Bridging Virtual and Physical Worlds: From payment to property mapping (part 2)

19 / 10 / 2023

With the acceleration of digitalisation and the increasing migration of services on digital worlds we will show how that could impact payment and offer new opportunities for the payment industry actors.

As hinted at the end of the first part of this blog, in this post I will explore the idea of an economy without the need for intermediary monetary payments to secure asset or value transfers. Economic value could be based on the valorisation of what you provide to the virtual society. Investments may concentrate on creating properties or assets for immediate use. In this scenario, Payment Service Providers (PSPs) could transform into virtual pawn shops, responsible for evaluating assets, assessing their value and assigning them to the users that want them

Future financial institutions could play a pivotal role in this transformation. Currency exchange offices might transition in a first phase to asset exchange offices, and later even into service exchange offices where people no longer own goods but only use them as services. Where the value will be related to the past services rendered, or future utility of services to be provided.

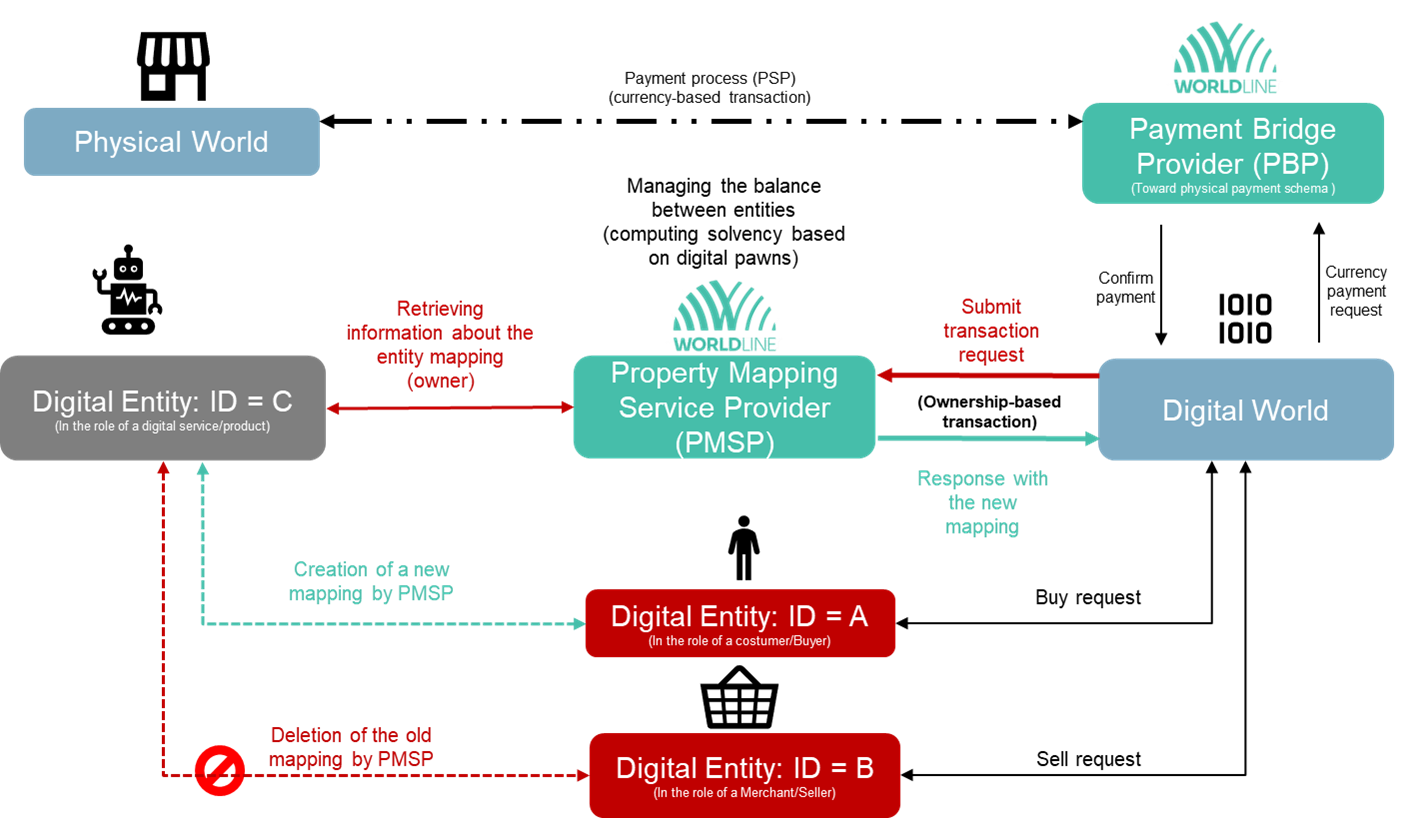

Eliminating an asset as an intermediary of exchange could be a significant breakthrough. We will examine new roles for dealing with payment from two perspectives: one within the virtual world and the other as a bridge to the physical world (see Figure 1). This leads to a new concept that could become the future mission of PSPs, which we will refer to as Mapping Payment.

