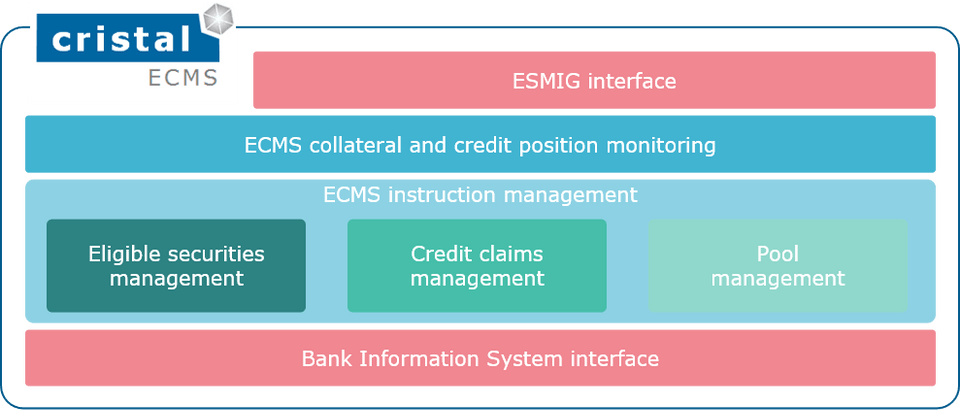

In response, Worldline has developed CRISTAL ECMS, a new module of our CRISTAL Payment and Liquidity Management Hub.

CRISTAL ECMS offers banks a solution for mobilising and demobilising collateral throughout the eurozone. It enables users to monitor the collateral pool, seeing what the mobilised assets are and which assets are encumbered by being used to secure monetary policy transactions. It enables banks to fine-tune the intraday liquidity buffer – i.e., the part of unencumbered assets used to get credit lines in the ECB settlement platform – and the end-of-day balance through marginal lending requests.

As with all other CRISTAL modules, CRISTAL ECMS may be implemented as a standalone component to offer a specific service for a specific market infrastructure. It may also be integrated with other CRISTAL modules, to deliver the full benefits of comprehensive liquidity management in central bank money: global liquidity monitoring and seamless liquidity distribution across all compartments of central bank money.

All of the CRISTAL modules are then integrated into a single console that provides real-time information, corresponding to the complete scope of the ECB TARGET Services and beyond. CRISTAL also enables banks to distribute euro liquidity to external prefund payment systems, such as Instant Payment systems and EBA STEP2, to support Continuous Gross Settlement.

CRISTAL’s key benefit is providing the bank with a proactive settlement platform that enables it to save one-third of the intraday funding requirements and then of the required collateral to get intraday liquidity from central banks.

With the go-live of ECMS planned for November 2023, it’s high time for banks to revise their set-up to meet the new information technology requirements that will arise with the ECMS project. Whether you simply want to meet the minimum regulatory changes to continue managing central-bank collateral or you want to improve your liquidity and collateral management, Worldline can provide the solution.

Interested? Learn more about Payment & Liquidity Management.

Discover all our financial solutions for Financial Institutions.