In the ever-evolving world of digital payments, the concept of payment orchestration has emerged as a game-changer for businesses globally. But what exactly is payment orchestration, and why is it becoming indispensable for companies across various industries?

Let us explore the transformative world of payment orchestration, a critical component in modern digital economies. We delve into how solutions like Worldline's PaymentIQ are innovating in this space, offering unparalleled flexibility and efficiency.

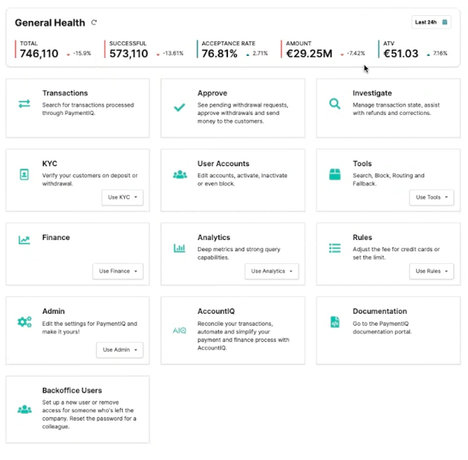

Perhaps the most important aspect of our solution is that it was designed from the start to meet the needs of merchants and their end-customers. Just over a decade ago, it was a forward-looking merchant who came to us to develop a tailored orchestration platform. One that would enable them to manage all their payment solutions from a single, intuitive dashboard, and use payment logic to optimise acceptance rates.

The resulting payment orchestration platform has been helping merchants seamlessly integrate multiple payment gateways, streamline transactions, and optimise payment routes to:

- Accept more legitimate transactions, worldwide

- Control payment strategy management

- Reduce operational costs.

Let’s peek under the hood of our payment orchestration solution to understand how it delivers these benefits.

What is payment orchestration?

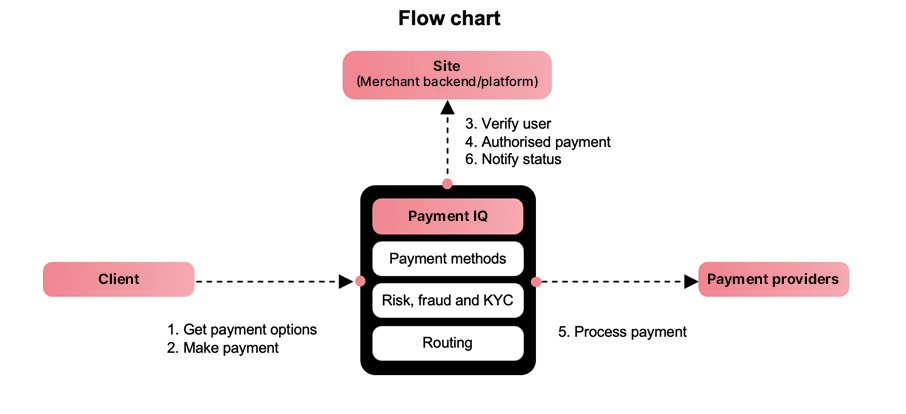

Payment orchestration refers to a sophisticated system that integrates and manages multiple payment service providers, acquirers, and banks into a single, unified software layer. This system streamlines the entire payment process - from routing through reconciliation, ensuring efficient and secure transactions between merchants, customers, and payment providers

Key features of payment orchestration platforms (POPs):

Simplified Integration

POPs reduce the complexity of managing multiple payment systems, enhancing business scalability and global operation capabilities.

Automated transaction routing

These platforms optimize payment routes based on various criteria, reducing false declines and boosting authorized transactions.

Enhanced customer experience

By providing diverse payment options and maintaining consistent online experiences, POPs help increase sales and reduce cart abandonment.

Cost Efficiency

POPs automate payment processes and minimize transaction fees, leading to significant cost savings for businesses.

Data Analytics and Reporting

Offering centralized analytics, POPs enable businesses to gain insights into customer behaviours and payment trends, optimizing payment operations.

The growing importance of payment orchestration in global business

In today's digital age, payment orchestration is not just a luxury but a necessity for businesses looking to scale globally. It supports international transactions by handling currency conversions and facilitates cross-border payments, thus playing a crucial role in global expansion

The future of payment orchestration

With the increasing demand for efficient and secure digital payment solutions, the market for payment orchestration is expected to grow significantly. This growth emphasizes the critical role of these platforms in modern business operations, particularly in an interconnected digital landscape

API-enabled flexibility

Our Front API gives merchants who do not want to use our awesome checkout (most do!) the option to build their own using the same API calls. Either way, the solution delivers a smooth checkout experience which is completely customisable, using the smart rules within the system.

In addition, the Integration API enables smooth interworking with a multitude of Payment Service Providers (PSPs) worldwide. The solution is completely agonistic; merchants are not obliged to use Worldline’s own payment services. Businesses can expand into new markets without the headache of integrating new local payment gateways individually from scratch.

By consolidating payment processing under one roof, our solution drastically simplifies merchant operations and reduces integration costs and time (often just a matter of days, rather than the traditional weeks or months).