Considering this development, it's natural to wonder what a virtual world truly needs for transactions to occur. We will outline a possible answer for banks and merchants who may be curious about how their businesses will be affected and which new partners they should collaborate with to adapt to these changes.

Trusted third-party for managing property within the virtual world (Property Mapping Service Provider):

In a virtual world where the notion of a monolithic object does not exist, exchanging items simply involves assigning them to different owners. Hence, currencies could have little relevance, as being themselves digital assets. Whereas the key stone would become a digital identifier that links between the owner and the good for conducting exchanges.

This could be seen as a modern bartering, as the role of currency for facilitating comparison on value by offering a fractionalization of value is no longer necessary due to the inherent non-atomic and liquid nature of digital elements.

A comparison can be drawn with the advent of virtual machines in cloud offerings, where access to bare metal services is gradually disappearing in favour of customized virtual solutions; or for the paper magazines sales reduction, as digital world provides access only to the article of interest without buying the full magazine.

Indeed, the reason for the disappearance of barter was mainly due to physical constraints, which sometimes made it impossible to find equivalences between things rather than valuing them in absolute terms. In fact, the valuation of things to this day still follows market mechanisms, which mainly revolve around global supply and demand, which was already the case in barter but on a local scale.

The new role that appears in such virtual environments (e.g. Metaverse) is to be positioned as the trusted third-party enabling identification management for any transaction. Indeed, no entity can build a virtual world alone, as the utility of a shared environment is to build relationships from which business could occur. The condition of success would be, for the trusted third party, guaranteeing a seamless interoperability.

The provided service in this new role needs to be capable of identifying the addresses of the two entities engaging in an exchange in a non-falsifiable manner. The new name of this role could be named Property Mapping Service Provider (PMSP) as not handling currencies for payment, but rather mappings between exchanged services (identity management/identification management) within the virtual world.

In the mapping process, handling the entire order fulfilment involves integrating settlement and managing the balance to evaluate the solvency of each digital entity. This could depend on a pawn mechanism that constantly appraises the added value held by each transacting entity.

That way all the transactions of the virtual world including coins themselves (e.g. game coins) would be based solely on property management (e.g. who is the owner of the coin in which game).

Classical payment would still occur in the physical world by transiting through a bridge as explained later in the role of the Payment Bridge Provider (PBP).

This solution, however, requires resolving a number of challenges, among which are:

- Establishing PMSPs as reference players amidst other solutions such as decentralized wallet solutions, by enabling global interoperability and assuming the role of a trustworthy “oracle”.

- Providing the necessary technological solution for a scalable and an efficient management of the mapping.

- Distinguishing the legal factors and handling the particular restrictions associated with property ownership transfer, depending on the various types of exchanged services/assets (e.g. age limitations, national laws).

- Handling potential fraud risks associated with the streamlining of the order fulfilment process (consolidated within the mapping).

Figure1: Schema of the two new roles that a Paytech could play while managing transactions in a virtual world.

Trustworthy intermediary for bridging virtual and physical worlds (Payment Bridge Provider):

Virtual worlds depends on the physical world. It is necessary to propose rules and safeguards that allow the virtual world to remain connected to the physical world, enabling its expansion and extension. This implies the addition of certain characteristics necessary to ensure proper conduct and compliance with laws during these transitional phases between the virtual world and the physical world.

This will require a new role to tackle these challenges that one could name Payment Bridge Provider (PBP).

While the services proposed by the PBP will be in some aspects similar to those provided in a full physical world, some additional ones need to be provided:

- Differentiating between types of digital assets, such as fully digital ones (value confined to the digital world) and digital twins of physical assets (possessable or usable in the physical world).

- Offering a technical service that connects the external world (value-to-currency and currency-to-value transformation), facilitating exchanges between the virtual and physical world.

- Establishing a method to quantify the added value of virtual world assets by devising a conversion process for virtual services into fiat currency. This necessitates assessing the added value of goods/services based on factors like scarcity, time, and utility. Adapting the supply and demand economic model could be one potential solution for this purpose.

Why PMSP cannot exist without a PBP:

In the physical world, value creation is based on physical raw materials and expertise, which together enable the provision of a service. If we transpose this model to a virtual world, we realize that there would be needs regarding resources (e.g. energy powering the servers, the servers themselves, etc.) that cannot be self-provided in order to enable autonomous and total value creation in such an environment.

Thus, the concept of wealth that is created in the virtual world depends on contributions from the external physical world, mainly in the form of fiat currency. This is why we believe that the virtual worlds are not and will not become economical self-sufficient worlds, but rather depending on their ability to generate value that would, in the end, benefit the physical world.

While PSP roles would still exist in the physical world, virtual worlds will offer new opportunities for payment companies. That will require redesigning new roles which are both the Property Mapping Service Provider (PMSP) for managing transactions inside virtual worlds and the Payment Bridging Provider (PBP) for the mandatory exchanges with the physical worlds.

The challenge of defining both the “value computation process” and the “exchange process” of property in these new roles, would be at the heart of the success of the new concept of Mapping Payment.

Interested to know more? Stay tuned or contact WL labs.