Improving mobile banking experiences: A look at 3 innovative use cases

22 / 03 / 2022

How can we make mobile banking experiences as smooth as possible on mobile?

How can we make customer experience be as smooth as possible on mobile?

While 2020 and 2021 went through a lot of major upsets, the digital transition was greatly accelerated.

More than 408 millions of online transactions had been processed in the second semester of 2020.

As a major actor in financial services, it was an obvious move for Worldline to reflect on how to redefine mobile banking use cases.

Thanks to our smartphones, it has never been easier to access banking services via mobile applications.

Making a transfer to a friend is now possible directly from the comfort of our sofa or between two workouts at the gym.

Nonetheless, these new uses also bring new challenges.

We aim to accompany users through these new journeys, and that’s why we designed these 3 innovative use cases, for both iOS and Android.

1. Make the user buying journey as smooth as possible through Interactive Notifications

It is a fact that users buy more and more with their smartphones.

At the same time, most online purchases now have to be validated through strong authentication.

However, we should aim for this mandatory step to be as seamless as possible.

Let’s look at a typical workflow: once payment data has been entered in the e-commerce website or app, the user must switch to their banking app to validate the payment, then switch back to the e-commerce to complete their purchase.

This app switching action is a painful interruption in the user’s buying journey, that can potential lead to users dropping out of the purchasing process.

Fortunately, mobile banking apps can efficiently address this issue through interactive notifications.

For example, a user wants to buy a snowboard on an e-commerce app.

At the checkout, they receive an interactive push notification that invites them to enter their PIN directly inside the notification.

Thanks to this interactive notification, the user never had to leave the e-commerce app.

(Of course, a production implementation of this feature would require a case by case analysis for regulation compliance)

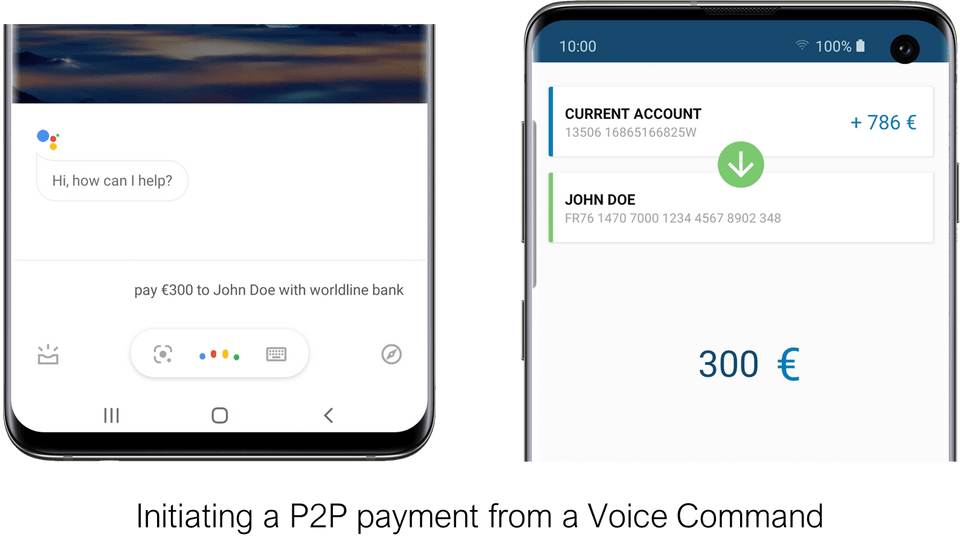

2. Voice Banking: How Worldline leverages Voice Assistants to improve the banking experience

Voice assistants let users execute specific app features from a voice command.

For example, users could say: “OK Google, pay 34€ to John with Worldline bank”.

Immediately after, the user can validate his action in his application, with pre-filled information parsed from the voice command.

Later, if the user wants to know his current account balance, he will just have to say:

“OK Google, show Worldline bank current account balance.”

Instantly, the user would see the information straight away on his screen, with no need to actually open the banking app.

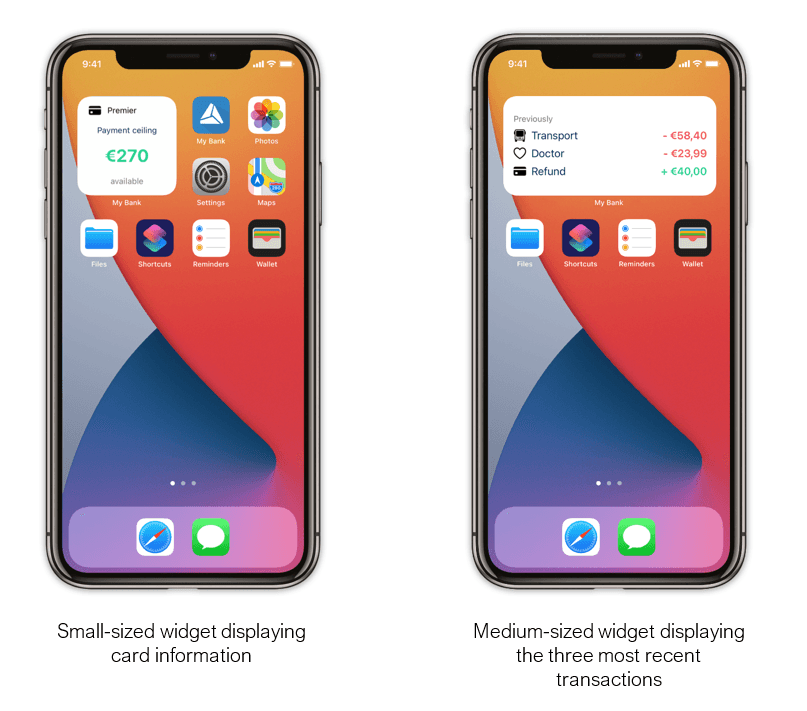

3. Display key information at a glance with a Widget

Most of the time, when users open their banking apps they only want to check their current balance, and maybe their most recent transactions.

But each time they’re also required to authenticate to access these pieces of information.

In order to simplify that journey, banking apps can implement widgets. Which are small portions of the banking app can be placed on the home screen of the smartphone and will make key information accessible at a glance.

Of course, users retain full control over the data that is made accessible outside the banking app.

Widgets come in several possible sizes, here are some examples what they could look like:

These three innovative use cases are part of our effort to continuously monitor the latest trends and technological innovations, with the goal to deliver best-in-class mobile banking apps to our customers.

Learn more about our Mobile Banking solution.

If you’d like to know more about of our mobile banking capabilities, feel free to contact:

Nicolas Bouheret

Head of Financial Services Mobile Competence Center

nicolas.bouheret@worldline.com